Wells Fargo (NYSE:$WFC) have been caught up in a big scandal since September 2016 that resulted in former CEO John Stumpf stepping down as well as a flurry of lawsuits. While the banking institution has mostly moved past the scandal since then, recent news has arisen that the number of unauthorized accounts created by the bank were far more than what the public had previously thought. The lawyers representing the victims of Wells Fargo’s wrongdoings said in a legal filing, “Based on public information, negotiations, and confirmatory discovery, the parties estimate the number of unauthorized accounts for the period of 2002-2017 is approximately 3.5 million. This number may well be over-inclusive, but provides a reasonable basis on which to estimate a maximum recovery.”

A Brief Rundown

The scandal breakout that occurred in September 2016 was a build up of situations that had been occurring as early as 2005 when Wells Fargo’s employees began to show concern with fraud occurring due to high sales quotas for the bank’s consumer financial products. Employees were creating fake accounts for their customers in order to meet these quotas. However, these concerns were largely ignored by management. Then, when some employees tried to address the fraud to Human Resources or Wells Fargo’s ethics hot lines, they were fired. Some were even blacklisted from working in the banking industry.

Stumpf, the CEO at the time, knew of specific cases of fraud occurring as early as 2002, but was not fully aware until of the bank’s issues of sales practices until 2012. The extent to which Stumpf ignored the problem in order to generate extra profit was not revealed until it became public that a Wells Fargo employee was fired after directly emailing the former CEO about the fraud. As such, Stumpf was ousted as CEO by the board at Wells Fargo. Stumpf also had to give up the $41 million in Wells Fargo stock he owned.

Stumpf and Wells Fargo’s actions have broken down 164 years of trust with its customers and investors. The scandal has stripped Wells Fargo’s status as one of the most reliable investments and banks. Some of the public even believe that Stumpf should be jailed because of his allowance of unjust treatments of Wells Fargo employees and consumers to happen.

The Fraud Going Far

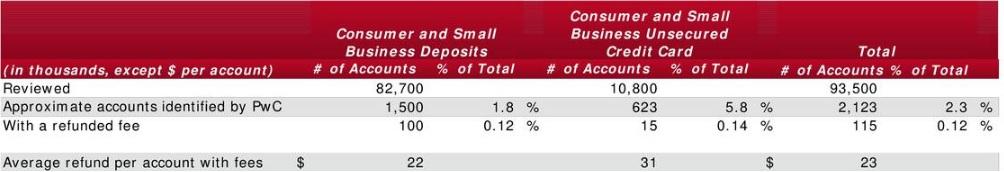

When the fraud was first revealed in October 2016, it was believed — based on an independent study by PricewaterhouseCoopers (NYSEARCA:$PWC) — that only about 2.3% of accounts were fraudulent, and only one in every 833 accounts incorrectly charged its customers (averaging $23 per mischarged customer). The total of mis-charges resulted in $2.6 million, the full amount in which the bank is refunding to affected customers.

However, as mentioned above, recent discoveries have suggested that the number of unauthorized accounts may be more than what had been estimated before. This could mean a possibility of a higher amount of mischarged customers. The total number of unauthorized accounts still hasn’t been verified, Wells Fargo representative Ancel Martinez said in response to the plaintiff attorneys’ claims.

Changes to Earnings

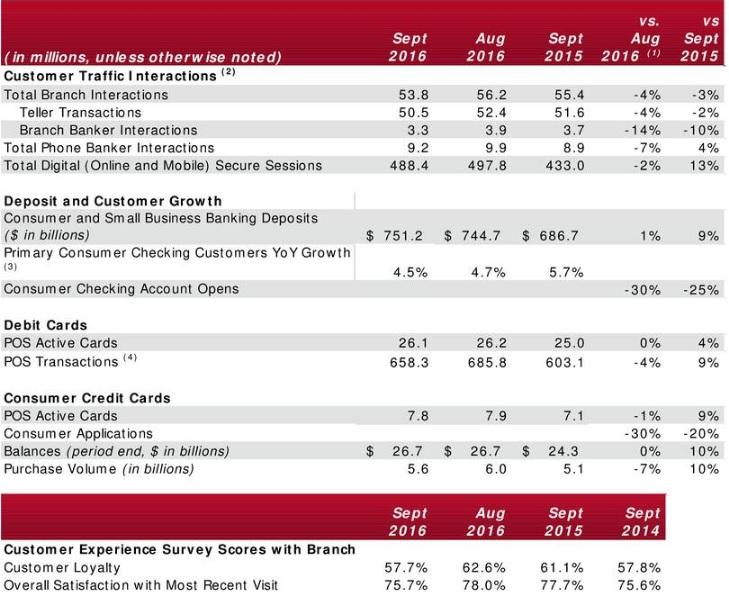

Short-term impacts such as Wells Fargo’s credit card, checking accounts, as well as mortgage referrals all fell when the scandal was first reported in September 2016. New checking account openings fell by 30% and mortgage referrals fell by 24% in September when compared to August 2016.

