Gartner, Inc.

IT

performed well in the past six-month period and has the potential to sustain the momentum. If you haven’t taken advantage of its share price appreciation yet, it’s time you add the stock to your portfolio.

Let’s take a look at the factors that make the stock an attractive pick.

An Outperformer

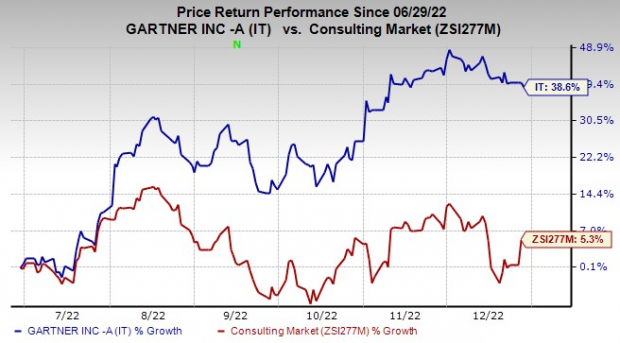

: A glimpse at the company’s price trend reveals that its shares have surged 38.6% in the past six-month period compared with 5.3% rise of the

industry

it belongs to.

Image Source: Zacks Investment Research

Solid Rank

: Gartner currently sports a Zacks Rank #1 (Strong Buy). Our research shows that stocks with a Zacks Rank #1 or #2 (Buy) offer attractive investment opportunities. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Northward Estimate Revisions

: Three estimates for 2022 moved north in the past 60 days versus no southward revision, reflecting analysts’ confidence in the company. The Zacks Consensus Estimate for 2022 earnings has moved up 11.2% in the past 60 days.

Positive Earnings Surprise History

: Gartner has an impressive earnings surprise history. The company outpaced the Zacks Consensus Estimate in each of the trailing four quarters, delivering an earnings surprise of 27.1%, on average.

Strong Growth Prospects

: The Zacks Consensus Estimate for 2022 earnings is pegged at $10.14 per share, which reflects year-over-year growth of 10%. The company’s long-term expected earnings per share growth rate is at 12.3%.

Driving Factors

: Gartner has a large and diverse addressable market with low customer concentration that mitigates operating risks. Operating in an industry with low barriers to entry, the company has an integrated research and consulting team designed to best serve client needs. This enables it to have a competitive advantage against its rivals.

Leveraging the breadth and depth of its intellectual capital, Gartner creates and distributes proprietary research content as broadly as possible via published reports, interactive tools, facilitated peer networking, briefings, consulting and advisory services, and events.

Gartner’s endeavor to reward its shareholders in the form of share repurchases is appreciable. In 2021, 2020 and 2019, the company repurchased 7.3 million, 1.2 million and 1.4 million shares for $1.7 billion, $176.3 million and $199 million, respectively.

Such moves indicate the company’s commitment to create value for shareholders and underline its confidence in business. Also, these moves help instil investors’ confidence in the stock and positively impact earnings per share.

Other Stocks to Consider

Other stocks worth considering in the broader Zacks

Business Services

sector are

Booz Allen Hamilton Holding Corporation

BAH

and

CRA International, Inc.

CRAI

.

Booz Allen presently carries a Zacks Rank #2. BAH has a long-term earnings growth expectation of 8.9%.

Booz Allen delivered a trailing four-quarter earnings surprise of 8.8%, on average.

CRA International carries a Zacks Rank of 2 at present. CRAI has a long-term earnings growth expectation of 14.3%.

CRA International delivered a trailing four-quarter earnings surprise of 25.7%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report