- H1 2022 revenue increased to ~$15.0 million, up 604% from H1 2021 and 117% from H2 2021, driven by House of Brands

- Gross Profit increased to ~$7.0 million, up 547% compared to H1 2021 and 363% compared to H2 2021

- Company reaffirms its 2022 revenue guidance to range between $35.0 million – $45.0 million, indicating approximately 300% – 400% projected revenue growth from 2021

- Management to host a webcast today at 4:30 P.M. ET

FORT LAUDERDALE, Fla. & TORONTO– Flora Growth Corp.(NASDAQ:FLGC) (“Flora” or the “Company”), a manufacturer and distributor of global cannabis products and brands, reported today its financial and operating results for the six months ended June 30, 2022. All financial information is provided in U.S. dollars unless indicated otherwise.

“In the first half of 2022, Flora Growth Corp. (NASDAQ:FLGC) delivered on its promise to double revenue compared to the second half of 2021, and we expect to maintain that trajectory to deliver our full year guidance as a result of continued growth in our House of Brands, the launch of several new brands in the United States, and the commencement of sales in our Commercial Wholesale and Life Sciences business,” said Luis Merchan, Chairman and CEO of Flora Growth Corp. (NASDAQ:FLGC). “We started 2022 with the integration of both Vessel and JustCBD, and despite macro headwinds in the global markets as well as global cannabis regulations, we are extremely pleased with our growth year-to-date. We are also seeing positive movement in our Life Sciences division with progress on the approval of our clinical trials in the United Kingdom and the acquisition of Masaya, a science-backed, high-potency CBD brand.”

Merchan added: “We continue to prudently manage our overhead and working capital as we expect to improve profitability going forward. With all three of our core pillars generating revenue in the second half of 2022, continued gross margin expansion and a focus on streamlining operating expenses – we believe we have a path to profitability that few global cannabis companies can achieve in this difficult environment. The execution of our key initiatives is a testament to our team’s ability to deliver on plan. We will continue to execute as we focus on profitability and long term value creation.”

H1 2022 Financial Highlights:

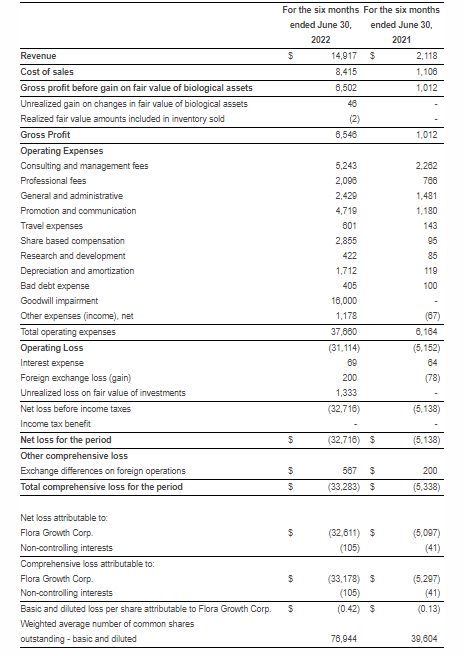

- Total revenue for the six months ended June 30, 2022, was $14.9 million, up more than 7x year-over-year and 2x sequentially, with the growth driven by Flora Growth Corp.’s (NASDAQ:FLGC) House of Brands division, which includes the acquisitions of JustCBD and Vessel.

- Gross profit for the period increased to approximately $6.5 million, up more than 5x year-over-year and 4x sequentially.

- Net loss was approximately $32.7 million compared to a net loss of $5.1 million in H1 2021 and a net loss of $16.2 million in H2 2021. The increase in net loss included a non-cash goodwill impairment charge of $16.0 million related to the Vessel acquisition value, driven by a decline in market conditions (Vessel’s peer group public share prices) and the Company’s stock price.

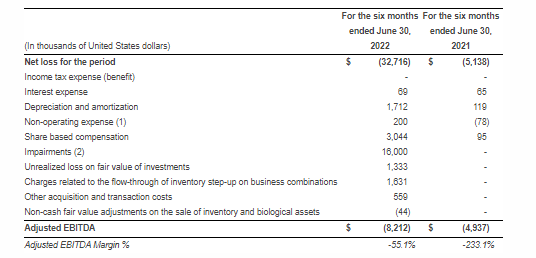

- Adjusted EBITDA was $(8.2) million compared to $(4.9) million in H1 2021. Adjusted EBITDA margin improved significantly from -233% in H1 2021 to -55% in H1 2022. For a reconciliation of these non-IFRS financial measures to the most directly comparable IFRS financial measures, please see Table 4 under “Reconciliation of IFRS to non-IFRS financial results” included at the end of this release.

