GSK plc.

GSK

will report second-quarter 2022 results on Jul 27, before market open. In the last reported quarter, the company delivered an earnings surprise of 14.29%.

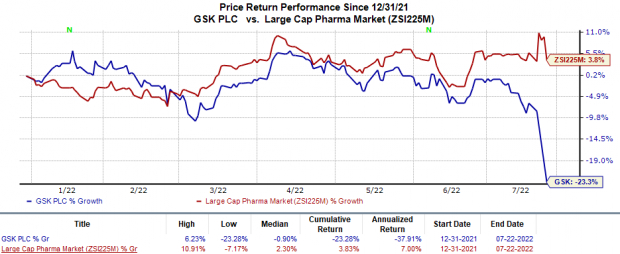

Shares of GSK have underperformed the

industry

so far this year. The stock has lost 23.3% against the industry’s increase of 3.8%.

Image Source: Zacks Investment Research

GSK’s earnings surpassed estimates in each of the trailing four quarters, delivering a beat of 24.09% on average.

Factors to Note

In the second quarter, higher sales from newer respiratory and HIV drugs are likely to have been offset by a decline in sales of older HIV drugs and Established Pharmaceuticals segment sales. It remains to be seen if the recovery in vaccine sales, particularly Shingrix seen in the first quarter, continued in the to-be-reported quarter. The Zacks Consensus Estimate for revenues stands at $9.35 billion.

In April, the FDA

withdrew

the emergency use authorization (EUA) granted to the COVID-19 drug, Xevudy (sotrovimab), which was developed in collaboration with

Vir Biotechnology

VIR

. The FDA’s decision for GSK/Vir Biotechnology’s antibody therapy was based on new data, which showed that it was unlikely for sotrovimab dose to be effective against the dominant Omicron variant, which is the dominating COVID-19 variant in the United States as well as Europe.

The Vir Biotechnology-partnered Xevudy was a major top-line driver for GSK. During first-quarter 2022, GSK recorded £1.31 billion ($1.75 billion) from Xevudy sales, out of which nearly 60% were generated in the United States. It remains to be seen how much Xevudy sales were recorded by GSK and Vir Biotechnology in the second quarter.

The growth trend in Respiratory category sales is expected to have continued in the second quarter on the back of strong demand for Trelegy Ellipta and Nucala, amid recovery, following the pandemic. However, older respiratory drugs, Advair and Relvar/Breo Ellipta, which face competitive and pricing pressure, are likely to have unfavorably impacted GSK’s respiratory sales.

GSK’s key vaccine, Shingrix’s sales showed a strong demand recovery in the United States, which coupled with new launches in different countries, benefited first-quarter sales. We expect this growth to have continued in the second quarter. Sales of Meningitis vaccines are also likely to have started recovery on the back of CDC purchases in the United States. Sales of GSK’s lupus drug, Benlysta, showed impressive growth in the recent quarters despite COVID-related disruption. We expect the momentum to have continued in the soon-to-be-reported quarter.

Oncology sales, comprising Zejula and Blenrep, are also likely to have witnessed growth. The uptake trend of the newly-approved Jemperli remains to be seen.

The competitive environment and the shift in portfolio toward two-drug regimens may have hurt sales of three-drug regimens — Tivicay and Triumeq — and older HIV drugs. However, the strong growth trend witnessed in two-drug regimens, Juluca and Dovato, might have helped the company partially offset some of the losses in sales of the three-drug regimens. The uptake of its new HIV drug, Apretude, an extended-release cabotegravir approved last December, remains to be seen.

GSK may provide an update on the timeline for the regulatory filings in the United States and Europe for its COVID-19 vaccine candidate, which is being developed in collaboration with Sanofi on the earnings call.

Earlier this month, GSK

completed the spin-off

of its consumer healthcare segment into a new standalone company called Haleon. As a result, GSK will now focus on its existing business segments, which comprise Pharmaceuticals (respiratory, HIV, immuno-inflammation and oncology) and Vaccines.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for GSK this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here as you will see below. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP:

Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is -4.32%. The Most Accurate Estimate stands at 74 cents per ADS, lower than the Zacks Consensus Estimate of 77 cents per ADS.

Zacks Rank:

GSK currently carries a Zacks Rank #4 (Sell).

You can

see the complete list of today’s Zacks #1 Rank stocks here

.

Stocks to Consider

Here are some large drug/biotech stocks that have the right combination of elements to beat on earnings this time around:

AstraZeneca

AZN

has an Earnings ESP of +1.38% and a Zacks Rank #3.

AstraZeneca’s stock has risen 12% this year so far. AstraZeneca topped earnings estimates in two of the last four quarters. AZN has a four-quarter earnings surprise of 1.32%, on average. AstraZeneca is scheduled to release its second-quarter 2022 results on Jul 29.

Bayer

BAYRY

has an Earnings ESP of +5.26% and a Zacks Rank #3.

Bayer’s performance has been pretty impressive, with the company exceeding earnings expectations in each of the trailing four quarters. It delivered a four-quarter earnings surprise of 17.71%, on average.

Bayer is scheduled to release its second-quarter 2022 results on Aug 4. The stock is up 8.2% this year so far.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report