First Bancorp

FBNC

has inked a deal to acquire Dunn, NC-based

Select Bancorp, Inc.

SLCT

for roughly $314.3 million. The all-stock deal is expected to close in the fourth quarter this year.

Richard Moore, CEO of First Bancorp, said “Select Bank is a high quality institution with a long-standing history of service and strong community banking relationships,” He added, “We are thrilled that the Select Bank team will be joining First Bank, and we look forward to the opportunity to serve their customers.”

Per Bill Hedgepeth, president, CEO, and director of Select Bancorp, “We are very excited about this partnership and the unique opportunity it presents.” “He also said, “We have long admired First Bancorp, and our combined company will be positioned to capitalize on an enhanced presence in exceptional markets, talent, and financial strength.”

Transaction Details

Per the terms of the deal, shareholders of Select Bancorp will get 0.408 share of First Bancorp’s common stock for each share of Select Bancorp’s common stock.

As of Mar 31, 2021, Select Bancorp had total assets of $1.8 billion, deposits of $1.6 billion and loans of $1.3 billion. Following the transaction’s completion, the combined entity will have more than $9 billion in total assets, $6 billion in loans, and $8 billion in deposits.

Currently, Select Bank operates 22 banking locations in North Carolina, South Carolina, and Virginia, with a robust foothold in North Carolina’s Fayetteville, Raleigh, Charlotte, and Wilmington. The deal will likely solidify First Bank’s position in North Carolina.

The transaction has already been approved by the boards of both companies. It, however, still requires regulatory approval, consents of both companies’ shareholders, and is subject to customary conditions.

Conclusion

First Bank anticipates that the acquisition will complement its existing footprint, and help the bank compete in several new markets. The deal is likely to further support the company’s financials.

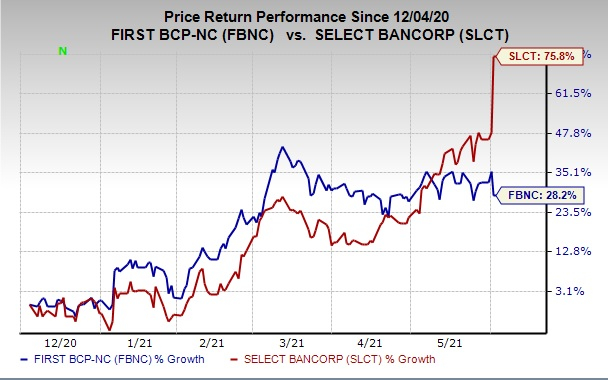

Notably, shares of First Bancorp and Select Bancorp have rallied 28.2% and 75.8%, respectively, over the past six months.

Image Source: Zacks Investment Research

Other Banks Making Similar Moves

Several other banks including

Bank of America

BAC

and PacWest Bancorp (PACW), have been undertaking similar actions.

Bank of America has acquired Santa Barbara, CA-based Axia Technologies, Inc., a health care payment and technology firm that provides secure patient payments. Terms of the transaction remain undisclosed.

In order to fortify its existing Homeowners Association (HOA) banking services,

PacWest Bancorp

PACW

in April, announced that its banking subsidiary, Pacific Western Bank, has signed an all-cash deal worth $250 million to acquire MUFG Union Bank, N.A.’s HOA Services Division. The transaction is likely to close in the fourth quarter of 2021, subject to necessary approvals.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report