In an interview in 2011, recently-named Bank of America (NYSE:$BAC) CEO Brian Moynihan informed Fortune’s Shawn Tully of his top goals for the company. “We need to get back most of the shares we issued in the crisis that caused all the dilution,” Moynihan said.

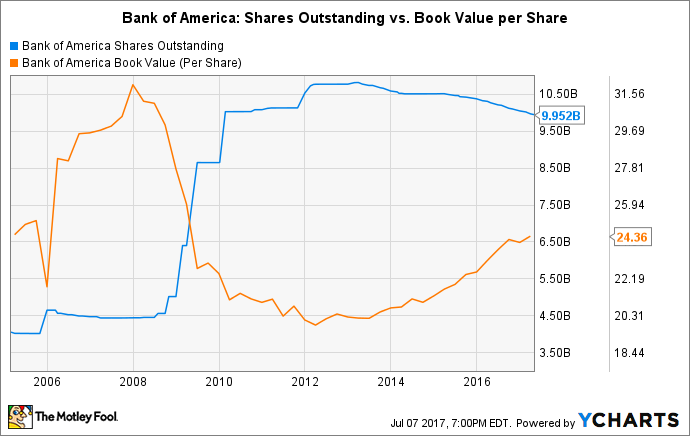

The crisis that caused dilution occurred from 2008 to 2012, when Bank of America increased its outstanding share count from 4.5 billion shares to 11.6 billion shares on a fully diluted basis. Some of the increase was due to Bank of America’s purchase of Merrill Lynch back in 2008 — the acquisition upped Bank of America’s outstanding share count by 1.4 billion shares. A large part of the increase was due to the bank’s need to cushion its losses from financial and banking crises which lead to a loss that totals almost $200 billion.

While issuing shares have allowed Bank of America to get through several crises, the rise in it has made the company’s stock to trade at less than half its book value per share. As such, Bank of America has seriously damaged the value of shareholders’ stocks.

At the end of 2007, Bank of America’s book value was $32 per share — four years later it went down significantly to $20 per share. To this day, Bank of America is still feeling the result from its decision to dilute shareholders. The bank’s shares are still trading below its pre-crisis peak because their book value greatly affects its share price.

As such, the reason why one of Moynihan’s main goals for Bank of America is to reverse the dilution. In his latest shareholder letter, he explains the situation in length and explains further why he wants to solve the dilution problem:

In 2006, we earned the most in our history ($21 billion). We had 4.6 billion shares outstanding, meaning our diluted earnings per share was $4.58. We also paid a common stock dividend of $2.12 per share or 46 percent of our earnings. Now, compare this to our 2016 results: earnings were $18 billion, but because we had more than twice as many shares outstanding, our EPS was $1.50 per diluted share, and our common stock dividend was $0.25 per share or 17 percent of earnings.

The biggest difference between the two periods is the increase in common shares and a reduction in the dividend. Both were necessary to stabilize the company after the worst economic crisis since the Great Depression, and now that our company is stronger, we are focused on reducing the dilution and increasing the dividend.

Our shares outstanding, on a fully diluted basis, peaked at 11.6 billion. We issued more than 7 billion common shares during the crisis. We funded acquisitions, strengthened our balance sheet to meet higher capital requirements, and repaid the government’s TARP investment within 13 months. We are working the share count down; at year-end, we were at 11 billion shares.

For Bank of America investors, this is extremely good news. Moynihan’s letter suggested strongly that the company is now at a stable enough position to begin working towards lowering its share counts. Recently, the bank has announced that it will be repurchasing about $12 billion worth of common stock in the next year. The news came after the end of its second round of stress tests in June.

In reference to today’s price, $12 billion is worth about 486 million shares of common stock. Taking into consideration the bank’s current market capitalization of $246 billion, its share back rate for the next year is about 5% of its market value. Using these numbers, it will take Bank of America about a decade and a half to get back all the shares it issued from 2008 to 2012.

While it may be a while until Bank of America can truly reach its goal of solving its dilution problem, the long-term investment may be worth it to some investors given the current steady performance the bank has put up so far.

Featured Image: depositphotos/wolterke