Halozyme Therapeutics, Inc.

HALO

reported first-quarter 2022 adjusted earnings of 47 cents per share (excluding stock-based compensation expense), which missed the Zacks Consensus Estimate of 48 cents. The company’s earnings were 37 cents per share in the year-ago period.

Total revenues increased 31.8% year over year to $117.3 million, primarily driven by strong royalty payments, especially from

J&J

JNJ

, partially offset by lower revenues under collaboration agreements. The top line, however, missed the Zacks Consensus Estimate of $126.91 million.

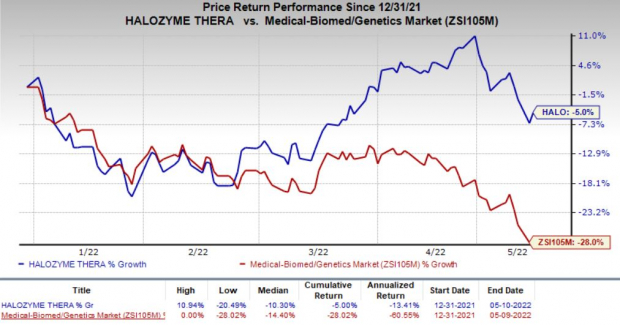

Halozyme stock has declined 5% so far this year compared with the

industry

’s 28% decrease.

Image Source: Zacks Investment Research

Quarterly Highlights

Halozyme’s top line comprises product sales, royalties and revenues under collaborative agreements.

Several companies are using Halozyme’s ENHANZE technology for developing a subcutaneous formulation of their currently marketed drugs. The company has five marketed partnered drugs based on this technology including the subcutaneous formulation of J&J’s Darzalex and

Roche

’s

RHHBY

Phesgo.

Royalty revenues were $69.6 million in the first quarter, up 88.5% from the year-ago quarter, mainly driven by strong sales uptake of J&J’s subcutaneous Darzalex and to a lesser extent by Roche’s Phesgo. Royalty revenues generated nearly 60% of the total revenues for the company during the first quarter. Robust demand for J&J’s subcutaneous Darzalex, multiple label expansions and continued launches in new territories along with an additional contribution from Roche’s Phesgo are likely to drive Halozyme’s strong royalty revenues.

Product sales, solely from the sale of bulk API to collaborators using the ENHANZE platform for drug development, were $22.1 million in the quarter, up 1.7% from the year-ago quarter. The company supplies API to ENHANZE partners like J&J and Roche.

Revenues under collaborative agreements were $25.5 million, down 15.8% year over year.

Research and development ([R&D] including stock-based compensation) expense increased 31.6% year over year to $11.9 million, mainly due to costs related to merger and acquisition.

Selling, general and administrative (SG&A) expenses (including stock-based compensation) expenses were $13.8 million, up 25.1% from the year-ago period.

2022 Guidance Maintained

Halozyme maintained its guidance for revenues and earnings for 2022 issued last month. The company expects total revenues in 2022 to be between $530 million and $560 million, indicating year-over-year growth of 20%-26%.

The company expects revenues from royalties to increase approximately 50% year over year to $300 million on the back of a strong uptake of the subcutaneous formulation of J&J’s Darzalex as well as growth in Roche’s Phesgo. Product sales and collaborative revenues are expected to be flat year over year.

The company expects adjusted earnings to be in the range of $2.05-$2.20 per share (excluding stock-based compensation expense).

In April, HALO announced that it would acquire Antares Pharma for approximately $960 million. The acquisition is expected to be completed by June-end. It will add an industry-leading auto-injector platform as well as a commercial business with three proprietary products to Halozyme’s portfolio. Although the acquisition is expected to be immediately accretive to the top and bottom lines, Halozyme stated that its guidance does not include any impact of the Antares acquisition.

The company expects the Antares acquisition to accelerate top-and bottom-line growth and enhance cash flow generation over the next five years.

Zacks Rank & Stock to Consider

Halozyme currently carries a Zacks Rank #3 (Hold).

A better-ranked company from the medical sector is

Alkermes

ALKS

, sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ loss per share estimates have narrowed from 14 cents to 3 cents for 2022 in the past 30 days. ALKS has gained 15.9% so far this year.

Alkermes delivered an earnings surprise of 350.48%, on average, in the last four quarters.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report