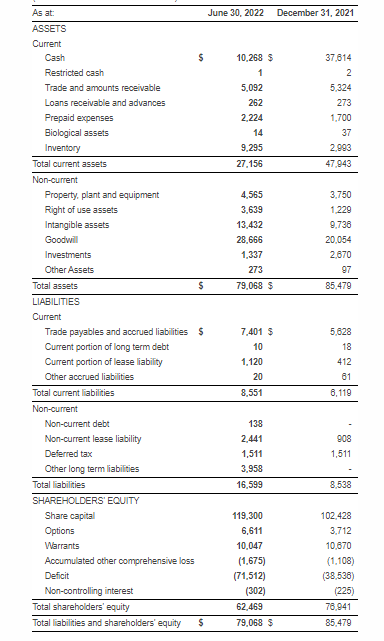

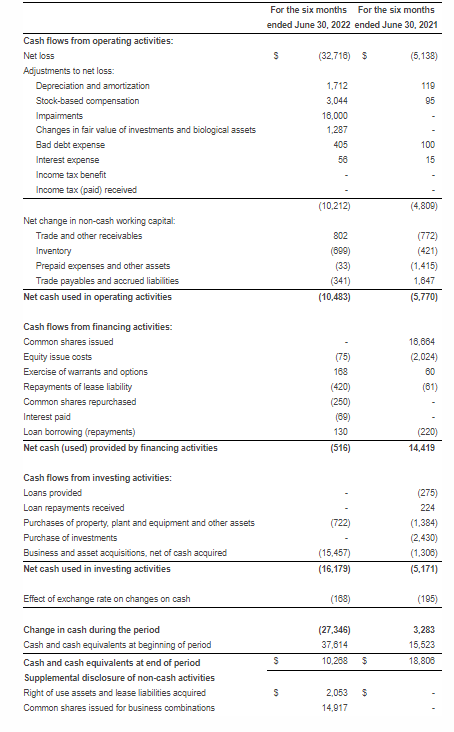

- As of June 30, 2022, the Company had approximately $10.3 million in cash compared to $37.6 million on December 31, 2021. The decrease was primarily due to cash paid for the JustCBD acquisition in February 2022, as well as higher operating expenses related to investments in headcount, sales and marketing to deliver on the Company’s growth objectives.

Reaffirms 2022 Outlook

- The Company is reaffirming its 2022 revenue guidance to range between $35.0 million – $45.0 million, projecting growth of approximately 300% – 400% over 2021.

H1 2022 Operating Highlights:

- Completed the acquisition of JustCBD, purchasing the company for $16.0 million in cash and 9.5 million common shares of Flora Growth Corp. (NASDAQ:FLGC).

- Following the acquisition of Vessel Brand, Inc. in November 2021, Flora Growth Corp. (NASDAQ:FLGC) named James Choe as Chief Strategy Officer and Jessie Casner as Chief Marketing Officer.

- Appointed former Director of Cannabis for the Florida Department of Agriculture and Consumer Services, Holly Bell, as Vice President of Regulatory Affairs.

- Signed a distribution agreement with Giant OTG Management to provide access to JustCBD products in U.S. airports.

- Increased presence in Europe with the opening of an office in London, while also receiving approval to sell JustCBD products on Amazon UK. The Company also established a brick-and-mortar JustCBD store in the Czech Republic and intends to launch more stores in Germany through its partnership with Greenyard.

- Acquired CBD brand Masaya to expand its Life Sciences offerings. Masaya formulations were submitted as part of the clinical trial program in partnership with the NHS (National Health Service in the UK) and University of Manchester.

- Completed build out of Flora Growth Corp.’s (NASDAQ:FLGC) all-outdoor cultivation and on-site extraction facility producing distillates and isolates using flower grown at its outdoor operation in Bucaramanga, Colombia.

- The Company reorganized its laboratory facilities which now include:

- Flora Growth Corp. (NASDAQ:FLGC) Lab 1 – cannabis extraction facility in Bucaramanga, Colombia

- Flora Growth Corp. (NASDAQ:FLGC) Lab 2 – GMP processing facility for cannabis and non-cannabis topicals, phytotherapeutics and OTC medicines in Bogota, Colombia

- Flora Growth Corp. (NASDAQ:FLGC) Lab 3 – cannabis transformation facility for edibles and other cannabis derivatives in Fort Lauderdale, Florida

- Flora Growth Corp. (NASDAQ:FLGC) Lab 4 – custom formulations lab for cannabis prescriptions in Bogota, Colombia

Subsequent Announcements:

- Appointed Elshad Garayev to serve as Flora Growth Corp.’s (NASDAQ:FLGC) Chief Financial Officer. Mr Garayev served in a variety of financial leadership positions at companies such as Amazon, Boeing BP and RPK Capital.

- Appointed Brandon Konigsberg to the Board of Directors, who will serve as Chair of the Audit Committee and as a member of the Compensation Committee. Konigsberg was a former executive at JP Morgan Chase (“JPMC”), and has held various leadership roles, including CFO and COO for several growing and turnaround business units.

- Entered into an agreement with Pharma Indigena Misak Manasr Sas (“Manasr”), the largest indigenous tribe in Colombia, to commercialize and sell cannabis products domestically and internationally in partnership with the Misak people.

Earnings Call: August 15, 2022, at 4:30pm ET

Flora Growth Corp.’s (NASDAQ:FLGC) will host its H1 2022 earnings call via webcast today at 4:30 P.M. ET. During the webcast, Flora Growth Corp.(NASDAQ:FLGC) management will discuss its financial and operating results, and will also provide comments on the Company’s 2022 commercial operation, house of brands and life sciences strategies. Following the presentation, Flora Growth Corp. (NASDAQ:FLGC) will host a Q&A session.

