Tandem Diabetes Care, Inc.

TNDM

has been gaining from robust pump shipments worldwide. The company’s revenues for the first quarter of 2022 topped the Zacks Consensus Estimate. The continued uptake of the Control-IQ technology and t:slim X2 insulin pumps buoy optimism. The raised sales guidance for 2022 also instills investors’ confidence. However, escalating operating costs and stiff rivalry do not bode well.

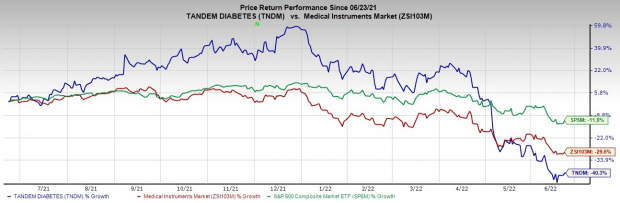

In the past year, the Zacks Rank #3 (Hold) stock has plunged 40.3% versus a 29.6% decline of the

industry

and an 11.8% drop of the S&P 500.

The renowned medical device company has a market capitalization of $3.67 billion. The company surpassed earnings estimates in the trailing two quarters and missed in two, the average surprise being 60%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Factors At Play

Impressive Q1 Results:

Tandem Diabetes exited the first quarter with better-than-expected revenues. The company delivered record sales growth in and outside the United States for the first quarter. Robust pump shipments, resulting from an increase in the company’s installed base, buoys optimism. The company recorded a new milestone as its installed base surpassed more than 350,000 people worldwide.

The company also witnessed strong customer retention in the reported quarter, driven by the impressive positive response from the Control-IQ technology. Continued adoption of the company’s t:slim X2 insulin pumps looks encouraging.

Product Pipeline Innovation Continues:

Tandem Diabetes constantly undertakes innovation and develops products to cater to consumers’ and clinical needs. In February 2022, the company gained the FDA clearance for the t:connect mobile app — the first-ever smartphone application capable of initiating insulin delivery on both iOS and Android operating systems. Another notable product under development is the Mobi, a novel miniaturized durable pump, which will be submitted to the FDA through the ace pump 510(k) pathway in the third quarter of 2022.

The company further anticipates that 2022 will benefit from new sensor offerings by both CGM partners, DexCom and Abbott. Tandem Diabetes is working closely with both CGM partners to bring their technology to market through the iCGM pathway.

Upbeat Guidance:

Tandem Diabetes updated its financial guidance for 2022. For the year, sales are projected in the range of $850-$865 million (up from the prior projection of $845-$860 million), indicating annual sales growth of 21-23%.

Full-year sales guidance for the United States is pegged in the range of $635-$645 million (up from the prior estimate of $630-$640 million). The company maintained its full-year sales guidance for outside the United States in the band of $215-$220 million.

Downsides

Mounting Expenses:

During the first quarter, Tandem Diabetes’ selling, general and administrative expenses rose 25.1%, whereas research and development expenses increased 84.6%. The escalating expenses resulted in an operating loss in the quarter, building pressure on the bottom line.

Coronavirus Impact:

Tandem Diabetes is taking a careful approach to the potential impact of COVID-19 on its business in 2022. Despite witnessing robust demand in international markets, the company expects COVID impacts on distributor order timing to continue producing significant variability in sales outside the United States.

Tough Competition:

Tandem Diabetes operates in a highly competitive environment, dominated by firms ranging from large multinational corporations with significant resources to start-ups. Also, the competitive and regulatory conditions in the markets where the company operates limit the company’s ability to switch to strategies like price increases.

Estimate Trend

In the past 30 days, the Zacks Consensus Estimate for Tandem Diabetes’ 2022 earnings has moved down to 35 cents by a penny.

The Zacks Consensus Estimate for its 2022 revenues is pegged at $855.03 million, suggesting a 21.7% rise from the 2021 reported number.

Key Picks

A few better-ranked stocks in the broader medical space are

Alkermes plc

ALKS

,

AMN Healthcare Services, Inc.

AMN

and

Medpace Holdings, Inc.

MEDP

.

Alkermes has an estimated long-term growth rate of 25.1%. Alkermes’ earnings surpassed estimates in the trailing four quarters, the average surprise being 350.5%. It currently carries a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

Alkermes has outperformed the industry in the past year. ALKS has gained 14.4% against the industry’s 42.6% decline in the said period.

AMN Healthcare has a long-term earnings growth rate of 1.1%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 15.6%, on average. It currently flaunts a Zacks Rank #1.

AMN Healthcare has outperformed its industry in the past year. AMN has gained 7.6% against the industry’s 54.2% fall.

Medpace has a historical growth rate of 27.3%. Medpace’s earnings surpassed estimates in the trailing four quarters, the average surprise being 17.1%. It currently has a Zacks Rank #2 (Buy).

Medpace has outperformed its industry in the past year. MEDP has declined 20.2% compared with the industry’s 54.2% fall.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report