Great Panther Mining Limited

GPL

produced 17,913 gold-equivalent ounces in the first quarter of 2022, 41% lower than the year-ago quarter due to lesser output at the Tucano mine in Brazil and the Topia mine in Mexico.

The company stated that it remains on track to return to a normalized production rate in the second half of the year and affirmed its consolidated production guidance at 100,000-119,000 gold-equivalent ounces for 2022. In the second half of 2022, Tucano is expected to contribute at least 65% of the guidance, with stripping activities planned mainly for the first half.

Total gold production at Tucano was 14,037 ounces in the quarter, 31% lower than the first quarter of 2021. This was primarily due to the ongoing stripping of the TAP AB, TAP C and Urucum North pits, leading to low ore production and, consequently, higher consumption of the low-grade stockpiles. Also, rain levels were 32% higher in the quarter than historical averages, which impacted mine development.

At Topia, total silver-equivalent production was 290,694 ounces in the quarter, 20% lower than the year-ago quarter. The decrease in output was due to declining ton milled in the absence of stockpiles, and lower gold and silver grades. These factors were partly offset by higher gold recovery and increased production, attributed to the change in metal equivalency ratios for zinc.

There was no production reported from the Guanajuato mine complex as it remains on care and maintenance. GPL is awaiting the necessary permits from the Comisión Nacional del Agua (“CONAGUA”) to extend the tailings storage facility at the mine. Meanwhile, it is considering options to maximize value from the mine.

The company is slated to release first-quarter 2022 financial results on May 12, 2021, after market close. While lesser production numbers are expected to have acted as an offset, higher gold and silver prices through the quarter are likely to have somewhat negated the setback.

The Zacks Consensus Estimate for the company’s sales for the quarter is currently pegged at $24.2 million, indicating a year-over-year decline of 54%. The estimate for earnings per share is pegged at a loss of 1 cent, whereas it reported earnings per share of 1 cent in the first quarter of 2021.

Here’s How GPL’s Peers Fare in Q1

Endeavour Silver Corporation

EXK

announced that it produced 2 million silver-equivalent ounces in the first quarter of 2022, rising 4% year over year. Consolidated silver production was 1,314,955 ounces in the quarter, up 25% year over year.

The improvement was mainly driven by a 23% increase in silver production at the Guanacevi mine and a 70% rise in silver production at the Bolanitos mine. Endeavour Silver sold 1,717,768 ounces of silver and 8,381 ounces of gold in the quarter.

Hecla Mining

HL

reported silver production of 3.3 million ounces in the first quarter of 2022, up 3% on a sequential basis, courtesy of improved performance at the Greens Creek mine. Compared with the first quarter of 2021, production was down 7%.

Gold production was down 13% to 41,642 ounces in the quarter compared with the fourth quarter of 2021. Hecla Mining’s silver-equivalent production for the quarter was 9.7 million ounces, while gold-equivalent production was 123,537 ounces.

Fortuna Silver Mines Inc.

FSM

reported a 93% surge in gold production to 66,800 ounces in the first quarter of 2022. Total gold output benefited from contributions of 30,068 ounces from the Lindero mine and 28,235 ounces from the Yaramoko mine (acquired in July 2021).

Silver production was 1,670,128 ounces in the quarter, reflecting a 13% drop from the prior-year quarter. This was mainly due to a decrease in head grade at the San Jose mine, which was in line with the Mineral Reserve average grade. Fortuna Silver’s gold-equivalent production was 103,098 ounces. The company stated that all of its mines remain on track to achieve the full-year guidance.

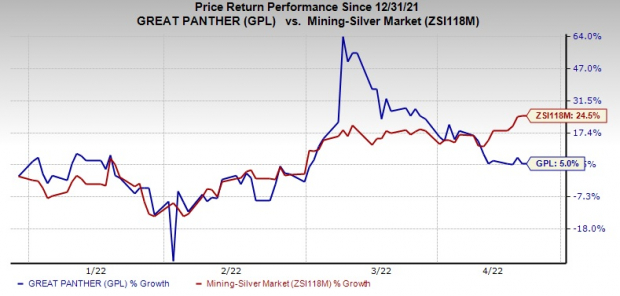

Zacks Rank & Share Price Performance

Great Panther currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

The company’s shares have gained 5% so far this year compared with the

industry

’s growth of 24.5%.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report