For many investors, dividend investing has been an effective way to grow their wealth.

When it comes to dividend growth stocks, not many are able to keep up with the dividend aristocrats and dividend kings that have continuously raised their dividends for 25 and 50 years respectively.

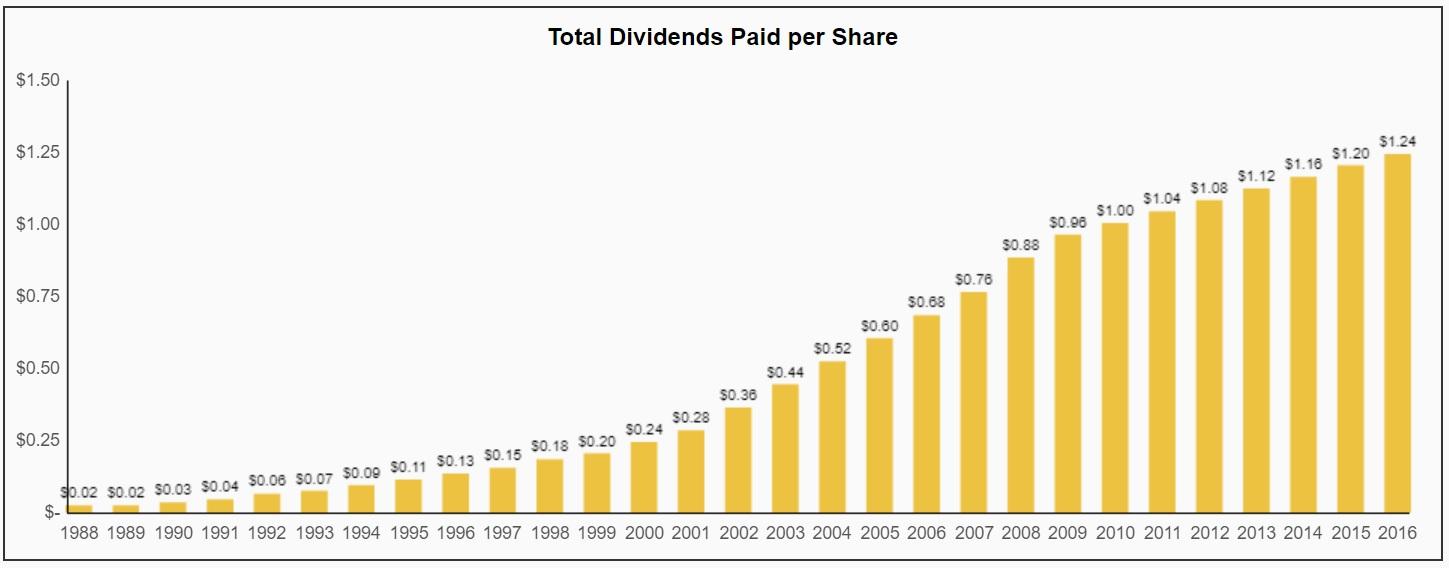

Sysco corporation (NYSE:$SYY) is currently a dividend aristocrat that has boasted over 48 years of consecutive dividend growth, and is just 2 years shy of taking its place as a dividend king.

Today we’ll look at whether or not Sysco is poised to continue their dividend issuance into the future, and whether or not today’s valuation is a reasonable estimate.

Business Overview

Sysco, which was founded in Houston, Texas in 1969, is one of the largest global distributors of food. Serving as a middleman of sorts between food producers, and retail consumers, Sysco employs over 65,000 people, and serves over a half million customers from restaurants, hotels and hospitals, to government agencies and schools.

Not only does Sysco boast a large network, but it also serves a diverse portfolio of products to clients in 13 different countries. The U.S, however, still proves to be its most important region, and it’s not even a competition.

Business Analysis

There are usually two key factors that allow a company to consistently grow their dividend for decades.

Firstly, in order to consistently provide and increase dividends, companies must be built on fundamentally resilient business models that are capable of sustaining consistent cash flow growth. The second factor (that builds on the last), is the existence of a sustainable competitive advantage. Although not always necessary, this provides the company with a line of defense that fortifies its cash flows, and hopefully allows for scale to increase margins to maximise profits.

