Foot Locker, Inc.

FL

is benefiting from sturdy growth in its digital realm, robust brand portfolio and disciplined inventory-management strategies. It is also committed to make prudent investments to accomplish long-term goals. These apart, management remains equally focused on bolstering the shareholder value.

The company announced a 50% hike in its quarterly cash dividend that took the total to 30 cents per share. The annualized dividend rate is brought to $1.20 per share. The raised dividend is payable Oct 29, 2021 to the shareholders of record as of Oct 15. Based on its share price of $55.80 on Aug 16, Foot Locker has a dividend yield of 2.2%.

Dividend payouts are the biggest enticement for investors while hikes not only boost shareholder returns but also raise the stock market value. The latest hike also reflects Foot Locker’s solid cash funds that are used to return value to its shareholders via dividends and buybacks as well as reinvestment in the business.

During the first quarter of fiscal 2021, Foot Locker returned a total of $55 million via share repurchases and dividends. It bought back 620,544 shares worth $34 million during the quarter. At the end of the fiscal first quarter, the company had cash and cash equivalents of $1,963 million, which increased 16.8%, sequentially. The company’s cash position was sufficient to meet the current portion of long-term debt and obligations under finance leases of $101 million as of May 1, 2021.

What’s More?

Earlier this month, the company agreed to acquire the U.S.-based footwear and apparel retailer Eurostar, Inc. (WSS) for $750 million and Text Trading Company, K.K. (atmos) for $360 million. Headquartered in Japan, Text Trading Company, K.K. owns and licenses the atmos brand.

Post acquisition, both WSS and atmos will maintain their names, operating as new banners in the company’s portfolio. Both transactions will be funded by cash and are expected to drive the buyer’s earnings per share in fiscal 2021. These deals are likely to be concluded late in the third quarter of fiscal 2021.

Well, the aforesaid deals demonstrate Foot Locker’s consistent efforts to boost growth across its business. The retailer is benefiting from its strategic partnerships including collaboration with

NIKE

NKE

. It is consistently bolstering its omni-channel experience via addition of functionalities. The company is seeing robust product tailwinds, driven by basketball and footwear, comfort trends in apparel as well as new brands across its portfolio. International expansion is another key catalyst. It is also progressing well with its FLX membership program.

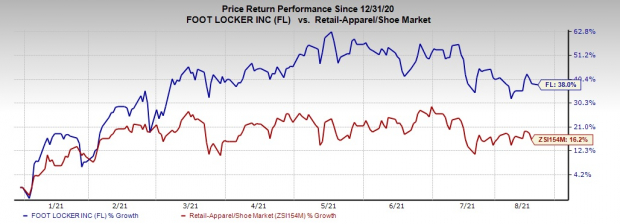

Image Source: Zacks Investment Research

Gaining from the aforementioned strengths, this New York-based company’s shares have surged 38% so far this year, outperforming the

industry

’s 16.2% growth.

Key Stocks to Consider in Retail

Abercrombie

ANF

has a long-term earnings growth rate of 18% and a Zacks Rank #1 (Strong Buy), currently. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Gap

GPS

, presently a Zacks #1 Ranked stock, has a long-term earnings growth rate of 12%.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report