Dollar Tree Inc.

DLTR

is an attractive bet for the long term, owing to its strong fundamentals, robust product demand, efforts to evolve assortments to drive the consumables category at Dollar Tree and initiatives to improve the value proposition at Family Dollar. Dollar Tree’s Key Real Estate Initiatives like expansions of H2, Dollar Tree Plus! and Combo Stores are on track and position it for growth in the long term.

However, the company expects the increased demand for consumables and inflationary costs to affect margins and the bottom line.

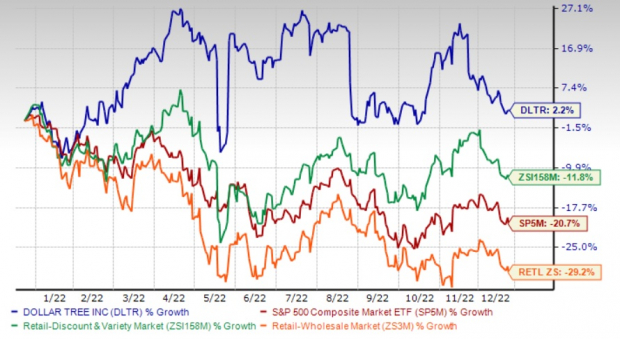

Shares of Home Depot have gained 2.2% in the past year against the

industry

’s decline of 11.3%. The stock’s performance also compared favorably against the Retail-Wholesale sector and the S&P 500’s declines of 28.2% and 19.5%, respectively, in the same period.

The Zacks Consensus Estimate for the Zacks Rank #3 (Hold) company’s current financial year’s sales and earnings suggests growth of 7.2% and 24%, respectively, from the year-ago period’s reported number.

Image Source: Zacks Investment Research

Dollar Tree’s Growth Strategies

Dollar Tree is witnessing significant benefits from the continued demand for the company’s products, which is aiding top-line growth, as well as improved margins. In the third quarter of fiscal 2022, Dollar Tree’s earnings improved 25% year over year, while consolidated net sales advanced 8.1% year over year. Enterprise same-store sales (comps) improved 6.5% year over year.

For the Dollar Tree banner, comps were up 8.6%, while the same for the Family Dollar banner improved 4.1%. After adjusting for the impacts of currency fluctuations, comps for the Dollar Tree banner rose 8.5%. Comps at Dollar Tree benefited from a double-digit increase in average ticket, partly negated by a decline in traffic. Comps at Family Dollar were aided by increases in both ticket and traffic.

Dollar Tree has made significant progress over the years in optimizing its store portfolio through store openings, renovations, re-banners and closings. It is delivering compelling results for its Key Real Estate Initiatives, which include the expansion of its $3 and $5 plus assortment in Dollar Tree stores, as well as Combo Stores. It also remains on track with H2 Renovations at Family Dollar stores.

Consequently, the company outlined plans to accelerate its key initiatives in fiscal 2022 and beyond. In fiscal 2022, it expects to complete 800 Family Dollar H2 Renovations as part of the Key Real Estate Initiative. Out of this, 190 will be Dollar Tree stores and 400 will be Family Dollar stores. Within the Family Dollar stores, 350 stores will be in the Combo Store format. Also, management intends to expand the $3 and $5 Plus assortments to more than 1,500 Dollar Tree stores. It expects to have at least 5,000 Dollar Tree Plus! stores by the end of 2024.

The company is on track to reach its long-term target of operating 26,000 stores, with more than 10,000 Dollar Tree and 15,000 Family Dollar outlets, across North America. Additionally, it is on track to leverage Family Dollar and Dollar Tree distribution center systems, and combined merchandise. This will help in bringing the latest products into Dollar Tree stores without any disruptions.

Strong View

Dollar Tree is optimistic about its fiscal 2022 top-line performance despite concerns regarding margins and the bottom line. Hence, it raised the fiscal 2022 sales view. The company’s efforts to evolve the assortment to drive consumables’ performance at Dollar Tree and the initiatives to improve the value proposition at Family Dollar remain on track, which are likely to aid the top line.

