Epizyme, Inc.

EPZM

incurred a loss of 38 cents per share for first-quarter 2022, narrower than the year-ago period’s loss of 69 cents.

Adjusted loss (excluding gains on change in fair value of warrants to purchase common stock) for the first quarter was 39 cents, wider than the Zacks Consensus Estimate of a loss of 35 cents but narrower than the year-ago period’s loss of 69 cents.

Total revenues for the first quarter were $8.7 million, which missed the Zacks Consensus Estimate of $10.9 million but increased from the year-ago quarter’s $7.6 million.

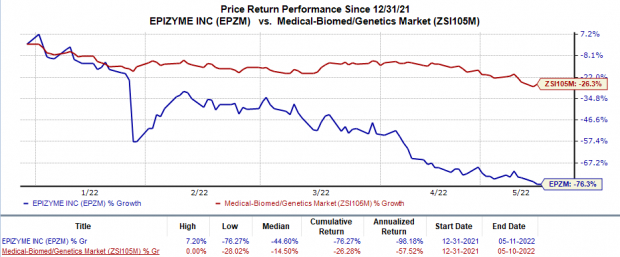

Shares of Epizyme have plunged 76.3% so far this year compared with the

industry

’s 26.3% decline.

Image Source: Zacks Investment Research

Quarter in Detail

Tazverik (tazemetostat) received accelerated approval from the FDA in January 2020 to treat metastatic or locally-advanced Epithelioid Sarcoma (ES). In June 2020, the regulatory body approved the supplemental new drug application for Tazverik for two distinct follicular lymphoma (FL) indications.

The drug generated net product revenues worth $8.7 million in the first quarter. Commercial sales of the drug were $8.1 million, which grew 10% sequentially.

Adjusted research and development expenses declined to $27.8 million from $30.3 million in the year-ago quarter. Selling, general and administrative expenses also declined to $23.6 million from $31.5 million in the prior-year quarter.

Epizyme had $199.7 million of cash, cash equivalents and marketable securities as of Mar 31, 2022, compared with $176.8 million on Dec 31, 2021.

Recent Update

Since the FDA approval for Tazverik to treat both indications is under an accelerated pathway, Epizyme is also conducting confirmatory studies for ES and FL with Tazverik. A phase Ib/III confirmatory study (EZH-301) is evaluating Tazverik in combination with doxorubicin compared with doxorubicin plus placebo as a front-line treatment of ES.

Another phase Ib/III confirmatory study (EZH-302, SYMPHONY-1) is evaluating Tazverik combined with R2, clubbing Revlimid with Rituxan compared with R2 plus placebo for treating at least second-line FL patients. While data from the phase Ib portion of the study is expected later this year, Epizyme announced in March 2022 that it had dosed the first patient in the phase III portion of the study.

EPZM initiated a phase Ib/II basket study, ARIA (EZH-1501), during fourth-quarter 2021 to evaluate the safety and efficacy of tazemetostat across multiple new types of hematological malignancies. Epizyme already initiated a bispecific cohort of the study evaluating a combination of tazemetostat with

Roche’s

RHHBY

mosunetuzumab in patients with R/R FL who received two or more prior lines of therapy. Preliminary data from the study is expected in second-half 2022.

Mosunetuzumab is Roche’s investigational CD20xCD3 T-cell engaging bispecific antibody. Epizyme entered into a clinical supply agreement with Roche for the bispecific cohort of the EZH-1501 study.

Our Take

Epizyme’s performance for the first quarter was dismal. Nevertheless, management’s efforts to increase the commercial adoption of Tazverik as well as develop tazemetostat for additional indications are encouraging. EPZM also has multiple pipeline readouts in 2022.

Zacks Rank & Stocks to Consider

Epizyme currently has a Zacks Rank #3 (Hold). Better-ranked stocks in the overall healthcare sector include

Abeona Therapeutics

ABEO

and

Alkermes

ALKS

. While Alkermes sports a Zacks Rank #1 (Strong Buy) at present, Abeona Therapeutics carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ loss per share estimates for 2022 have narrowed from 14 cents to 3 cents in the past 30 days. Shares of ALKS have rallied 15.9% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Abeona Therapeutics’ loss per share estimates for 2022 have narrowed from 34 cents to 33 cents in the past 30 days. Shares of ABEO have declined 52.5% in the year-to-date period.

Abeona Therapeutics has a mixed surprise history, with its earnings having surpassed expectations in one of the trailing four quarters, missing the mark in another and meeting the same on the remaining two occasions, the average surprise being 0.7%. In the last reported quarter, Abeona Therapeutics missed earnings estimates by 7.7%.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report