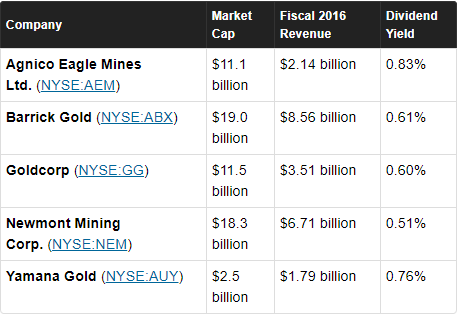

When you think of stocks with high paying dividends, the gold sector doesn’t generally come into mind for most investors. Due to gold mining being a very capital demanding business, companies generally reinvest profits to remain profitable even in times when gold prices are volatile. This leaves very little, if any at all, for shareholders to reap.

Royal Gold (NASDAQ:$RGLD) and Franco Nevada (TSE:$FNV) are gold streaming and royalty companies that offer some of the more premium dividend yields when looking at gold stocks. However, as of right now, we’re more concerned with the companies that actually mine for the precious metal.

Enticed By The Yield, Captured By The Loyalty

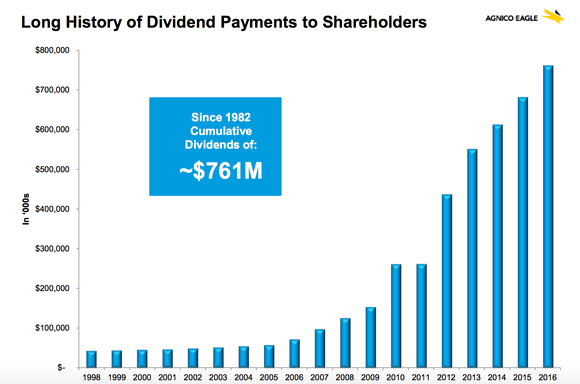

Although Agnico Eagle (TSE:$AEM)’s stock has attracted attention from Investors due to their higher yield, it should be their commitment that entices shareholders. That is, Agnico has consistently issued dividends for its shareholders every year for the past 35 years. However, it must be noted that dividend payouts can rise or fall, and even disappear if the company is facing tough situations. For example, Kinross Gold (TSE:$K) halted its dividend payouts in 2013, and has yet to declare another. For investors looking into gold investments, Agnico Eagle’s track record of dividend payouts may be a worthy stock to pickup.

Management guidance has Agnico placed in a position to extend its years of consecutive dividend payouts. With fiscal 2017 gold production predicted to to be 1.55 milion ounces, management expects a production of 2 million ounces by 2020. Additionally, Agnico predicts that all-in sustaining costs (AISC) from $850 to $900 per gold ounce in fiscal 2017 (decreasing as productions grows through 2020), providing a sufficient margin to increase its cash position.

Gold’s Dominant Player

With the largest market cap at about 18.8B, Barrick Gold (TSE:$ABX) is a prominent presence in the gold industry. As Barrick has some of the largest gold-producing mine operations in the world, it’s to no surprise that they excel at keeping operating expenses low. Being the best performer of its peer group in fiscal 2016, Barrick Reported AISC figures of $730 per gold ounce. By comparison, Agnico reported an AISC of $824, in the same fiscal year, a 12.8% difference. With such exceptional cost management, Barrick was able to accomplish a breakeven lower than $1000 for fiscal 2016, meaning that even if gold fell to $1,000 per gold ounce, Barrick would still have cash reaching the bottom line. With gold sitting above $1,000, and consistent breakeven figures of $1,000, Barrick generates some serious free cash flow. For fiscal 2017, Barrick has maintained a breakeven of $1,000 per gold ounce, with AISC presumed to be between $720 and $770.

Barrick’s significant debt reduction also implies continued dividend payouts as this displays Barrick’s strong financial position, and also reduces the size of interest payments. This was evidenced in fiscal 2016, as the company not only reduced its debt by $2 billion, but also increased its dividend by 50%. Plans are also in place to further decrease the company’s debt situation, maintaining target debt levels of under $5 billion by the end of fiscal 2018.