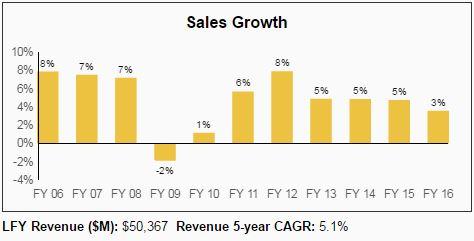

Due to food still being a necessary aspect of life no matter the economic crisis, Sysco Corporation suffered minimally in 2009, with sales declines of just 2%. Additionally, the company is further shielded by its diverse portfolio of clients that not only provides an array of revenue sources, but allows Sysco’s breadth of operations allow it to enjoy growing economies of scale.

Benefitting from both key factors, Sysco has been able to generate incredibly consistent cash flows, ultimately providing increasing dividends to its shareholders.

On top of all of this, wholesale food distribution is a rather simple business, which might explain why Warren Buffett decided to to enter the industry through his acquisition of McLane Company from Wal-Mart (NYSE:$WMT) for $1.45 billion.

As the whole food distribution space has a very selective process, new innovations are unlikely to pose any significant threats, leading to slow operational changes in the industry. At the end of the day, food manufacturers require cost-efficient options to get their products to retailers and end consumers.

In order to be on top, the best operators not only offer prompt and accurate deliveries, but should also have a broad product offering with highly competitive pricing. However, distributors essentially act as middlemen, and are constrained to very low operating margins (Sysco had margins less than 5% for the last decade). As a result, players must either establish themselves as niche leaders, or offer competitive pricing.

