Earnings are essential for public companies because they provide investors with a roadmap of the company’s financial performance and profitability. “Earning’s season” typically falls in January, April, July, and October after companies have had time to construct their quarterly reports. Because

Alcoa

AA

is usually the first sizable company to report earnings each quarter, earnings season informally starts when Alcoa reports.

Whether it is earnings season or not, savvy investors understand that it is worthwhile to follow earnings reports at any time of the year. Not only do earnings and the stock’s subsequent reactions provide clues into the company itself, but the report can also give investors an early view into essential industry trends and how the general market is absorbing earnings. Despite the dismal performance in the market this week, several companies reported stellar earnings reports and reacted accordingly. Below are some recent EPS winners and losers:

Winners: Software

MongoDB Inc

MDB

provides a general-purpose database platform. The company serves financial services, government, healthcare, media and entertainment, retail, technology, and telecommunications industries. Tuesday, MongoDB reported total revenue of $333.6 million, up 47% year-over-year. Non-GAAP net income was $18.7 million or $0.23 per share versus $.03 per share last year.

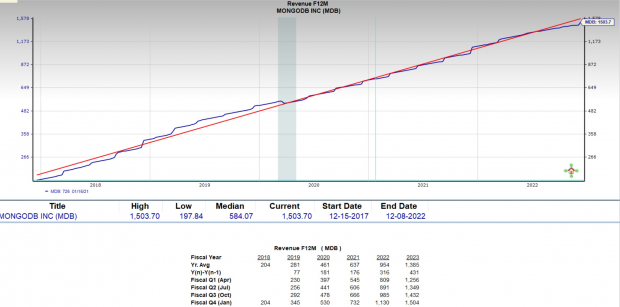

Image Source: Zacks Investment Research

Pictured: MDB revenue estimates look favorable moving foward.

While MongoDB’s fell in recent months with other tech stocks, the quarter was a potential turning point. According to Zacks Consensus Revenue Estimates for next year, the company’s growth will continue next year. One possible driver for the software firm is its burgeoning partnership with the undisputed king of software,

Microsoft

MSFT

.

The two software leaders have partnered to integrate MongoDB’s Atlas software into the Microsoft Azure Marketplace. Azure has the scale to provide MDB with a growth runway for years.

Industry View:

After a nasty correction in the software space, leading software stocks are showing that the poor macroeconomic backdrop of the past year was merely a bump in the road rather than a destination. Last week,

Splunk (SPLK).

Splunk develops software that enables organizations to gain insights into their business by accessing, managing, and analyzing data in real time. The software firm smashed Zacks Consensus Estimates by 97% and raised revenue and margin guidance.

Box Inc

BOX

,

a software platform that allows companies to manage internal and external data, content, and store files in the cloud, swung to a profit. Unlike most of its peers, Box is above its 200-day moving average, indicating strong relative strength. The Internet-Software Group is a top-tier group, ranking 60 out of the 251 groups tracked by Zacks.

Is the post-EPS drop in Salesforce a gift for investors?

Salesforce Inc

CRM

,

the leading customer relationship platform in the world, is one of the few software stocks to fall after reporting earnings this quarter. Several high-level executives have left the company including the President and the Co-CEO in recent weeks. The founder and CEO of Slack, a key acquisition of Salesforce, also parted ways with the cloud giant. Though the recent departures are disheartening for CRM investors, the short-term weakness in the stock may spell an opportunity for longer-term value investors.

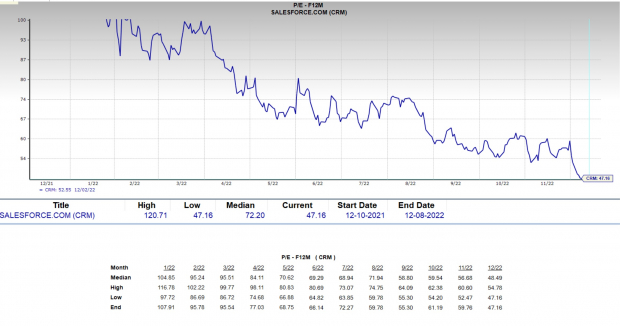

Image Source: Zacks Investment Research

Pictured: CRM’s valuation is slated to shrink over the next 12 months.

Despite the drama, Salesforce remains a juggernaut in the software space and is highly profitable. Revenue, which equates to approximately $26.5 billion in FY22, grew 25% year-over-year. Both EPS and revenue grew at a double-digit pace in Q3. Moving forward, the company anticipates revenue to continue to grow at a healthy clip of 17% for 2023. The most attractive part about CRM’s stock is the shrinking valuation (pictured above). As the stock approaches levels not seen since the heat of the Covid crash, value investors may be looking to CRM stock as a late black Friday sale.

Image Source: Zacks Investment Research

Pictured: CRM’s stock price is approaching levels not seen since the Covid crash.

Losers: Select Retail

This week,

Lululemon Athletica

LULU

,

the company behind a wildly popular yoga and athletic brand, was a rare post-EPS underperformer. The stock dropped by more than 10% Friday after announcing its third-quarter results. The results were strong. The company saw revenue increase 28% while EPS grew 23%. While the current results were solid, the stocks’ reaction underscores the importance of paying attention to what’s going on “under the hood” in an earnings report. According to the quarterly report, LULU’s inventory levels show $1.7 billion worth of unsold apparel, a whopping 85% increase versus last year. The Textile-Apparel Group, which LULU belongs to, ranks in the bottom 28% of all industry groups tracked by Zacks. Outside of a bounce play, LULU’s stock is an avoid at this juncture.

Discount Retail

Discount retail-giant

Target

TGT

was among the more disappointing earnings reports recently. On December 16

th

, the stock sliced lower by 13% after Target reported that Q3 EPS growth dropped by 49%. The disappointing news is the third straight quarter of double-digit negative EPS growth. Even though Target is a discount retailer, the company blamed weakening profit trends on inflation rates, rising interest rates, and economic uncertainty. To make matters worse, management lowered topline and bottom-line expectations for the fourth quarter.

Costco Wholesale Corp

COST

,

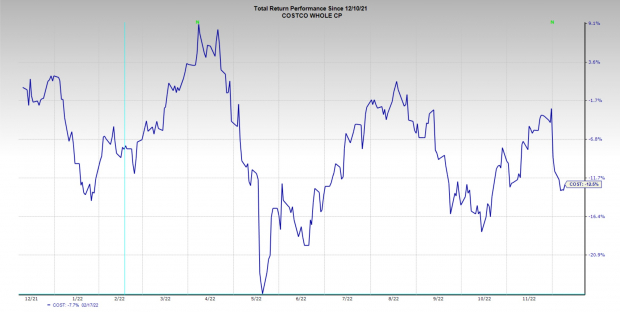

a company famous for providing its members discounted prices on goods when purchased in bulk, announced lackluster earnings. The company’s sales grew by 8% while EPS grew by a dull 4%. Friday, the COST reversed early losses to finish slightly higher. Though COST’s earnings were not devasting, they did not generate excitement like those in the software space. COST has been stuck in a choppy, frustrating range for the better part of a year:

Image Source: Zacks Investment Research

Pictured: Costco stock has been stuck in a frustrating choppy period.

Industry Overview:

The recent earnings trends in many retail stocks have been concerning. Specifically, in the past few weeks, companies like the ones mentioned above have delivered forward-looking statements filled with uncertainty about the economic climate and the underlying businesses. For now, from an opportunity cost perspective, there are better industries to be invested.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report