Putting the Digs on Goldcorp

Goldcorp (TSE:$G) has given itself five years to accomplish an assignment that sees to increase its revenue and assets, while decreasing operating margins. Specifically, Goldcorp wants to grow gold production and gold reserves by 20% and reduce AISC by 20% by 2020. In order to achieve these targets, expansionary activities have begun in Penasquito, Musselwhite, and Red Lake, while new operations have started in Coffee, Cerro Casale, and Caspiche.

Monitoring expenses is an important aspect of any business, but it is crucial for the success of gold miners. As a result, companies that have low operating costs tend to be good targets for investors looking for higher dividend yield due to their ability to build larger floats of free cash flow. In the first quarter of 2016, Goldcorp announced plans a target for 2018 of $250 million in “sustainable annual mine site and corporate efficiencies”. With more than 100% of the initial goal realized, management is preparing for even more efficient operations in 2019 and forward.

The Golden Cash Cow

Although with a lackluster dividend yield, Newmont Mining Corp (NYSE:$NEM) makes up with cash flow where it’s smaller yield fails to impress. To put into perspective, they have more than doubled their free cash flow in the past three years, with 2014 and 2016 figures of $383 million and $784 million respectively. By comparison, even though Barrick is known for its low operating costs, it only has revenue to free cash flow conversions of 17.69% compared to Newmont Mining Corp’s 24.63%. Goldcorp trails the group at just a 3.11% conversion.

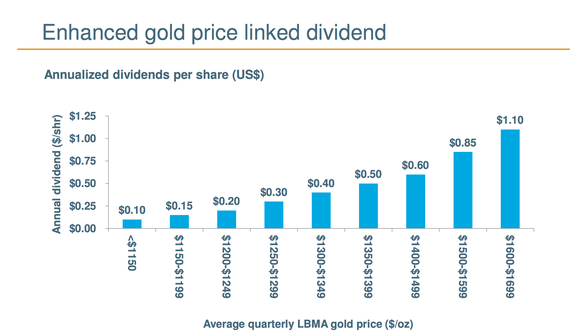

Additionally, investors may also like Newmont’s conservative approach to dividend payouts as it fluctuates according to the London Bullion Market Association’s price of gold. This provides investment transparency, and implies that management has a good grasp of the value they’re able to return to shareholders without running into issues.

An Optimistic Gold Stock

There was disappointment on Wall Street last February, when Yamana Gold (TSE:$YRI) declared their intent to forgo acquisitions in order to focus on growing organically. This had an impact on the stock value; however investors should still keep an eye out. According to recent investor presentations, the construction of Yamana’s next cornerstone mine, Cerro Moro is not only on budget, but ahead of schedule. With operations expected to commence in early 2018, forecast gold production estimates for fiscal 2018 and 2019 are 80,000 and 130,000 gold ounces respectively, averaging a very low AISC of below $600 per gold ounce.

With cash flow from operations growing by 26% from fiscal 2014 through fiscal 2016, Yamana is only aiming to increase margins as Cerro Moro and other expansionary projects in Canadian Malartic and Chapada commence operations.

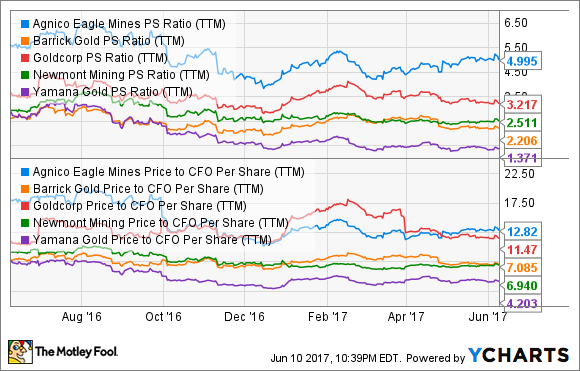

With shares trading below 1.4x sales and 4.2x cash from operations, current bearish sentiment means Yamana Gold may be an excellent undervalued gold investment for investors.

Featured Image: twitter