Automatic Data Processing, Inc.

ADP

is benefiting from its strong business model as well as its three-tier business strategy.

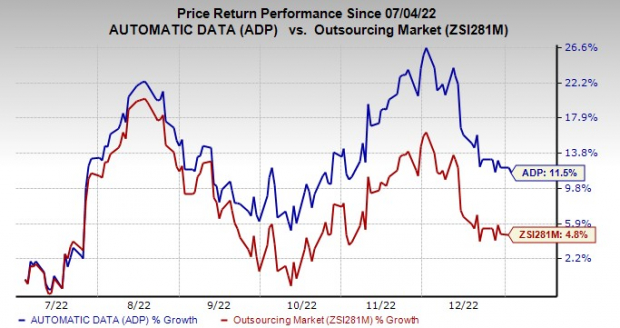

ADP’s earnings and revenues for 2023 are expected to improve 15.8% and 8.5%, respectively, from the corresponding year-ago reported figures. Shares of ADP have jumped 11.5% in the past six-month period compared with 4.8% rise of the

industry

it belongs to.

Image Source: Zacks Investment Research

Factors That Augur Well

ADP has a strong business model, high recurring revenues, good margins, robust client retention and low capital expenditure. It has a strong cash generating ability that allows it to pursue growth in areas that exhibit true potential. Adjusted EBIT margin grew 30 basis points to 24.1% in first-quarter fiscal 2023.

ADP’s three-tier business strategy helps it to maintain and grow its strong position as a human capital management (HCM) technology and services provider. The company is focused on delivering a complete suite of cloud-based HCM and HR Outsourcing solutions. It is expanding its international HCM and HRO businesses with established local, in-country software solutions and cloud-based multi-country solutions.

A Key Risk

ADP’s current ratio at the end of first-quarter fiscal 2023 was pegged at 0.97, lower than the current ratio of 0.99 reported at the end of fourth-quarter fiscal 2022 and the prior-year quarter’s 1.05. Decreasing current ratio is not desirable as it indicates that the company may have problems meeting its short-term debt obligations.

Zacks Rank and Stocks to Consider

ADP currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the broader Zacks

Business Services

sector are

Booz Allen Hamilton Holding Corporation

BAH

and

Cross Country Healthcare, Inc.

CCRN

.

Booz Allen

carries a Zacks Rank #2 (Buy) at present. BAH has a long-term earnings growth expectation of 8.9%.

Booz Allen delivered a trailing four-quarter earnings surprise of 8.8%, on average.

Cross Country Healthcare

is currently Zacks #2 Ranked. CCRN has a long-term earnings growth expectation of 6%.

CCRN delivered a trailing four-quarter earnings surprise of 10.1%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report