Shares of

Galera Therapeutics, Inc.

GRTX

were down almost 70% on Tuesday after the company announced unsatisfactory data from the phase III ROMAN study evaluating avasopasem for treating severe oral mucositis (“SOM”) in patients with locally advanced head and neck cancer (“HNC”) who are undergoing standard-of-care radiotherapy.

The study failed to meet the endpoint of reduction in the incidence of SOM. Data from the study showed 16% relative reduction in the incidence of SOM in the avasopasem treatment group (54%) as compared to the placebo group (64%).

Per the company, though the study demonstrated reductions in the incidence, duration and severity of SOM, it did not achieve statistical significance for the primary endpoint.

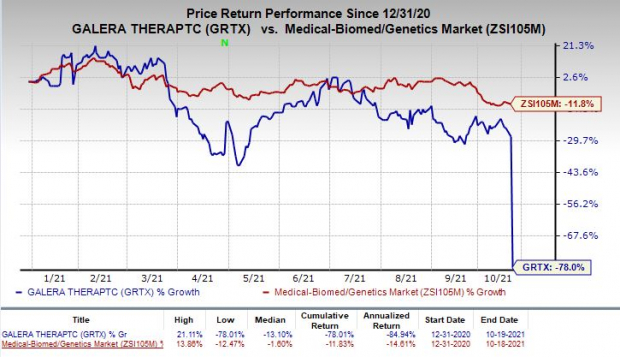

Galera’s stock has plunged 78% so far this year compared with the

industry

’s decrease of 11.8%.

Image Source: Zacks Investment Research

We note that oral mucositis is a side effect of radiation therapy. The double-blind, placebo-controlled ROMAN study was evaluating avasopasem in patients with locally advanced HNC who are receiving seven weeks of standard-of-care radiotherapy plus cisplatin. The company continues to analyze the above-mentioned data.

Galera is also evaluating avasopasem in the phase IIa AESOP study for the reduction of radiation-induced esophagitis in patients with lung cancer. Top-line data from this study is expected in the first half of 2022.

This apart, the company is developing another product candidate, GC4711, in early- to mid-stage studies, to augment the anti-cancer efficacy of stereotactic body radiation therapy in patients with non-small cell lung cancer and locally advanced pancreatic cancer.

We note that Galera has no approved product in its portfolio at the moment. Therefore, the successful development of avasopasem and other pipeline candidates remains critical for the company’s growth.

Zacks Rank & Stocks to Consider

Galera currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector include

Fulcrum Therapeutics, Inc.

FULC

,

Athenex, Inc.

ATNX

and

Amicus Therapeutics, Inc.

FOLD

, all carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Fulcrum Therapeutics’ loss per share estimates have narrowed 2.2% for 2021 and 2.5% for 2022, over the past 60 days. The stock has soared 102.4% year to date.

Athenex’s loss per share estimates have narrowed 9% for 2021 and 9.2% for 2022, over the past 60 days.

Amicus Therapeutics’ loss per share estimates have narrowed 1.3% for 2021 and 37.5% for 2022, over the past 60 days.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report