Ciena Corporation

CIEN

is scheduled to report fourth-quarter fiscal 2022 results on Dec 8.

The Zacks Consensus Estimate for fiscal fourth-quarter earnings is pegged at 8 cents per share, suggesting a 90.6% decline from the year-ago quarter’s levels.

For the fiscal fourth quarter, management anticipates revenues between $800 million and $880 million. The Zacks Consensus Estimate for revenues is pegged at $851.5 million, indicating an 18.2% decline from the year-ago quarter’s levels

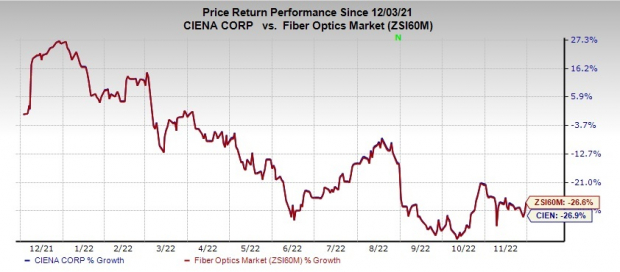

Shares of Ciena have declined 26.9% in the past year compared with the

sub-industry

‘s decline of 26.6%.

Image Source: Zacks Investment Research

Factors to Note

Lingering global supply-chain disruptions, elongated lead times, component shortages and related higher logistics costs are likely to act as major dampeners. Higher expenses on product development amid stiff competition in the networking space might further have limited margin expansion in the to-be-reported quarter.

However, the company’s performance is likely to get some cushioning owing to strong order flow and a higher backlog amid robust secular demand trends like 5G, cloud and automation, and infrastructure spending among others. Increasing cloud adoption and rising demand for higher capacity and bandwidth, and the proliferation of edge applications bode well for Ciena.

Ciena’s routing and switching solutions are likely to have witnessed strong uptake. The contribution from the Vyatta platform, which Ciena acquired from AT&T, is likely to have favored the segment.

Ciena is witnessing strong momentum for its WaveLogic 5 Extreme solution. In the last reported quarter, the company added 14 new customers for its WaveLogic 5 Extreme solution.

Also, the company continues to win deals for its solutions in next-gen metro and edge-use cases. Incremental gains from the healthy performance of its software automation business, especially Blue Planet Software, are likely to have favored the top line.

What Our Model Says

According to the Zacks model, the combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Ciena has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell). You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter.

Stocks to Consider

Here are some stocks that you may consider as our model shows that these have the right combination of elements to beat on earnings this season.

Casey’s General Stores

CASY

has an Earnings ESP of +12.58% and a Zacks Rank of 3 at present. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Casey’s General Stores is set to release second-quarter fiscal 2023 results on Dec 6. The Zacks Consensus Estimate for earnings is pegged at $3.10 per share, suggesting a 19.7% increase from the prior-year quarter’s reported figure. Shares of CASY have gained 19.9% in the past year.

MongoDB, Inc

MDB

has an Earnings ESP of +1.66% and a Zacks Rank of 3 at present.

MongoDB is set to release third-quarter fiscal 2023 results on Dec 6. The Zacks Consensus Estimate for the bottom line is pegged at a loss of 17 cents per share. Shares of MDB have increased 64% in the past year.

Coupa Software Incorporated

COUP

has an Earnings ESP of +71.17% and a Zacks Rank of 3.

Coupa Software is scheduled to release third-quarter fiscal 2023 results on Dec 12. The Zacks Consensus Estimate for earnings is pegged at 11 cents per share, suggesting a 64.5% decline from the prior-year quarter’s levels. Shares of COUP have decreased 62.3% in the past year.

Stay on top of upcoming earnings announcements with the Zacks

Earnings Calendar.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report