Since then, some investors have shown concern over a permanent dramatic decrease in cross-selling quotas which could result in less profit for Wells Fargo. Given its first quarter reports in 2017, these concerns were somewhat justified.

Wells Fargo’s first quarter reports showed a lower profit due to higher costs and lower revenue from mortgage banking. Still, the company was close to meeting its expectations, with an $1 earnings per share (EPS) compared to the expected 97 cents by Thomson Reuters analysts’ consensus and a $22 billion in revenue compared to the expected $22.32 billion by Thomson Reuters analysts’ consensus.

Shares didn’t fall dramatically — only a mere 2% — when Wells Fargo’s first quarter reports were released, suggesting that investors believe to an extent that the banking company will be able to re-attain its former glory and customer trust. This may be due to the September 2016 customer loyalty and satisfaction data. While showing some decline, the number stayed close within the range from 2014 to 2015.

Management Addresses Changes

Tim Sloan, the new president and CEO of Wells Fargo said in a statement, “I am deeply committed to restoring the trust of all of our stakeholders, including our customers, shareholders, and community partners. We know that it will take time and a lot of hard work to earn back our reputation, but I am confident because of the incredible caliber of our team members. We will work tirelessly to build a stronger and better Wells Fargo for generations to come.”

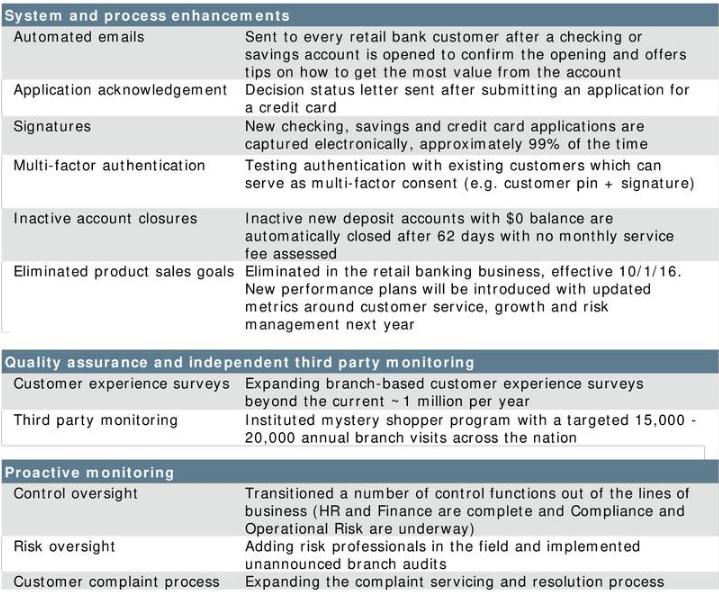

While the above promise from Sloan may sound empty at first, Wells Fargo have matched Sloan’s words with strong actions — making it quite possible that the company is actually committing to righting its wrongs. Some measures that Wells Fargo have taken, or will take, are:

- Separating the roles of Chairman and CEO in order to make the Board of Directors more independent from the company.

- Stripping Carrie Tolstedt, former head of community banking at Wells Fargo, of severance and retirement benefits. $19 million in Wells Fargo stock was also forfeited from Tolstedt’s holdings.

- Ensuring all 43 million holders of retail and/or small business accounts have had their accounts opened properly.

- Getting in contact with customers affected by the fraudulent accounts

- Getting in contact with various credit bureaus on the behalf of customers who were affected by fraudulent accounts/unauthorized credit cards in order to help restore customers’ FICO scores.

Wells Fargo have also taken measures to help ensure that frauds like this will have much lower chances of occurring again. Law firm Shearman & Sterling has been hired by management to investigate the fraud independently. As well, Wells Fargo plans to change its ethics line procedures and have offered to rehire the employees that were wrongfully fired for trying to report the fraud. In addition, Wells Fargo has also put in place a number of safeguards — both automated and procedural — to ensure that all customers’ accounts are valid and opened with consent. Of course, new cross-selling product quotas are also going to be introduced.

Putting the Situation in Perspective

Although the scandal has certainly damaged Wells Fargo’s reputation, it still doesn’t change the fact that the company’s stock is one of the few that investors deem a “Sleep Well At Night”, or SWAN, stock in the banking industry.

Since it was founded in 1852, Wells Fargo have shown integrity, consistency, and an emphasis on providing good customer service and keeping the trust of employees, customers, and shareholders alike. It has shown a consistent and conservative banking culture that has allowed the company to live through many economic disasters, for it to grow, and for it to thrive over time.

