Shares of

Entrada Therapeutics, Inc

.

TRDA

were down 32.1% in after-market trading on Dec 19 after the company announced that it received a clinical hold notice from the FDA regarding its Investigational New Drug Application (IND) for ENTR-601-44 for the potential treatment of Duchenne muscular dystrophy (DMD).

The regulatory body indicated they will provide an official clinical hold letter to Entrada within 30 days. Entrada plans to share additional updates pending further communications with the agency.

Entrada is developing a new class of medicines, Endosomal Escape Vehicle (EEV) therapeutics, through which it is building a robust development portfolio of oligonucleotide-, antibody- and enzyme-based programs for the potential treatment of neuromuscular diseases, immunology, oncology and diseases of the central nervous system. The company’s lead oligonucleotide programs include ENTR-601-44 targeting DMD and ENTR-701 targeting myotonic dystrophy type 1 (DM1).

The clinical hold was disappointing as ENTR-601-44 is one of the lead programs of the company and will delay the development of the candidate.

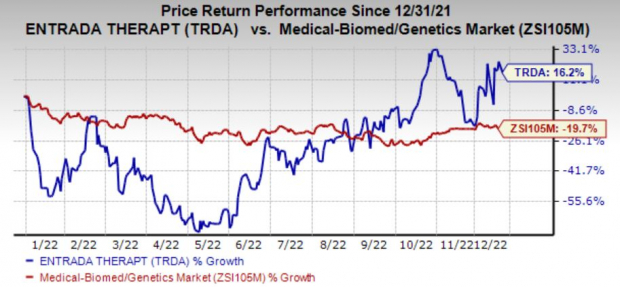

Shares of Entrada have jumped 16.2% in the year so far against the

industry

’s decline of 19.7%.

Image Source: Zacks Investment Research

Entrada’s shares surged earlier in the month after it announced a collaboration deal with biotech giant

Vertex Pharmaceuticals, Inc.

VRTX

. The collaboration primarily focuses on Entrada’s program for DM1, ENTR-701, which is in late-stage preclinical development.

Per the terms, Vertex will pay Entrada an upfront payment of $224 million and make an equity investment of $26 million in the latter. Entrada is also eligible to receive up to $485 million for the successful achievement of certain research, development, regulatory and commercial milestones and tiered royalties on future net sales for any products that may result from this collaboration agreement.

The deal with Vertex results in an immediate cash influx of $250 million and investors were upbeat about the same. This cash influx will enable the company to extend its cash runaway. Cash, cash equivalents and marketable securities were $215.6 million as of Sep 30, 2022.

Entrada currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the healthcare space are

Gilead Sciences, Inc.

GILD

and

Kala Pharmaceuticals

KALA

.

Both the companies carry a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Earnings estimates for Gilead Sciences have increased 48 cents in the last 60 days to $7.09. Gilead has surpassed earnings estimates in three of the past four quarters with an average positive beat of 0.36%.

Earnings estimates for Kala Pharmaceuticals have increased 26 cents in the last 30 days to $13.32. Kala has surpassed earnings estimates in two of the past four quarters with an average positive beat of 2.39%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report