On Dec 15, Wall Street witnessed a relief rally after the Fed released its last FOMC meeting statement of 2021. The outcome of the FOMC meeting was in line with the market’s expectations. In fact, the adjustment regarding a more hawkish Fed was already factored in stock markets’ valuation. Consequently, Wall Street witnessed a strong northbound movement as a large section of investors were uncertain about a more aggressive Fed.

The stage is set for a year-end Wall Street rally as the Fed has removed uncertainties regarding interest rate movement in the near term and the resurgence of the Omicron variant of coronavirus has had little impact on the global economy so far. Therefore, it will be prudent to invest in momentum/growth stocks with a favorable Zacks Rank. We will discuss five of those stocks, namely –

NVIDIA Corp.

NVDA

,

Advanced Micro Devices Inc.

AMD

,

QUALCOMM Inc.

QCOM

,

Analog Devices Inc.

ADI

and

Broadcom Inc.

AVGO

.

Fed Removes Investors’ Concerns

Fed Chairman Jerome Powell said in his post FOMC statement that the central bank will raise the tapering of the monthly bond-buy program from $15 billion per month to $30 billion per month effective January 2022. At this rate, the quantitative easing program will end on March 2022.

With respect to an interest rate hike, Powell said “We’re in a position where we’re ending our taper by March, in two meetings, and we’ll be in a position to raise interest rates as and when we think it’s appropriate.”

However, Fed’s dot-plot indicated that all 18 members are expecting at least one rate hike in 2022. Out of 18 Fed members, 12 are expecting three rate hikes in 2022 followed by another two rate hikes in 2023 and 2024.

Importantly, the FOMC statement reiterated that the Fed will pursue its existing benchmark lending rate of 0-0.25% that it sets on March 2020 “until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment.”

Per the Fed, the headline PCE inflation will stay at 5.3% in 2021 but will reduce to 2.6% in 2022. The core PCE inflation – Fed’s favorite inflation gauge – is estimated to stay at 2.7% in 2022. The unemployment rate is likely to fall from an estimated 4.3% in 2021 to 3.5% in 2022.

Markets Express Sigh of Relief

The year-to-date impressive bull run of Wall Street has suffered setbacks since Black Friday due to the resurgence of coronavirus and the Fed Chairman’s indication to shift toward more hawkish and aggressive policies in the December FOMC meeting.

Concerns about Omicron have already faded out as available data shows its less severity. On Dec 15, the Fed removed market participants’ concerns regarding near-term market interest rate movement, setting the stage for a year-end rally.

Consequently, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — rallied 1.1%, 1.6% and 2.2%, respectively. These indexes posted the best daily-gain in a week and the best performance on a Fed meeting day since Nov 5, 2020.

Surprisingly, the technology sector, which is expected to be the worst sufferer due to a rise in market interest rate, gained the most on Dec 15. Aside from the tech-heavy Nasdaq Composite, the Technology Select Sector SPDR (

XLK

), one of the 11 broad sectors of the market’s benchmark the S&P 500 Index, surged 2.7%. The Philadelphia Semiconductor Index (SOX) climbed 3.7%.

Our Top Picks

We narrowed our search to five semiconductor behemoths (market capital > $50 billion) that have strong growth potential for the rest of 2021. These stocks have seen positive earnings estimate revisions in the last 30 days. Each of our picks carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

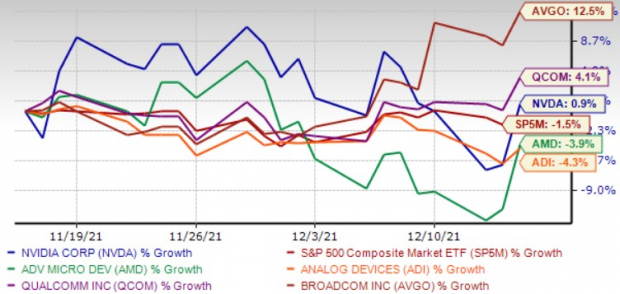

The chart below shows the price performance of our five picks in the past month.

Image Source: Zacks Investment Research

NVIDIA

is benefiting from the coronavirus-induced work and learn-at-home wave. NVIDIA is also benefiting from strong growth in GeForce desktop and notebook GPUs, which is boosting gaming revenues. Moreover, a surge in Hyperscale demand remains a tailwind for NVIDIA’s Data Center business.

The expansion of NVIDIA GeForce NOW is expected to drive its user base. Further, the solid uptake of AI-based smart cockpit infotainment solutions is a boon. The collaboration with Daimler-owned Mercedes-Benz is expected to strengthen NVIDIA’s presence in the autonomous vehicles and other automotive electronics spaces.

NVDA has an expected earnings growth rate of 73.2% for the current year (ending January 2022). The Zacks Consensus Estimate for current-year earnings has improved 4.6% over the last 30 days.

Qualcomm

is well positioned to benefit from a solid 5G traction with greater visibility to meet its long-term revenue targets. For calendar-year 2021, 5G handsets with Qualcomm chips are expected to witness 150% year-over-year growth at the midpoint to about 450-550 units.

Qualcomm has raised the bar for driverless cars with the launch of the first-of-its-kind automotive platform — Snapdragon Ride — which enables automakers to transform their vehicles into self-driving cars using AI.

QCOM has an expected earnings growth rate of 22.8% for the current year (ending September 2022). The Zacks Consensus Estimate for current-year earnings has improved 1.5% over the last 30 days.

Advanced Micro Devices

is riding on robust performance from the Computing and Graphics, and Enterprise Embedded and Semi-Custom segments. AMD is benefiting from strong sales of its Ryzen and EPYC server processors, owing to the increasing proliferation of AI and Machine Learning in industries like cloud, gaming and supercomputing.

The growing clout of 7 nanometer products in the data center vertical, driven by work-from-home and online learning trends, is a key catalyst. Advanced Micro Devices has raised its 2021 guidance for revenues on the back of strong growth across all businesses.

AMD has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings improved 0.4% over the last 7 days.

Broadcom

is riding on continued strength across both Semiconductor solutions and Infrastructure software verticals. In fourth-quarter fiscal 2021, Semiconductor revenues benefited from higher demand for wireless solutions and continued momentum in networking and broadband solutions.

Networking revenues of AVGO were driven by routing from service providers in the expansion of 5G networks for backhaul, metro, and call, as well as major share gains in ethernet network interface controllers within data centers. Synergies from acquisitions of CA and Symantec’s enterprise security business aided results of Broadcom. Further, an upbeat first-quarter guidance on strong uptick in broadband, networking and wireless revenues is encouraging for AVGO.

Broadcom has an expected earnings growth rate of 17.9% for the current year (ending October 2022). The Zacks Consensus Estimate for current-year earnings has improved 6.2% over the last 7 days.

Analog Devices

has strength across communication, consumer, industrial and automotive end-markets. Further, solid demand for high-performance analog and mixed-signal solutions was a tailwind. Growing momentum across the electric vehicle space on the back of robust Battery Management System solutions remains a positive for ADI.

Further, growing power design wins are the other positives for Analog Devices. The solid momentum of the HEV platform across cabin electronics ecosystem remains a tailwind for ADI. Moreover, Analog Devices remains optimistic about the growth prospects associated with its Maxim acquisition and 5G.

ADI has an expected earnings growth rate of 16.7% for the current year (ending October 2022). The Zacks Consensus Estimate for current-year earnings has improved 4.4% over the last 30 days.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report