Backed by these efforts, we anticipate Dollar Tree’s fiscal 2022 total revenues to be $28,179.4 million, which is in sync with the company’s raised guidance of $28.14-$28.28 billion for consolidated net sales. Earlier, the company anticipated consolidated net sales of $27.85-$28.10 billion for the fiscal year. We expect enterprise comp growth to be 5.2% for fiscal 2022, in line with the company’s view of mid-single-digit growth. Our estimate for comps comprises an 8.6% increase in Dollar Tree and 1.4% growth at Family Dollar. The company anticipated comps growth in the high-single digits for the Dollar Tree segment and the low-single digits for the Family Dollar segment.

For fourth-quarter fiscal 2022, Dollar Tree expects consolidated net sales of $7.54-$7.68 billion, with enterprise same-store sales growth of mid to the high-single digits. This will comprise a mid-to-high single-digit increase in the Dollar Tree segment and low to mid-single-digit growth in the Family Dollar segment. We expect net sales of $7,568.4 million for the fiscal fourth quarter, with a 4.9% rise in comps. We anticipate comps growth of 7.5% for the Dollar Tree segment and 2.4% for the Family Dollar segment in the fiscal fourth quarter.

Headwinds to Address

Despite the strong sales trends across both banners, Dollar Tree expects the increased demand for consumables and inflationary costs to affect margins and the bottom line in the near term. Consequently, the company has provided a bleak earnings view for fiscal 2022. Notably, its fiscal third-quarter performance reflected headwinds from inflationary pressures and an unfavorable product mix due to the demand shift toward low-margin consumable goods. These headwinds also partly offset growth in the gross margin in the quarter. The gross margin for the Family Dollar segment declined 100 bps largely due to a product mix shift and product cost inflation.

For fiscal 2022, management envisions earnings in the lower half of the previously mentioned $7.10-$7.40 per share. Through the rest of fiscal 2022, it expects to witness continued gross margin pressure across both segments from the inflationary cost situation. Dollar Tree expects consumables to outperform discretionary, which will negatively impact the gross margin. Some of the assumptions for the earnings view include net interest of $30 million for the fiscal fourth quarter and $127 million for fiscal 2022.

Dollar Tree has been witnessing higher SG&A expenses for the past several quarters, owing to elevated payroll, increased repairs and maintenance expenses, and store facility costs. In third-quarter fiscal 2022, SG&A expenses, as a percentage of sales, increased 170 bps to 24.4%. The increase resulted from elevated professional fees, increased store payroll and stock compensation expenses, and inflationary pressures across many expense categories like utilities, and higher repairs and maintenance costs.

Stocks to Bet on

We highlighted three better-ranked stocks in the Retail – Wholesale sector, namely

Ross Stores Inc.

ROST

,

Tecnoglass

TGLS

and

Chico’s FAS

CHS

.

Ross Stores operates as an off-price retailer of apparel and home accessories primarily in the United States. ROST currently sports a Zacks Rank #1 (Strong Buy). The ROST stock has gained 3.5% in the past year.

You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The Zacks Consensus Estimate for Ross Stores’ current financial-year sales and earnings per share suggests declines of 1.6% and 11.7%, respectively, from the year-ago reported figures. ROST has a trailing four-quarter earnings surprise of 10.5%, on average.

Tecnoglass manufactures and sells architectural glass and windows, and aluminum products for the residential and commercial construction industries. TGLS currently flaunts a Zacks Rank #1. The TGLS stock has rallied 9.3% in the past year.

The Zacks Consensus Estimate for Tecnoglass’ current financial-year sales and earnings per share suggests growth of 43.4% and 82.2%, respectively, from the year-ago reported figures. TGLS has a trailing four-quarter earnings surprise of 26.9%, on average.

Chico’s FAS, an omni-channel specialty retailer of women’s private branded casual-to-dressy clothing, intimates, and complementary accessories, currently sports a Zacks Rank of 1. The company has a trailing four-quarter earnings surprise of 87.5%, on average. Shares of CHS have risen 0.2% in the past year.

The Zacks Consensus Estimate for Chico’s current financial-year sales and earnings per share suggests growth of 19.6% and 127.5%, respectively, from the year-ago reported numbers.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report