Live Audio Webcast Details

Date: Monday, August 15, 2022

Time: 4:30 p.m. ET

Online Participant Link: https://www.floragrowth.com/flgc-h1-2022-earnings-call/

The recording will be available on the Company’s Investor Center page until June 2023.

The live webcast will be available online through the above participant link and will be archived and available on the Company’s website within approximately 24 hours. If any member of the investment community needs access to a phone dial-in, please email [email protected] and one will be provided.

About Flora Growth Corp.

Flora Growth Corp. (NASDAQ:FLGC) is building a connected, design-led collective of plant-based wellness and lifestyle brands, designed to deliver the most compelling customer experiences in the world, one community at a time. As the operator of one of the largest outdoor cannabis cultivation facilities, Flora Growth Corp. (NASDAQ:FLGC) leverages natural, cost-effective cultivation practices to supply cannabis derivatives to its commercial, house of brands, and life sciences divisions. Visit www.floragrowth.com or follow @floragrowthcorp on social media for more information.

Cautionary Statement Concerning Forward-Looking Statements

This press release contains ‘‘forward-looking statements,’’ as defined by federal securities laws. Forward-looking statements reflect Flora Growth Corp.’s (NASDAQ:FLGC) current expectations and projections about future events at the time, and thus involve uncertainty and risk. The words “believe,” “expect,” “anticipate,” “will,” “could,” “would,” “should,” “may,” “plan,” “estimate,” “intend,” “predict,” “potential,” “continue,” and the negatives of these words and other similar expressions generally identify forward looking statements. Such forward-looking statements are subject to various risks and uncertainties, including those described under the section entitled “Risk Factors” in Flora Growth Corp.’s (NASDAQ:FLGC) Annual Report on Form 20-F filed with the SEC on May 9, 2022, as such factors may be updated from time to time in Flora Growth Corp.’s (NASDAQ:FLGC) periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in Flora Growth Corp.’s (NASDAQ:FLGC) filings with the SEC. While forward-looking statements reflect Flora Growth Corp.’s (NASDAQ:FLGC) good faith beliefs, they are not guarantees of future performance. Flora Growth Corp.’s (NASDAQ:FLGC) disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes after the date of this press release, except as required by applicable law. You should not place undue reliance on any forward-looking statements, which are based only on information currently available to Flora Growth Corp.’s (NASDAQ:FLGC) (or to third parties making the forward-looking statements).

About non-IFRS financial measures

To supplement our condensed consolidated financial statements, which are prepared and presented in accordance with International Financial Reporting Standards (“IFRS”), we use the following non-IFRS financial measures: Adjusted EBITDA and Adjusted EBITDA margin.

- Adjusted EBITDA is a non-IFRS financial measure that does not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies. The Company calculates adjusted EBITDA as total net loss, plus (minus) income taxes (recovery), plus (minus) interest expense (income), plus depreciation and amortization, plus (minus) non-operating expense (income), plus share based compensation, plus impairment charges, plus (minus) fair value adjustments on investments, plus charges related to the flow-through of inventory step-up on business combinations, plus other acquisition and transaction costs, plus (minus) non-cash fair value adjustments on the sale of inventory and biological assets.

- Adjusted EBITDA margin % is a non-IFRS financial measure that does not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies. The Company calculates adjusted EBITDA margin % as adjusted EBITDA, as described above, divided by revenue for the period.

Table 1. Consolidated Statements of Financial Position

Flora Growth Corp. (NASDAQ:FLGC)

Interim Condensed Consolidated Statements of Financial Position

(Unaudited – Prepared by Management)

(in thousands of United States dollars)

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

Table 2. Consolidated Statements of Loss.

Flora Growth Corp.(NASDAQ:FLGC)

Interim Condensed Consolidated Statements of Loss and Comprehensive Loss

(Unaudited – Prepared by Management)

(in thousands of United States dollars, except per share amounts which are in thousands of shares)

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

Table 3. Consolidated Statements of Cash Flows.

Flora Growth Corp. (NASDAQ:FLGC)

Interim Condensed Consolidated Statement of Cash Flows

(Unaudited – Prepared by Management)

(in thousands of United States dollars)

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

Table 4. Reconciliation of IFRS to non-IFRS financial results.

Adjusted EBITDA (non-IFRS measure) reconciliation to net loss and Adjusted EBITDA margin to net income (loss) margin. The reconciliation of the Company’s Adjusted EBITDA, a non-IFRS financial measure, to net loss, the most directly comparable IFRS financial measure, for the six months ended June 30, 2022, and June 30, 2021 is presented in the table below:

(1) Non-operating expense includes foreign exchange gain (loss).

(2) Impairments include goodwill impairment.

SOURCE Flora Growth Corp. (NASDAQ:FLGC)

Get investment opportunities before the rest of the market in real-time. Get this company's corporate presentation now. Subscribe to download! Over 120,000 subscribersSUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.