Four Corners Property Trust

FCPT

recently announced the disposition of a Red Lobster property in Ohio for $4.9 million. As part of its strategic efforts, FCPT plans to redeploy the proceeds into new investment prospects in sync with its thresholds.

However, reflecting broader market concerns, shares of Four Corners were down 2.5% during last Friday’s trading session.

Primarily engaged in the ownership and acquisition of high-quality restaurants and retail properties, FCPT seeks potential acquisition opportunities to enhance its portfolio. The company has indeed been on an acquisition spree and recently purchased three Sun Auto Tire & Service properties for $9.1 million. The latest acquisition involves properties that are located in strong retail corridors in Missouri and corporate-operated under long-term, triple net leases.

Apart from the latest acquisition, Four Corners recently shelled out $12.3 million for purchasing a Cheesecake Factory property and a dual-tenant

Starbucks

SBUX

and

AT&T

T

property. Located in a highly trafficked corridor in Kansas, these properties, which are corporate-operated under net leases, have a weighted average of roughly seven years of residual term.

Also, Four Corners announced the acquisition of a Bubba’s 33-restaurant property for $3.1 million. Positioned in an extremely trafficked corridor in Texas, this marked the last property to be acquired from the seven-property $17.1 million outparcel portfolio transaction initially announced in July 2022.

Moreover, in the third quarter of 2022, FCPT acquired 26 properties for a combined purchase price of $69.9 million at an initial weighted average cash yield of 6.3%. The buyouts seem a strategic fit for FCPT and are likely to generate steady revenues over the long term.

However, rate hikes, inflation and macroeconomic uncertainty are raising concerns. FCPT has witnessed marginal downward revisions in estimates for both 2022 and 2023 funds from operations per share over the past month to $1.63 and $1.68, respectively.

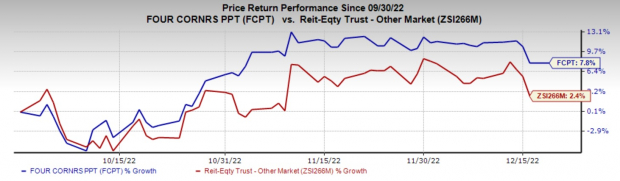

Four Corners currently carries a Zacks Rank #4 (Sell). Shares of FCPT have rallied 7.8% so far in the quarter, outperforming the

industry

’s increase of 2.4%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the REIT sector are

VICI Properties Inc.

VICI

and

Lamar Advertising Company

LAMR

, each carrying a Zacks Rank #2 (Buy) at present.

The Zacks Consensus Estimate for VICI Properties’ 2022 FFO per share has moved 3.2% north to $1.92 over the past month. You can see

the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Lamar Advertising Company’s ongoing year’s FFO per share has been raised 1.4% over the past two months to $7.34.

Note:

Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report