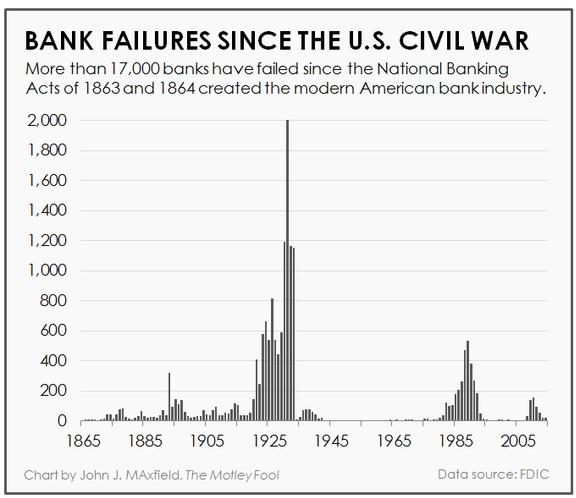

About 17,365 banks have fell in the U.S. alone since 1865 — thousands of them taking the life savings of millions of Americans with them. In comparison, Wells Fargo truly is a company to look up to when it comes to American banking.

Specifically, Wells Fargo has lived through 12 banking crises, 27 recessions, three economic depressions, and two world wars since it was first established 164 years ago. As such, despite the recent scandal and hot water Wells Fargo has found itself in, many investors and consumers still consider the banking institution to be one of the best among U.S. banks.

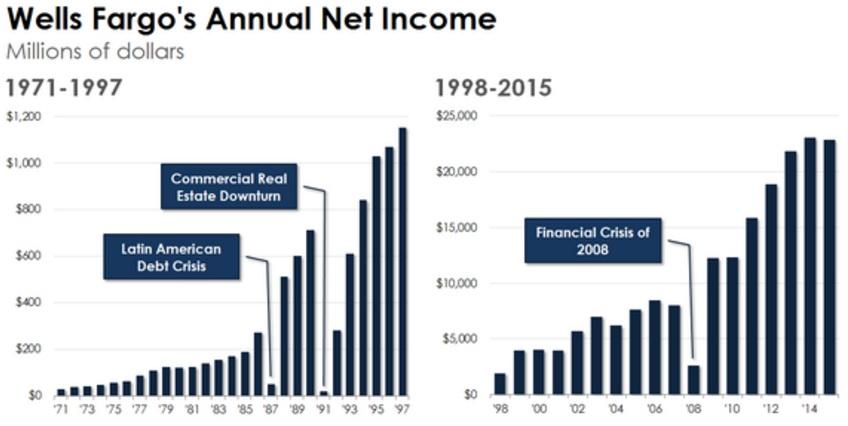

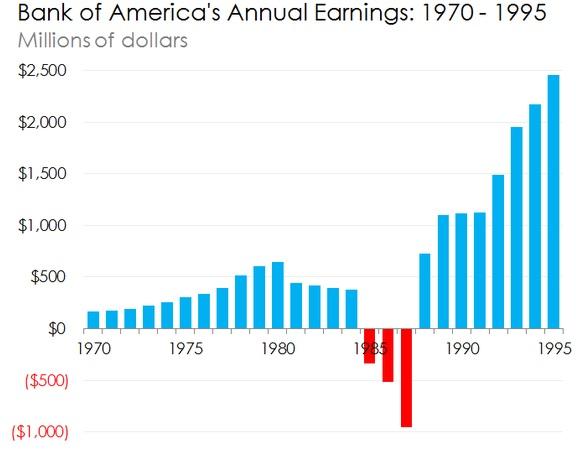

What’s more impressive is that Wells Fargo not only managed to live through various financial crises, they were able to profit during these times. So far, the bank has yet to report a loss for 45 years straight, even managing to gain net income during the financial crisis in 2008 — the most devastating crisis since the Great Depression. Compared to other big-name banks like Bank of America (NYSE:$BAC), who saw losses for three consecutive years during the banking crisis in the 1980s, Wells Fargo is a much more reliable bank and investment.

Summary

The fact that Wells Fargo and previous management have allowed such a fraud to occur is still most definitely a wrongdoing on the company’s part, but when one considers Wells Fargo’s consistency and strength in more than 150 years of U.S. banking, the fraud seems somewhat forgivable. Thousands of other banks in U.S. banking history have done things that resulted in the loss of all of their customers’ money — ruining many lives — and have almost destroyed the world economy not once, but twice.

Given historical context, many investors in Wells Fargo have kept a hold on their stocks, believing it still is one of the U.S.’s safest big-name banks. Still, the banking company has a long way to go before it can fully regain the trust and faith it previously held with its customers, shareholders, and employees. As such, it is recommended that investors who are considering to invest in Wells Fargo despite its scandal to view the investment as a long-term dividend investment.

Featured Image: twitter