While the markets are moving on phantom vaccines months away, GILD has a globally approved Covid-19 treatment, but gets no respect, writes Joe Duarte.

I recently saw a headline mocking a rally in the futures market, which seemed to have been spurred by a positive press release from biotech viral kingpin Gilead Sciences (GILD). And upon a detailed review of the company, its management, and its price chart, I started to wonder why, given its solid drug portfolio and earnings history. Like the late king of the self-deprecating one-liners, Rodney Dangerfield, Gilead gets no respect.

The headline was based on the news that the company’s Covid-19 drug, remdesivir, reduced mortality rates on hospitalized patients with the virus by 62%. That means that based on backward looking data, roughly six out of 10 people that might have died, lived because they received remdesivir.

Be that as it may, the analysis which followed the headline suggested that Gilead was cherry picking results in order to hype the drug, while suggesting in a thinly veiled fashion that remdesivir doesn’t really help anyone (see chart below).

So, what gives? Sure, remdesivir is not a certain cure for Covid-19. And it may never be anything more than decent results when the drug is used in the right setting. But GILD does not live by remdesivir alone. For one thing it essentially owns the antiviral market, especially in HIV where it continues to dominate.

Does anyone remember that Gilead’s Harvoni and Sovaldi cured Hepatitis C and are still selling well and that the company is now a leader in generic versions of the drugs with over 60% of that market? Moreover, Gilead’s Tamiflu is a staple treatment for non-Covid-19 flu.

How about its successful treatments for chronic angina, pulmonary hypertension, and rare forms of cancer? Moreover, the company is preparing to launch Filgotinib for rheumatoid arthritis in the United States, Europe and Japan while owning a deep pipeline of drugs in key stages of development.

So, why isn’t the market moving this stock higher? After all, remdesivir is the only drug approved by the Federal Drug Administration and other international regulatory agencies to treat Covid-19. In fact, remdesivir has recently been approved in Europe, Australia and India while the company is investing $1 billion to study an inhaled version of the drug.

Even more interesting, remdesivir is already a money maker. The U.S. government recently bought all the supply that was available, 500,000 vials at $390 per vial, and little will be available to the world until September. Interestingly, analyst estimates are for potential yearly sales of the drug as high as $8.5 billion, which may be optimistic. But even at $2 billion in annual sales, remdesivir would be a blockbuster. That’s a potential $500 million per quarter on average.

What else do we have to treat Covid-19 with? Vaccine data is not particularly encouraging given the fact that even if one is developed soon, the odds for lifetime immunity from it seems to be low.

And what are the alternatives? Certainly, the controversial malaria and lupus drug hydroxychloroquine and the old steroid dexamethasone have been helpful in some cases. But at the end of the day there is no universal treatment.

So, why would Gilead spend a billion in researching a drug that they know doesn’t work? Why are countries all over the world approving the drug? And why is it sold out? Does any of that make sense when you look at a price chart in a consolidation pattern? Is management deluding itself, or is the market getting it wrong?

The lack of answers is bewildering. But this much I know. If I ran Gilead, and I thought I had a dud, I wouldn’t spend a billion on it.

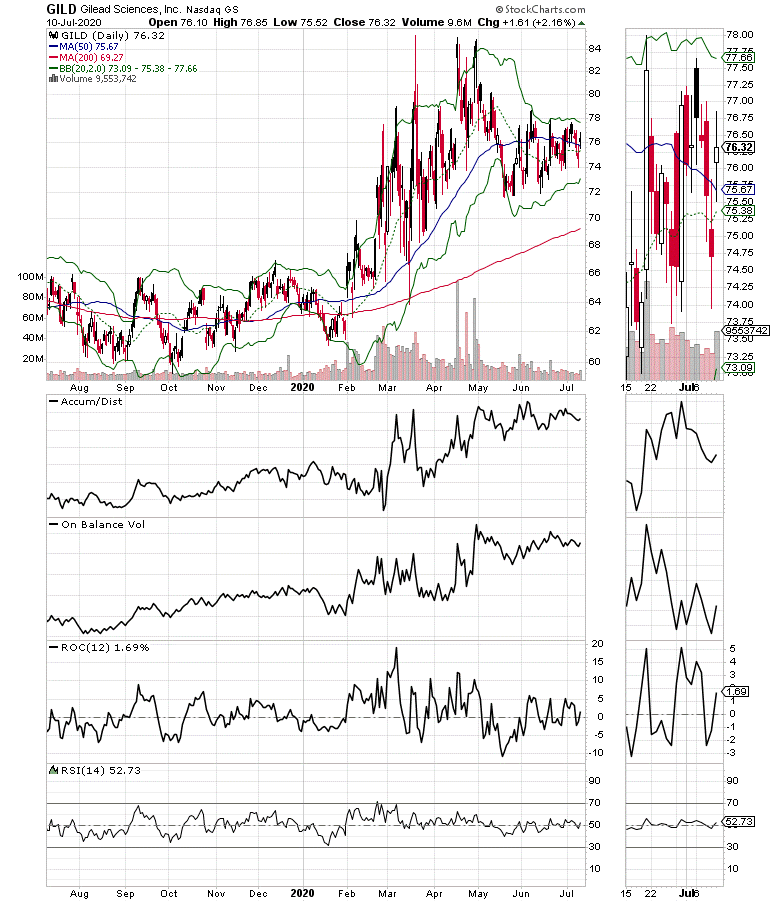

Be that as it may, the stock is still showing a stop and go trading pattern with resistance at $80, after it broke out of a long term base in the 60’s. On the bullish side, the stock remains above its 50- and 200-day moving average with good support near $72. Indeed, if the stock can move above $80 consistently it could move significantly higher.

Owning GILD could be painful. And it could take a long time before it pays off, if at all. But consider the fact that Covid-19 doesn’t seem to be going anywhere, at least for many months and there are few treatment alternatives.

Moreover, even if it slows down at some point, the virus could easily come back on a seasonal basis. And if that’s the case, just on restocking sales, Gilead could generate revenue, possibly sizeable revenues from remdesivir. And if that’s the case, given the existing sales of its other franchises, its pipeline, and the potential for a lot of intangible developments, this stock might be the ultimate contrarian play as the market misses the boat.

Sure enough; like Rodney Dangerfield, a guy with slick hair, big eyes, a cheap suit, and an out of fashion skinny red tie became wealthy while getting no respect, GILD may eventually be a pleasant surprise for patient investors.

We will certainly know more after Gilead reports earnings on July 28.

I own shares in GILD.

Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here. For more direction on managing the GILD trade, go here. For more on these portfolio management techniques and stock picks that work consider a FREE trial to Joe Duarte in the Money Options.com by clicking here.