First Solar, Inc.

FSLR

recently inked a deal with Origis involving the delivery of 750 megawatts (MW) of its thin-film photovoltaic (PV) solar modules to the latter. The agreement also highlights the inclusion of First Solar’s agile contracting approach, which aims to provide Origis an added advantage of the application of any advancement in technology by First Solar in solar modules manufacturing through 2024.

Through the deal, First Solar aims to further strengthen its more than five years of long-standing alliance with Origis, which, in turn, should also aid FSLR to consistently grow its business.

First Solar’s Capacity Addition Plans to Boost Growth

First Solar’s continuous efforts to expand its manufacturing capacity should assist the company in maintaining its position as the largest U.S. solar module manufacturer. In this context, it is imperative to mention that First Solar plans to build its third U.S. manufacturing facility in Ohio to expand its America’s domestic PV solar manufacturing capacity by 3.3 gigawatts (GW) annually. The facility boasts an investment value of $680 million.

Such an ambitious investment strategy will allow the company to expand its Northwest Ohio footprint to a total annual capacity of 6 GW. Also, FSLR plans to strategically grow its business in India through the construction of a 3.3 GW facility.

Underlined by substantial investments in manufacturing capacity in India and the United States, the company aims to double its nameplate manufacturing capacity to 16 GW by 2024.

Such capacity enhancements must enable First Solar to make timely delivery of PV modules to Origis, as mentioned above.

U.S Solar Market Boom & Peer Moves

As the need for clean energy accelerates the evolution of the renewables sources of energy away from fossil fuels, the widespread adoption of solar-based energy gains traction in the United States.

Per the Annual Energy Outlook report published by the U.S. Energy Information Administration in March 2022, the new wind and solar power will constitute the majority of this renewable energy increase, with total solar generation projected to surpass wind generation by the early 2030s.

Such intriguing factors bring the spotlight not only on First Solar but also on prominent solar players like

Enphase Energy

ENPH

,

SolarEdge Technologies

SEDG

and

Canadian Solar

CSIQ

who have already established a position in the U.S solar energy market either through the development of solar projects or by manufacturing related components or battery storage technologies.

In March 2022, Enphase Energy revealed that the Vermont-based utility, Green Mountain Power, decided to offer the Enphase Energy System to its customers as part of its battery lease grid services pilot program.

The Zacks Consensus Estimate for Enphase Energy’s 2022 earnings indicates an upward revision of 2.9% in the past 60 days. Shares of ENPH have rallied 22.8% in the past year.

In 2021, SolarEdge Technologies launched several new products like the Energy Bank residential battery and higher power optimizers and inverters in residential and commercial offerings in the United States.

SolarEdge boasts a long-term earnings growth rate of 24.7%. Shares of SEDG have returned 11.4% in the past year.

In April 2022, Canadian Solar sold its Gaskell West 2 and 3 solar-plus-storage projects to Matrix Renewables. Located in Kern County, CA, it has a generation capacity of 105 megawatt-alternate current plus 80 megawatt-hour energy storage.

The Zacks Consensus Estimate for Canadian Solar’s 2022 sales indicates a 37.7% improvement over the prior-year quarter’s reported figure. CSIQ shares have appreciated 13.4% in the past three months.

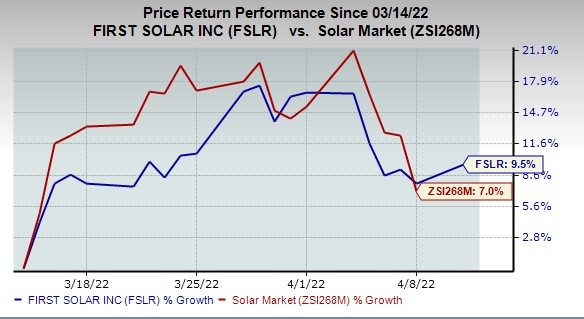

Price Movement

In the past month, shares of First Solar have rallied 9.5% compared with the

industry

’s growth of 7%.

Image Source: Zacks Investment Research

Zacks Rank

First Solar currently carries a Zacks Rank #4 (Sell).

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report