Governments all over the world are pushing for a greener future. The U.S. promised to cut emissions by up to 52%. Europe says it’ll cut emission by up to 55%. China says it’ll stop releasing CO2 in the next 40 years. But for that to happen, the world must have more copper. Unfortunately, with copper demand outstripping supply, there’s a problem. One that could create big opportunity for companies such as

Nine Mile Metals

(CSE: NINE) (OTCQB: STVGF),

Southern Copper Corp.

(NYSE: SCCO),

Freeport-McMoRan

(NYSE: FCX),

Teck Resources Ltd.

(NYSE: TECK), and

Turquoise Hill Resources

(NYSE: TRQ) (TSX: TRQ).

In addition, “More than 700 million mt of copper will need to be mined in the next 22 years to maintain 3.5% GDP growth, without taking into account the electrification of the global economy, which is the same volume of copper ever mined, Ivanhoe Mines Founder & Co-Chair Robert Friedland,” as noted by S&P Global. In addition, the world could run into a 9 million mt copper deficit by 2030, as noted by BMO Capital. All while demand increases for electric vehicles, solar and wind-power technology, and power grids. Plus, as also noted by S&P Global, “All power grids globally were unreliable, with huge investment needed to upgrade aging grids — in the US alone, he said investment of about $208 billion was needed by 2029 and around $338 billion by 2039.”

Look at Nine Mile Metals (CSE: NINE) (OTCQB: STVGF), For Example

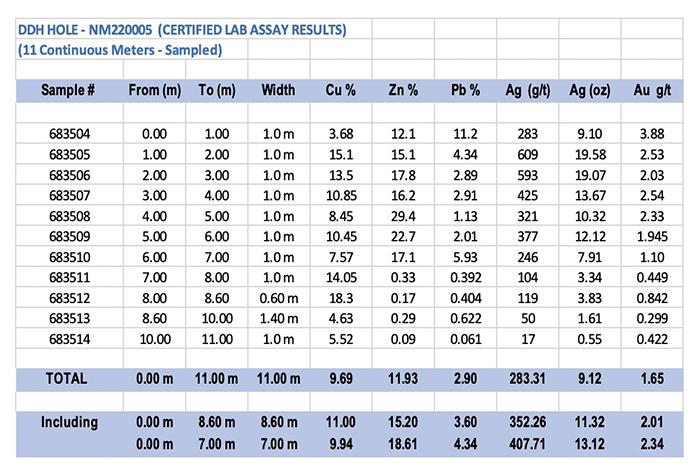

Nine Mile Metals

announced the certified ALS Global lab assay results for Hole NM220005, at the Company’s initial Stage 1 drill program at its flagship Nine Mile Brook VMS Project in the world-famous Bathurst Mining Camp, New Brunswick, Canada.

“We are very pleased with the certified results from ALS Global’s labs in North Vancouver, British Columbia. As expected, the results are spectacular high grades over a good width. We remain confident that our technical and disciplined approach to this exploration program will continue to deliver results for our shareholders and add value to our projects. We look forward to reporting our remaining certified results. Our next step is the EarthEX designed BHEM survey, which has never been done in this area. We are committed to utilizing new technology to our exploration programs here in the BMC and bring a new perspective”, stated Patrick J Cruickshank, MBA, Director and member of the Technical Advisory Committee.

Other related developments from around the markets include:

Southern Copper Corp.

reported

1Q22 net sales

were $2,763.8 million, which represented a 9.1% increase with regard to 1Q21’s figure. Growth was primarily fueled by higher metal prices for all our main products except silver (-8.5%). This increase was partially offset by a decrease in the sales volume of copper, molybdenum and silver. Metal prices increased for copper (+17.7%, LME); molybdenum (+69.7%); zinc (+36.0%) and gold (+4.2%). 1Q22 Net income was $784.7 million, which represented a 2.7% increase when compared to the $763.8 million registered in 1Q21. The net income margin in 1Q22 was 28.4%, versus 30.2% in 1Q21. 1Q22 adjusted EBITDA was $1,678.4 million, which represented an increase of 8.0% with regard to the $1,554.5 million registered in 1Q21. The adjusted EBITDA margin in 1Q22 was 60.7% versus 61.4% in 1Q21.

Freeport-McMoRan

announced that its Board of Directors

declared cash dividends

of $0.15 per share on FCX’s common stock payable on August 1, 2022, to shareholders of record as of July 15, 2022. These dividends are being paid consistent with FCX’s performance-based payout framework, which includes a base and variable dividend, announced in November 2021.

Teck Resources Ltd.

announced it is setting a goal to become a

nature positive company

including through conserving or rehabilitating at least three hectares for every one hectare affected by its mining activities. Teck is taking immediate action towards achieving this ambitious goal through land conservation investments that will protect 14,000 hectares of wildlife habitat and ecosystems in Canada and Chile. This is equivalent to over 40 percent of our current mining footprint and equal to 35 Stanley Parks in Vancouver; 40 Central Parks in New York; more than twice the size of Manhattan; or 20,000 football (soccer) fields.

Turquoise Hill Resources

announced that the

first drawbell of the Hugo North

underground mine at Oyu Tolgoi is scheduled to be fired on 17 June 2022. This is ahead of expectations and represents continued progress in terms of caving related milestones. The Company is assessing any net positive impact that this may have on timing of sustainable production of Panel 0 which is currently forecast in the first half of 2023 and will update the market as appropriate.

Legal Disclaimer / Except for the historical information presented herein, matters discussed in this article contains forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance or achievements expressed or implied by such statements. Winning Media is not registered with any financial or securities regulatory authority and does not provide nor claims to provide investment advice or recommendations to readers of this release. For making specific investment decisions, readers should seek their own advice. Winning Media is only compensated for its services in the form of cash-based compensation. Pursuant to an agreement Winning Media has been paid three thousand five hundred dollars for advertising and marketing services for Nine Mile Metals by Nine Mile Metals We own ZERO shares of Nine Mile Metals.

Please

click here

for full disclaimer.

Contact Information:

2818047972

[email protected]