Masimo Corporation

MASI

has been gaining on the back of its slew of favorable study outcomes over the past few months. A robust first-quarter 2022 performance, along with its focus on patient monitoring, is expected to contribute further. However, concerns regarding overdependence on Masimo SET and forex woes persist.

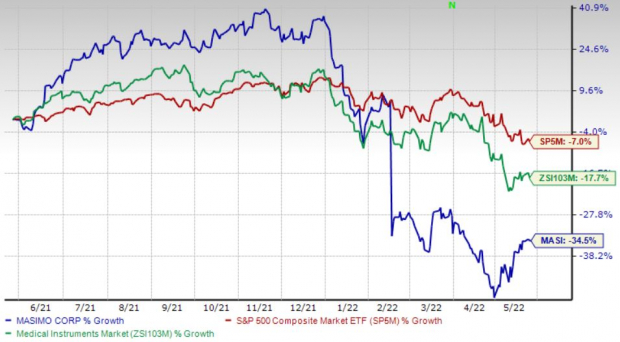

Over the past year, this Zacks Rank #2 (Buy) stock has lost 34.5% compared with the

industry

’s 17.7% fall and the S&P 500’s 6.9% decline.

The renowned global provider of non-invasive monitoring systems has a market capitalization of $7.74 billion. The company projects 15.1% growth for 2022 and expects to maintain its strong performance. Masimo has delivered an earnings surprise of 4.4% for the past four quarters, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strong Q1 Results:

Masimo’s solid first-quarter 2022 results buoy our optimism. The company recorded a solid uptick in the top line. It also registered robust order shipments in the reported quarter. The expansion of the company’s installed base is also impressive.

Masimo confirmed that it has been witnessing a rebound in elective surgeries and better access for its sales force within hospitals, which is encouraging. The gross margin expansion bodes well. The company raised its full-year financial outlook, which looks promising.

Positive Study Outcomes:

We are optimistic about Masimo’s products, which have been subjects of various studies over the past few months. In May, the company announced the findings of a retrospective study in which researchers investigated the potential ability of Masimo PVi (pleth variability index) to guide emergency room triage decisions for pediatric patients with signs of obstructive respiratory disease such as asthma attacks.

In April, Masimo announced the findings of a retrospective study in which researchers investigated the impact of anesthesia during cardiac surgery guided by Masimo SedLine Brain Function Monitoring, in particular by SedLine’s processed electroencephalography feature, the Patient State Index.

Patient-Monitoring in Focus:

On the first-quarter 2022 earnings call in May, Masimo confirmed that it had been witnessing a rebound in elective surgeries and registering better access for its sales force within hospitals. The company’s installed base has been growing due to strong and consistent customer demand for Masimo’s technologies.

In April, Masimo completed the previously announced acquisition of Sound United, which will add to Masimo’s broad portfolio of hospital and home medical technology solutions. Masimo also confirmed that it plans to launch some high potential products in consumer health and wellness.

Downsides

Overdependence on Masimo SET:

Masimo currently derives the majority of its revenues from its primary product offerings, like the Masimo SET platform, Masimo rainbow SET platform and related products. Thus, the company’s business is highly dependent on the continued success and market acceptance of its primary product offerings.

Forex Woes:

Masimo markets its products in certain foreign markets through its subsidiaries and other international distributors. As a result, events that result in global economic uncertainties could significantly affect its results of operations in the form of gains and losses on foreign currency transactions, and the potential devaluation of the local currencies of Masimo’s customers relative to the U.S. dollar.

Estimate Trend

Masimo has been witnessing a positive estimate revision trend for 2022. In the past 90 days, the Zacks Consensus Estimate for its earnings per share has moved 6.2% north to $4.61.

The Zacks Consensus Estimate for the company’s second-quarter 2022 revenues is pegged at $542.9 million, suggesting a 77.9% improvement from the year-ago quarter’s reported number.

Other Key Picks

A few other top-ranked stocks in the broader medical space are

Alkermes plc

ALKS

,

Veeva Systems Inc.

VEEV

and

AMN Healthcare Services, Inc.

AMN

.

Alkermes, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 25.1%. ALKS’s earnings surpassed estimates in the trailing four quarters, the average beat being 350.5%.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Alkermes has gained 27.1% against the

industry

’s 38.3% fall over the past year.

Veeva Systems has an estimated long-term growth rate of 18.1%. VEEV’s earnings surpassed estimates in the trailing four quarters, the average beat being 9.6%. It currently carries a Zacks Rank #2.

Veeva Systems has lost 40.9% compared with the

industry

’s 61.5% fall over the past year.

AMN Healthcare has an estimated long-term growth rate of 1.1%. AMN’s earnings surpassed estimates in the trailing four quarters, the average beat being 15.6%. It currently sports a Zacks Rank #1.

AMN Healthcare has lost 0.8% compared with the

industry

’s 64% fall over the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report