Enphase Energy, Inc.

ENPH

recently introduced its Encharge battery storage system in Germany in a bid to expand its presence in the growing energy storage market. Currently, installers in Germany can buy this user-friendly battery storage from IBC SOLAR AG, with more distributors likely to come online.

Moreover, this launch marked Encharge’s first availability in a foreign market.

Significance of Encharge

Enphase’s Encharge storage systems feature Lithium Iron Phosphate (LFP) battery chemistry, which provides a long cycle life, safe operation through enhanced thermal stability, and a UL9540A fire safety certification. Its passive cooling system provides better performance with fewer moving parts. Further, the storage systems feature Enphase embedded grid-forming microinverters that keep homes powered when the grid goes down, and is also cost effective.

Encharge offers the confidence and convenience of a maintenance-free battery system, over-the-air software upgrades, and a limited 10-year warranty.

This storage system already boasts a strong presence in the United States, wherein to further enhance its footprint, Enphase inked a supply deal with

Sunnova

NOVA

in January 2021.

Germany’s Battery Storage Market & Enphase’s Prospects

Storage technologies strengthen and stabilize the electrical grid by providing backup power, leveling loads and offering a range of other energy management services. One of the most important benefits of combining energy storage with renewable technologies is the ability to store energy after it is generated and distributing it when needed rather than right after it is produced. This reduces the need to curtail renewable generation and allows energy to be deployed during periods of high electricity demand.

Therefore, large battery storage systems are increasingly paired with renewable energy power plants to increase grid reliability and resilience across the globe. Notable growth has been observed in Germany’s battery storage market as well, Evidently, there are now more than 300,000 battery storage systems installed in German households, with average installation representing around 8.5 kilowatt-hour (kWh) of capacity in 2020. The data comes from a report by Energie Consulting, which was commissioned by Bunderserband Energiespeicher (BVES), Germany’s energy storage association.

Naturally, Germany currently offers a lucrative market for the expansion of Enhphase’s Encharge battery storage system, outside of the United States. Notably, the launch of Encharge, Enphase now offers an all-in-one solution, which will allow German homes to optimize their energy usage and reduce their overall energy bill.

Peer Moves

With the entire world currently in a mode of transition toward a greener future, solar demand is increasing manifold and so is the battery storage market. To this end, we note that the global battery energy storage system market is projected to witness CAGR of 32.8% from 2020 to 2025 to reach $12.1 billion, as projected by research firm, Markets and Markets. This not only boosts growth prospects of Enphase but also of other significant players in the energy storage place as mentioned below.

NextEra Energy

NEE

currently has more energy storage capacity than any other company in the United States, with more than 140 MW of battery energy storage systems in operation.

General Electric’

s

GE

renewable energy division offers customized storage products that include advanced lead-acid batteries as well as Energy Management Systems to integrate the battery management system into a fully functional storage digital controller. It currently has more than 207 MWh of energy storage in operation or in construction globally.

Zacks Rank & Price Performance

Enphase Energy currently has a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

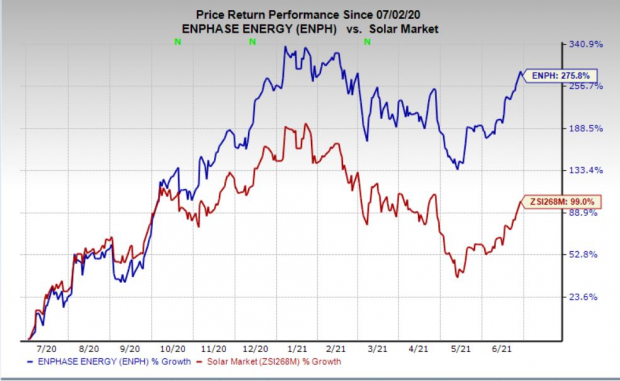

In the past year, shares of the company have surged 275.8% compared with the

industry

’s rally of 99%.

Image Source: Zacks Investment Research

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report