Exelixis, Inc.

EXEL

recently announced that it has initiated the dose-escalation stage of its phase Ib study, STELLAR-002.

STELLAR-002 is the second study to evaluate XL092 in advanced cancers. The phase Ib study is evaluating XL092 in combination with immuno-oncology therapies in advanced solid tumors. XL092 is a next-generation oral tyrosine kinase inhibitor (TKI) that targets kinases implicated in cancer growth and spread, including VEGF receptors, MET, AXL and MER.

The study’s objective is to evaluate the safety, tolerability and efficacy of XL092, in combination with

Bristol Myers’

BMY

Opdivo (nivolumab), Opdivo and Yervoy; and Opdivo and bempegaldesleukin.

The dose-escalation stage will determine the recommended dose in patients with advanced solid tumors for each of the XL092 combination therapy regimens. The study will begin to enroll tumor-specific expansion cohorts for patients with advanced renal cell carcinoma (RCC), urothelial carcinoma and metastatic castration-resistant prostate cancer, once the recommended dose is established. The primary efficacy endpoint of the expansion stage will be objective response rates, except for the cohort of patients with metastatic castration-resistant prostate cancer. The primary endpoint will be the duration of radiographic progression-free survival.

While Exelixis is sponsoring STELLAR-002, Bristol-Myers is providing Opdivo, Yervoy and bempegaldesleukin for use in the trial. Both the companies had entered into a clinical trial collaboration and supply agreement in June.

XL092 is the first internally discovered Exelixis compound to enter the clinic following the company’s reinitiation of drug-discovery activities. It is currently being developed to treat advanced solid tumors, including genitourinary cancers, as a monotherapy and in combination with immune checkpoint inhibitors.

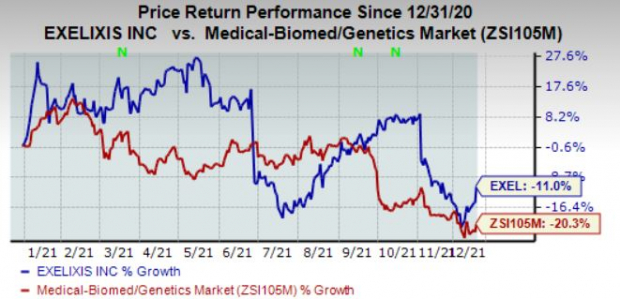

Exelixis’ shares have lost 11% in the year so far compared with the

industry

’s decline of 20.3%.

Image Source: Zacks Investment Research

Exelixis is looking to build a differentiated next-generation pipeline in oncology through strategic collaborations. The successful development of additional candidates will diversify its revenue base and reduce dependence on Cabometyx, which is approved for advanced RCC and previously treated hepatocellular carcinoma (HCC), maintaining momentum on label expansions.

In January 2021, the FDA approved Cabometyx in combination with immuno-oncology drug Opdivo for the first-line treatment of patients with advanced RCC. Sales of the drug saw an increase in volume thereafter driven by the strong uptake for the combination therapy of Cabometyx and Opdivo.

However, competition is stiff in this space and hence Exelixis is looking to develop its portfolio beyond Cabometyx.

Merck’s

MRK

Keytruda, in combination with

Pfizer’s

PFE

Inlyta, is also indicated for the first-line treatment of patients with advanced RCC.

Merck’s Keytruda, an anti-PD-1 therapy, is approved for the adjuvant treatment of patients with RCC at intermediate-high or high risk of recurrence, following nephrectomy, or following nephrectomy and resection of metastatic lesions.

Pfizer’s Inlyta has shown strong performance, driven by continued adoption in the United States and Europe. Pfizer’s older drug Sutent is also approved for advanced RCC.

Exelixis currently carries a Zacks Rank #4 (Sell).

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report