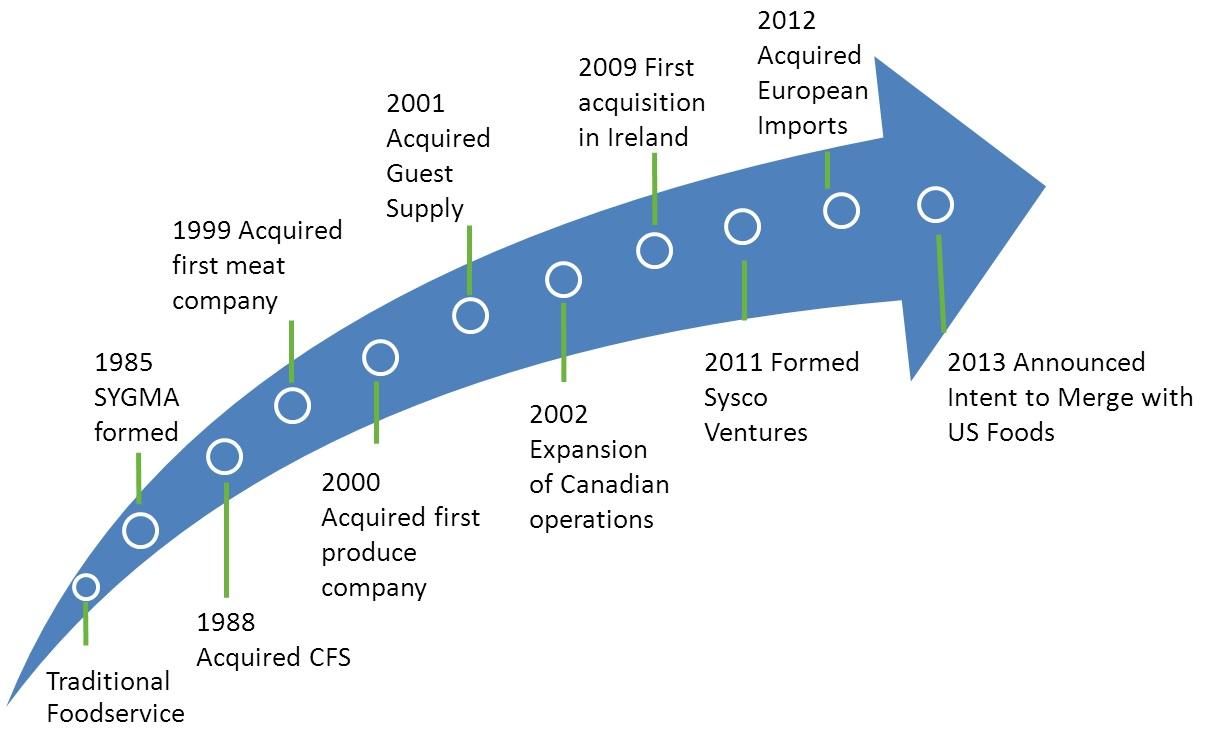

Unsurprisingly, there are competitive advantages that Sysco’s size grants in such a highly capital intensive industry. Since its formation, the company has been able to grow its annual sales to $50 billion from $115 million just 50 years ago. This heavy ramp up in revenue growth is attributed to a history of synergistic planned acquisitions.

Not only benefitting from the economies of scale that Sysco is able to take advantage of, very few competitors have the necessary capital or supply chain infrastructure to match Sysco’s inventory selection.

With a wealth of warehouses and distribution networks, Sysco is not only able to serve a diverse range of customers, but is capable of daily delivery. Further facilitating their margins, Sysco has a network of warehouses that allow the company to charge lower prices and delivery rates.

Although the U.S. market is nearing maturity, and has very little growth left for Sysco to capture, this is primarily because Sysco already has an enormous market share. According to Morningstar, Sysco’s revenue and operating income are two and three times the size of its closest competitor. This market dominance was the reason why the Justice Department decided to block Sysco’s $8.2 billion attempt at a buyout of U.S Foods, their closest competitors.

In light of this speed bump however, Sysco recognized that it must turn to global distribution in order to maintain its growth. Sysco’s $3.1 billion acquisition of Brakes Group in 2016 is just what the company needed, as it gave the company strong exposure to the international market.

As a result of its global expansionary efforts, Sysco has continued to grow revenue at a 5-year CAGR (Compound Annual Growth Rate) of 5.1%.

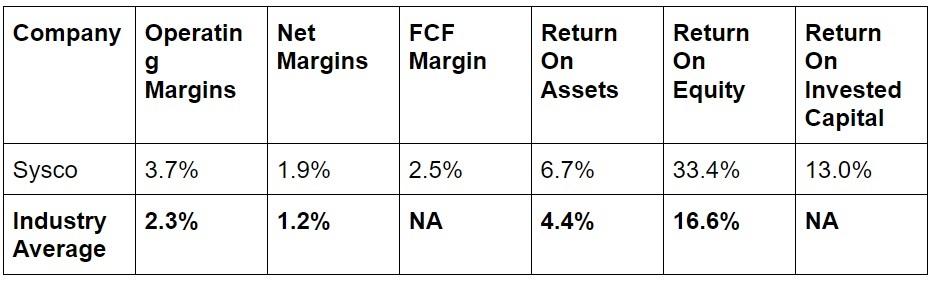

However, Sysco’s margins have been squeezed due to an incredibly fragmented industry which limits the pricing power of firms, and the general nature of the industry requiring high fixed operating costs, Sysco’s profitability along with its return on shareholder capital have recently seen a decline. Despite this, Sysco has been able to remain as a leader in the industry in terms of profitability, and still has impressive returns on investor capital thanks to its enormous economies of scale, and cost reducing initiatives.

