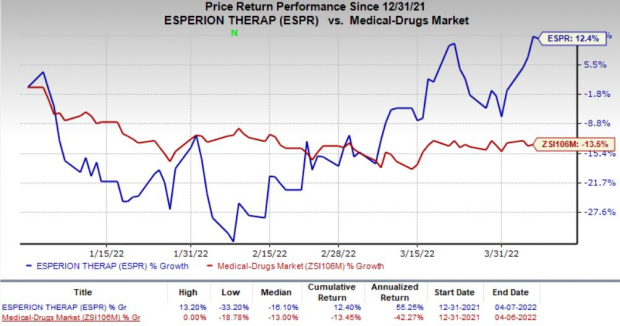

Shares of

Esperion Therapeutics

ESPR

have been gaining since the beginning of February and have rallied 12.4% so far this year. The upsurge in the stock price is majorly driven by the prospects of its two marketed drugs, namely Nexletol and Nexlizet. The stock has gained against the

industry’s

13.5% decline in the same period.

Image Source: Zacks Investment Research

The drugs are approved as an adjunct to diet and maximally tolerated statin therapy for the treatment of adults with heterozygous familial hypercholesterolemia (HeFH) or established atherosclerotic cardiovascular disease (ASCVD), who require additional lowering of LDL-C in the United States since 2020.

The drugs were approved in Europe for similar indication in April 2020. In Europe, Nexletol is available as Nilemdo and Nexlizet is marketed as Nustendi.

Esperion reported strong growth for product revenues during the fourth quarter of 2021. Product revenues, solely from the United States, were $12.2 million in the fourth quarter, up 49.3% year over year. The drugs have demonstrated strong sequential growth in the past few quarters. Management stated that prescriptions for its drugs were up 9% year over year. Product sales increased more than 200% year over year in 2021.

ESPR records royalties on sales of Nilemdo and Nustendi in Europe. Esperion has an agreement with Daiichi Sankyo Europe for the commercialization of both drugs in Europe and several other countries. ESPR also has an agreement to develop and commercialize Nexletol and Nexlizet tablets with Otsuka Pharmaceutical in Japan.

Esperion’s drugs hold a strong potential for further growth as the cardiovascular segment represents a significant opportunity. ESPR’s expansion into new countries through partnerships is likely to boost royalties going forward following the potential launch of the drugs.

Moreover, Esperion reported an increase in the drugs’ net price along with volumes, which implies strong growth going forward. The addition of the drugs to

Humana

’s

HUM

formulary in May 2021 boosted their coverage in the United States.

Humana is one of the largest health care plan providers in the United States. Apart from HUM, Esperion is in discussion with other payers to include the drugs in their lists for improving patient access and likely driving demand.

Although the consensus estimate for total revenues in 2022 indicates limited growth, several analysts are expecting strong revenue growth in 2023. Total revenues in 2023 can be driven by higher sales of Esperion’s marketed drugs as well as by the potential sales-based milestone payments from its partners.

Esperion’s restructuring initiatives also boosted its margins by reducing costs which is likely to continue in 2022. Analysts expect a significant decline in the net loss for ESPR in 2022 compared to 2021’s figure

Although Esperion’s drugs have a promising prospect, it faces stiff competition from other established players as well as newer drugs, including

Sanofi

SNY

and

Amgen

’s

AMGN

PCSK9 inhibitors, Praluent and Repatha, respectively.

Sanofi and Amgen have significant resources at their disposal, compared to Esperion, which may hurt the commercialization scope. While Sanofi recorded more than $250 million of Praulent sales, Amgen’s Repatha generated $1.1 billion in 2021.

Zacks Rank

Esperion currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report