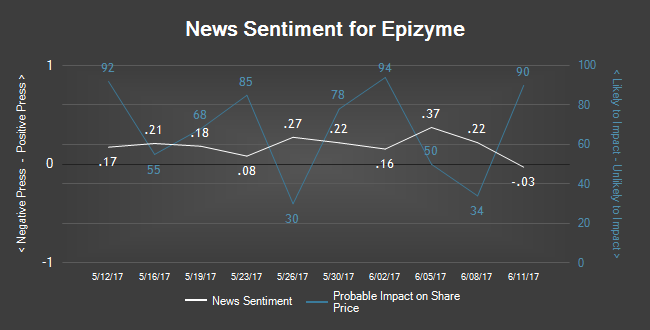

Media coverage of biopharmaceutical company Epizyme (NASDAQ:$EPZM) has been pretty positive recently, according to research group Alpha One Sentiment Analysis. Alpha One helps company identify positive and/or negative media coverage through the analysis of more than twenty million news articles and blogs in real time. The coverage is ranked on a scale of -1 to 1; the closer the score is to one, the more favourable the media coverage is. Epizyme has a score of 0.22 according to Alpha One, which is not bad especially since media coverage of Epizyme have an impact score of 78 out of 100, meaning recent news and blogs are more likely to affect the company’s stock prices.

On Wednesday, Epizyme’s share prices reached $12.00, rising up 7.62%. Trading volume was an impressive 3,242,996 shares. The company’s 50-day moving average price is currently at $15.49, and its 200-day moving average price is at $13.73. As of June 14, 2017, Epizyme’s stock seems to be doing well compared to its 52-week low at $7.02. Investors remain hopeful that it will be on track to hit its 52-week high of $18.50. Current market capitalization of Epizyme is $700.30 million.

Epizyme’s rise comes as a surprise after the company’s stock fell drastically after it reported its quarterly earnings data early last month on May 8th. According to its quarterly earnings data, Epizyme had a $0.56 earnings per share (EPS). However, the company had a negative return on equity of 55.41%, and a negative net margin of 1,376.33%.

As such, Epizyme seem to have been earning a positive nod from several brokerages. For example, Royal Bank of Canada reaffirmed Epizyme’s outperform rating, however it set the target price down from $26.00 to $19.00 on March 11th. On April 13th, CIBC also issued an outperform rating on Epizyme’s shares. Shortly after, on April 25th, Cann reissued a buy rating on the company’s stocks, setting it’s target price at $26.00.

Even after Epizyme’s disappointing quarterly earnings report, Zacks Investment Research changed its hold rating on Epizyme shares to buy, and set a target price of $18.00 on May 16th. Shortly after that, HC Wainwrite reissued its buy rating on Epizyme on May 19th.

On average, the biopharmaceutical has a rating of buy with a target price of $24.89.

Despite enthusiasm from brokerages for investors to buy the stock however, president of research and chief scientific officer of Epizyme, Robert Copeland, sold 5,000 shares of Epizyme stock on May 2nd — no doubt anticipating the price drop that would occur after the earnings data report on May 8th. The shares sold at a total of $87,200.00, with the average price of the share being $17.44. Copeland still owns about 36,538 shares of Epizyme stock that values at a total of about $637,222.72.

Similarly, chief financial officer (CFO) Andrew Singer sold about 2,013 shares of Epizyme stock on March 31st, earning a total of $34,402.17 with the stock average price being $17.09. Singer now owns about 36,175 shares of Epizyme stock, which is currently valued at $618,230.75.

About a quarter (25.40%) of the Epizyme’s stock are owned by those who work at the company.

About Epizyme

Epizyme, Inc is a biopharmaceutical company that is focused on finding epigenetic therapy treatment for cancer patients. It is a clinical-stage company, meaning that most of its therapies have yet to become commercialized. As part of its development and research of epigenetic therapies, the company has developed small molecule inhibitors known as histone methyltransferases (HMTs). The company hopes to seek a change in patient care by making medicine that are tolerable, orally administered, and targets the specific causes of diseases.

Featured Image: arrowstreet