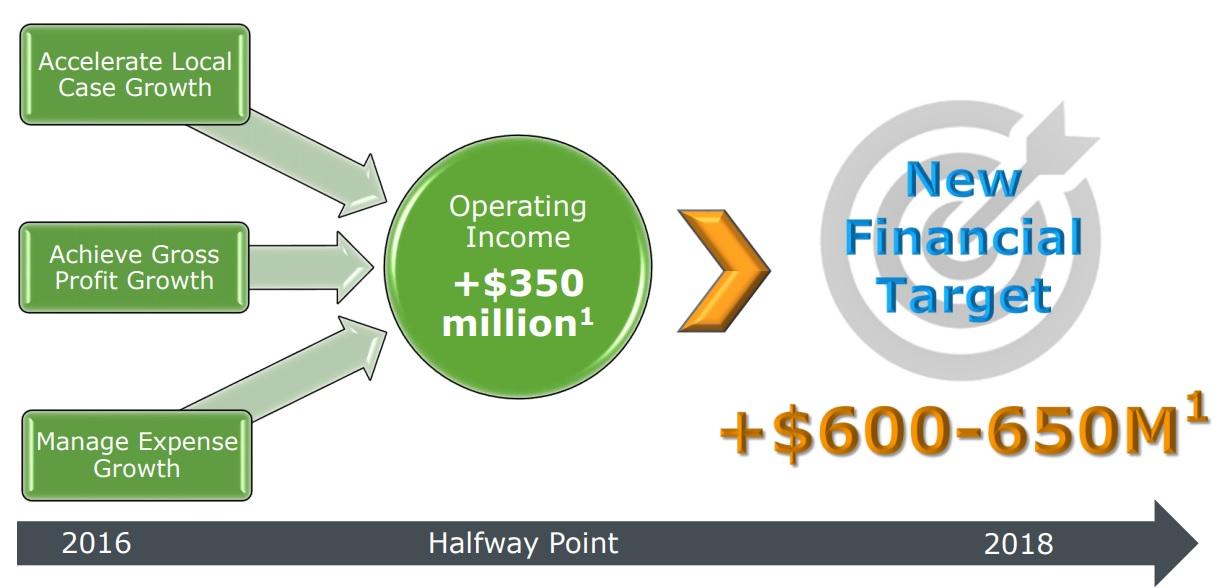

With promise from Nelson Peltz to learn down the company, when he took a position on Sysco’s board of directors in 2015, management has ramped up on its cost saving initiatives. In fact, Sysco expects to free up an additional operating income of $600 million to $650 million as a result of their operational improvements. This will represent operating income growth at an incredible annual rate of 10.2%, while increasing profitability by 33%.

As a result of these efficiency improvements, management has targeted a Return On Invested Capital of 15%, which is incredible in such a capital intensive and low margin industry.

Although it has yet to be seen just how plausible or sustainable these cost cuts are in the long term, this bodes well for potential dividend growth if Sysco is able to execute.

Key Risks

However, investing in Sysco also comes with its own risks.

As mentioned before, Sysco operates in a highly competitive and mature food distribution industry. In recent years, some market share has also been taken by smaller specialty distributors in the higher-margin restaurant business, which is in addition to the tens of thousands of already established domestic competitors. New competition contributes to the fragmentation of the market, further placing pressure on margins, and ultimately, profitability.

However, Sysco has been countering these growth stunting factors by expanding internationally and utilizing its economies of scale, offering more locally produced foods and ingredients in order to reduce costs in certain areas. If necessary, Sysco is large enough to easily acquire any local or niche distributors that may threaten its operations (market share).

As one of the world’s leading online retailers, Amazon has a heavily sophisticated warehousing, inventory management, and delivery system. When combined with its recent acquisition of Whole Foods (NASDAQ:$WFM), the company may have the network and expertise to disrupt the food distribution industry.

However, there’s little reason to believe that Amazon will enter the market, as establishing relationships with restaurants and necessary suppliers requires significant work. Along with a unique difference in inventory and delivery mechanisms necessary for wholesale food, tight industry margins should further deter Amazon.

Potential competitors that could also enter the food distribution market could include large national accounts or food producers that want to cut out the middlemen in distribution. However, high capital investments that lead to low value add may still be the contributing factor as to why this has not yet happened.

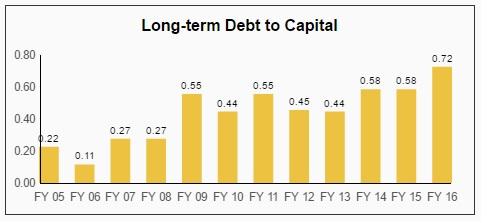

In order to finance its acquisition of Brakes Group, as well as the consistent buy back of shares (1.8% of shares annually over the last decade), Sysco had to significantly increase its debt levels. In an economy that is looking to raise interest rates, investors must scrutinize Sysco’s rising debt levels as large interest payments may pose a threat to Sysco’s already slim margins.

