Shares of

Splunk Inc.

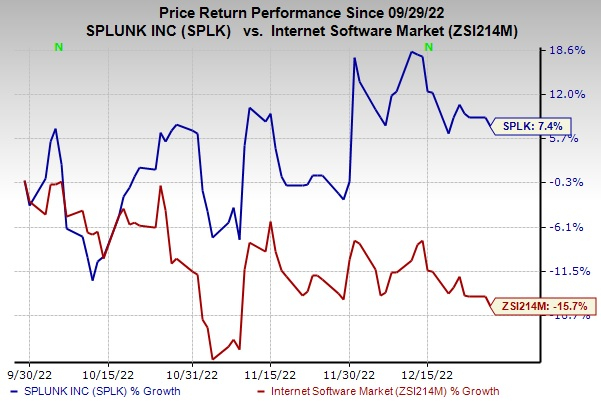

SPLK

have risen 7.4% over the past three months, driven by healthy revenues on the back of a flexible business model and a quick time-to-market schedule to meet clients’ evolving needs. Earnings estimates for the current fiscal have increased a stellar 223.3% over the past year, while that for the next fiscal are up 288.5%, implying solid inherent growth potential. With healthy fundamentals, this Zacks Rank #2 (Buy) software solutions provider appears to be a solid investment option at the moment. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Image Source: Zacks Investment Research

Growth Drivers

San Francisco, CA-based Splunk provides software solutions that enable enterprises to gain real-time operational intelligence by harnessing the value of their data. The company’s offerings enable users to investigate, monitor, analyze and act on machine data and big data, irrespective of format or source, and help in operational decision making. The company’s software has a broad range of applications, including security analytics, business analytics and IT operations. The valuable insight into machine and big data is allowing users/enterprises to improve service levels, reduce operational costs, mitigate security risks and maintain compliance. This has enabled the company to strengthen its market position.

Splunk’s software can be deployed in a wide variety of computing environments, from a single laptop to large globally distributed data centers as well as public, private and hybrid cloud environments. The company’s top line is benefiting from the high demand for its cloud solutions. Splunk’s ES (Enterprise Security) solutions also hold promise. Users leverage ES to centralize security management on a single platform and better handle the big data scale of their security operations center. It also benefits from the ongoing security threats and information and event management replacement cycle. Further, the company’s integration with Amazon Web Services (AWS) security hub to help customers accelerate detection, investigation and response to potential threats within their AWS security environment is likely to be a key catalyst in the long haul.

In addition, Splunk’s aggressive acquisition strategy has played a pivotal part in developing its business over the last couple of years. The SignalFx acquisition has enabled it to emerge as a leader in cloud monitoring and Application Performance Monitoring for firms transitioning to the cloud. The VictorOps buyout helps it address the needs of DevOps, which is a rapidly growing domain of software engineering. The acquisition of Phantom Cyber aided in the addition of security orchestration, automation and response to Splunk’s portfolio. The buyout of Rocana has strengthened the company’s machine data platform. Splunk is expected to continue pursuing acquisitions in order to expand its portfolio and increase market share over the long term.

The company’s business transition from perpetual licenses to subscription or renewable model is expected to benefit it in the long run. Splunk has been witnessing an increase in the number of renewable terms contracts, which is a tailwind. Cloud annual recurring revenues (ARR) in third-quarter fiscal 2023 soared 46% year over year to $1.62 billion. The company had 754 customers with ARR greater than $1 million, up 19% year over year.

The company delivered an earnings surprise of 222%, on average, in the trailing four quarters and has a long-term earnings growth expectation of 30%. It has a

VGM Score

of B.

Other Key Picks

Ooma Inc.

OOMA

, sporting a Zacks Rank #1, delivered an earnings surprise of 21.7%, on average, in the trailing four quarters. Earnings estimates for Ooma for the current year have moved up 37.8% since March 2022. It has a VGM Score of B.

Ooma offers communications services and related technologies for businesses and consumers in the United States and Canada. It helps to create powerful connected experiences for businesses and consumers through its smart cloud-based SaaS platform.

Harmonic Inc.

HLIT

, carrying a Zacks Rank #2, delivered an earnings surprise of 55.5%, on average, in the trailing four quarters. Earnings estimates for Harmonic for the current year have moved up 48.6% since March 2021.

Harmonic provides video delivery software, products, system solutions and services worldwide. With more than three decades of experience, it has revolutionized cable access networking via the industry’s first virtualized cable access solution, enabling cable operators to more flexibly deploy gigabit Internet service to consumers’ homes and mobile devices.

AudioCodes Ltd.

AUDC

, sporting a Zacks Rank #1, is likely to benefit from the secular tailwinds related to IP-based communications. Incorporated in 1992 and headquartered in Lod, Israel, it offers advanced communications software, products and productivity solutions for the digital workplace. It has a long-term earnings growth expectation of 9%.

AudioCodes aims to leverage its long-term partnership with Microsoft to further strengthen its market position. It is also likely to benefit from its continued focus on high-margin businesses.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report