Fifth Third Bancorp

FITB

recently announced the elimination of non-sufficient fund (“NSF”) fees for all consumer accounts, effective from Jun 23.

NSF fee is a charge imposed on customers when their checks bounce or when automated withdrawals lead to an overdraft in their accounts. The customers generally do not have the funds to cover a transaction or purchase. Hence, removal of such fees elevates customers’ financial strength.

Recently, banks have been facing increased scrutiny from regulators and lawmakers for charging overdraft and other fees from consumers. Several U.S. consumer banks have been asked to eliminate all consumer overdraft fees to safeguard customers. Fifth Third’s actions align with such requests and bode well for the company in the long run.

Apart from removing NSF fees, the bank has taken several actions in the past for the benefit of its customers. In December 2021, Fifth Third removed overdraft fees on small dollar transactions. The bank has the lowest concentration of overdraft fees as a percentage of deposit fees among its peers.

In April 2021, the bank launched Fifth Third Momentum Banking, which focuses on avoiding fees and having access to additional liquidity options. This includes the “Early Pay” initiative, which provides free access to paychecks up to two days early with direct deposit. The bank’s “MyAdvance” policy permits advance funds of $50 or more against future qualified direct deposits. Lastly, customers are also eligible to receive an instant availability for check deposits.

In 2018, FITB initiated an Extra Time feature that provides additional time to make a deposit for avoiding overdraft fees. Customers are allowed to make a deposit any time before midnight on the business day after the account was overdrawn.

Fifth Third’s continuous reduction of such charges is unlikely to negatively impact its revenues. The bank has been expanding its fee-income base over the years through strategic acquisitions. This has also enhanced its digital bank product offerings. Hence, the overall elimination of NFS fees and other reductions will help increase the bank’s customer base, thus driving its revenues in the near future.

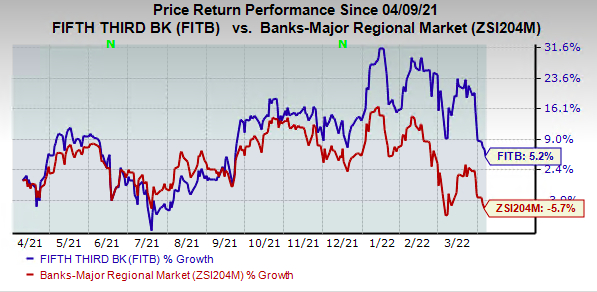

Shares of FITB have gained 5.2% over the past year against 5.7% fall of the

industry

it belongs to.

Image Source: Zacks Investment Research

Currently, Fifth Third carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Other Banks Taking Similar Steps

Several banks, including

Bank of AmericaCorporation

BAC

and

Citigroup Inc.

C

have stopped charging NSF fees and overdraft fees.

In January, Bank of America announced changes to its overdraft services, including plans to do away with NSF fees, effective February, and lower overdraft fees to $10 from $35, beginning in May. The company will also remove transfer fees associated with its Balance Connect for overdraft protection service in May.

Since 2010, BAC has taken several steps to “empower its consumer and small business clients to bank with greater confidence and reduce overdraft usage.” These efforts have substantially lowered fees related to overdraft. Such steps, besides SafeBalance accounts with no overdraft fees and Balance Assist, will reduce overdraft fee revenues by 97% from 2009 levels.

In February, Citigroup announced that it will completely terminate overdraft fees, return item fees and overdraft protection fees by this summer, making it the largest U.S. lender to do so.

Citigroup’s overdraft fee collection has been among the lowest when compared with its peers. Other than a consumer-friendly overdraft policy, the banking giant continues to expand access to banking products and services, making banking more financially inclusive for the underserved communities.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report