Lastly, investors should also understand that Sysco derives the majority of its revenue from the restaurant industry, which tends to be cyclical. As a result, Sysco’s revenue is still contingent on the health of the economy. For example, Sysco saw sales decline by 2% in 2009, when sales had grown by 7% just the year before in 2008.

While Sysco’s business performed relatively well compared to other companies during the crash, volatility in oil prices and consumer spending patterns on groceries and restaurants could stunt short-term results. However, these issues are unlikely to depress Sysco’s revenue figures in the long term.

Sysco’s Dividend Safety

In order to determine the safety of the dividends issued, investors must look at critical financial factors and ratios such as historical Earnings Per Share and Free Cash Flow payout ratios, debt levels, trends in free cash flow generation, cyclical aspects of the industry, Return On Invested Capital trends, and more.

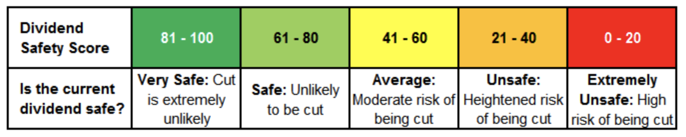

This is what the Dividend Safety Score developed by Simply Safe Dividends uses to assess the health of dividend stocks. With scores ranging from 0-100, investors are urged to stick with companies that have scored a minimum of 60 points. The high-cutoff zone has been placed below 20 points, as that has been the typical Dividend Safety Score derived from the firm’s financial factors during the announcement of its dividend cutoffs.

As the company has announced dividend increases each year it has been in business, it’s no surprise that Sysco received a dividend Safety Score of 97. This means that Sysco boasts one of the most resilient dividends in the market.

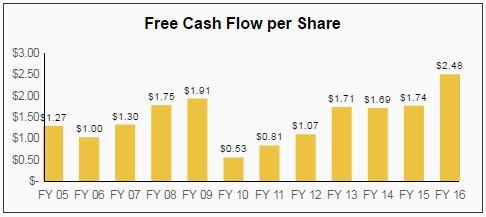

Sysco’s consistent streams of revenue, along with efficient management, has allowed the company to consistently pump out strong cash flow figures. With management’s ability to issue optimal payout ratios, these factors have been the driving force in Sysco’s strong historical dividend payouts.

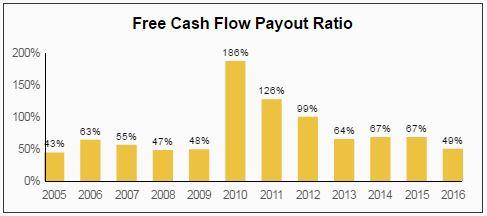

As a result of this efficiency, Sysco makes the perfect dividend stock for risk averse investors, as the company’s dividend is heavily backed by consistent cash flow even in economic downturns. Historically, Sysco’s free cash flow payout ratio has ranged between 40% and 70%, which is quite satisfactory for such a stable company.

Taking note, Sysco’s free cash flow growth during the recession was the result of interesting adjustments by management. As demand for goods typically fall during a recession, minimizing the need for inventory buildups and other working capital expenditures, freeing up more cash.

Additionally, Sysco still has a healthy balance sheet even after increasing their debt position to finance share buybacks and the acquisition of Brakes Group. As a result, management is able to ensure the ever-growing dividend payouts, as well as putting money into the future growth of the company.

Although Sysco’s increased debt position may be unfavourable to investors, they must keep in mind that the debt has been put to good use. As such, there should be little worry of interest payments, as projects of this nature tend to provide consistent cash flow.

