Shares of

Halozyme Therapeutics

HALO

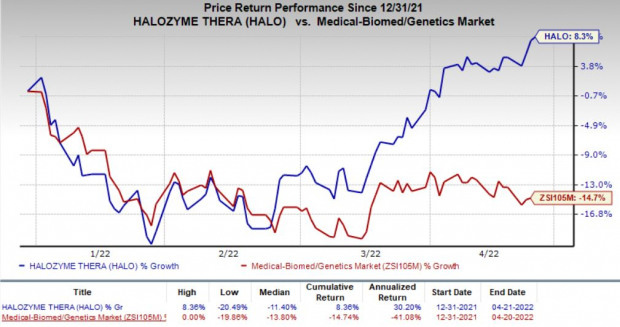

have been gaining since late February after declining in the first month of 2022. The company’s shares have gained 8.3% so far this year against the

industry

’s decline of 14.7%.

Image Source: Zacks Investment Research

The rise in share price was mainly driven by the strong demand for its partnered drugs developed using its ENHANZE drug-delivery technology. The company’s revenues and earnings beat estimates for the fourth quarter, reflecting the better-than-expected performance of its partnered drugs and the restructuring initiatives implemented over the last two years.

Halozyme’s guidance for 2022 suggests that strong growth will continue. The company expects the majority of the gain in revenues to be driven by robust demand for partner,

J&J

’s

JNJ

subcutaneous Darzalex, multiple label expansions of the drug and continued launches in new territories.

ENHANZE Technology Driving Revenues

Halzoyme has been riding on its proprietary drug delivery technology, ENHANZE, over the past couple of years. This promising technology attracted several large pharma companies to develop the subcutaneous (“SC”) formulation of their commercialized drugs using ENHANZE including J&J and

Roche

RHHBY

. Halozyme has developed the SC formulation of three drugs — Herceptin, Phesgo and Rituxan — from Roche’s portfolio. Roche is also developing SC formulations of Tecentriq and Ocrevus across 12 potential targets in different stages of clinical studies, with the development of Tecentriq for lung cancer in a late stage study.

Currently, the company has 11 collaborations and five marketed partnered drugs based on this technology. The marketed partnered drugs are driving royalties for Halzoyme while the under-development drugs indicate potential for additional royalties going forward.

In March, Halzoyme’s partner,

argenx

ARGX

successfully completed a phase III study evaluating an SC formulation of its efgartigimod in generalized myasthenia gravis. argenx is planning to file a biologics license application by the end of 2022. A potential approval will likely boost revenues for Halozyme through additional royalties in 2023.

Halozyme expects to generate $1 billion in annual royalties from its ENHANZE technology by 2027.

Other Factors

Halozyme also supplies bulk API to collaborators using the ENHANZE platform for drug development, which it records under product sales. The sale of bulk API also brings a good chunk of its revenues every year. Halozyme expects at least five partnered products to enter mid- to late-stage development and four new partnered products to enter clinical stage in 2022. The higher number of research activities for partnered products as well as higher demand for commercialized partnered drugs will continue to boost bulk API sales this year.

Following the failure of its lead pipeline candidate, PEGPH20, in 2019, Halozyme initiated the restructuring of its business to support future growth. The restructuring activities have reduced operating expenses in the past two years with the trend expected to continue in 2022.

However, rising biosimilar competition for Roche’s Herceptin and Rituxan is a cause of concern. Lower sales of these drugs amid competition will hurt Halozyme’s royalties going forward. However, potential new drugs and the strong uptake of Darzalex Faspro are likely to offset the loss.

The strong demand for its new partnered drugs and the encouraging impact of its restructuring initiatives are likely to drive Halzoyme’s shares higher in the upcoming months.

Zacks Rank

Halozyme currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report