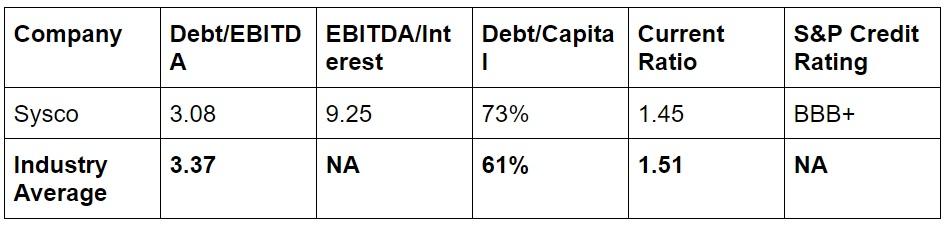

Upon analyzing its debt metrics, it’s apparent that Sysco’s debt levels are slightly higher relative to its peers, though still far from concerning thresholds.

The interest coverage ratio and the current ratios are all relieving qualities that have allowed Sysco to attain an investment-grade credit rating. This likely allows the company the flexibility of low cost debt, which is an incredible advantage in a capital crucial industry. This makes Sysco’s debt look a little better, especially during a time when interest rates are expected to be raised by the Feds.

While Sysco boasts an impressive 70% payout ratio that could also have investors worried, the company and nature of its business provide a very consistent cash flow. As such, Sysco is able to sustain such high dividend payouts with little cyclical risk.

Sysco’s Dividend Growth

The purpose of the Dividend Growth Score is to project how quickly the dividend of a stock is likely to grow. Although it considers many of the same factors as the Safety Score, a greater emphasis is placed on related metrics such as sales, payout ratios and earnings growth. Scores of 25 indicate a relatively weak dividend growth, while 50 indicates stocks that have average potential, and 75 or higher dictate stocks that may have higher potential for dividend growth.

Although Sysco scores a below average score of 43, this indicates that the company’s dividend may still grow, just at a slightly slower rate. This correlates with Sysco’s track record in recent years, and makes sense given the nature of the industry.

You can see that although still growing, growth has slowed from a 10- Year CAGR of 6.2% to just 3.3% this past year, and an average of 3.5% in the most recent 3 years.

As slow as growth may be, however, Sysco’s dividend should still grow faster than inflation. After all, analysts were optimistic about Sysco’s ability to grow its revenue by 3-4%, where up to 1% could be derived from acquisitions.

This, along with annual share repurchase plans of 2% of outstanding shares, as well as increased operational efficiency, should push margins to allow Sysco’s bottom line grow at a satisfactory rate of 5-8% annually.

Assuming that Sysco is able to maintain a similar payout rate, which it should, it’ll imply a long-term payout growth in the mid-single digit range as well.

Valuation:

Stocks had a good run this year, and Sysco’s share price followed suit. So much however, that the company could potentially be overvalued.

For example, when comparing Sysco’s forward-looking P/E Ratio of 20.3, it is not only higher than the S&P 500’s forward P/E Ratio of 17.8, but is also above its 13-year median of 19.5. Although the difference doesn’t seem significant, it is amplified when taking into account the company’s slower growth profile. Additionally, its dividend is also constrained, sitting at just 2.4%, down 0.8% from its 13 year median of 3.2%.

However, it would still be fair for investors to expect a total annual return of approximately 7.4% to 10.4%. This, of course, is contingent on the annual earnings growth and cost reduction efforts of Sysco which are expected to contribute 5-8% of investor returns in addition to the expected 2.4% in dividends. If you also consider the lack of volatility that Sysco is exposed to relative to the S&P 500, then Sysco may be an ideal low-risk, high quality option for dividend investors.

Although some metrics suggest an overvalued share price, Sysco still has aspects that foresee continued growth, and potential value for investors. There is little reason to sell the stock at this point in time, as it still contributes greatly in the diversification of a dividend growth portfolio.

Conclusion

While Sysco doesn’t generate the same excitement as other dividend growth stocks, its mild dividend growth combined with efforts to increase margins may benefit shareholders more than expected. Although Sysco has a very simple business structure, it has deep networks and years of industry experience that has cemented their presence. Its competitive advantage also allows for a diversified portfolio of revenue streams, and the nature of its offerings mean that cash flow generation would be less cyclical to the economy.

However, Sysco’s valuation may deter some investors today, meaning Sysco could potentially be a good share to watch for the future, as the stock is still believed to hold long-term growth value in the future, conservative dividend investors might went to enter at a slightly lower share price.

Featured Image: sysco