IDEXX Laboratories, Inc.

IDXX

has been gaining on record instrument placements during the fourth quarter of 2021. The impressive revenue growth within the Companion Animal Group (CAG) segment bodes well. Robust performance across all geographies also buoys optimism. However, mounting expenses and contraction of adjusted operating margin raise apprehension.

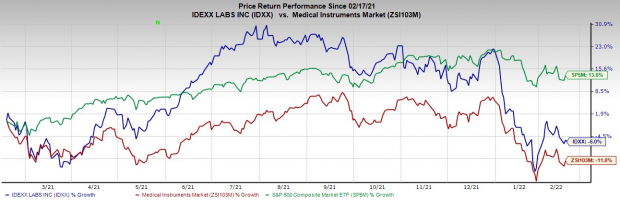

Over the past year, shares of this Zacks Rank #3 (Hold) company have lost 6%, compared with the

industry

’s 11% fall. The S&P 500 rose 13.6% during the same period.

The renowned medical device company has a market capitalization of $43.08 billion. Its earnings for fourth-quarter 2021 surpassed the Zacks Consensus Estimate by 13.2%.

Over the past five years, the company registered earnings growth of 26.3%, ahead of the industry’s 5.0% rise and the S&P 500’s 2.8% increase. The long-term expected growth rate is estimated at 13.0%, compared with the industry’s growth expectation of 14.1% and the S&P 500’s estimated 11.3% growth.

Image Source: Zacks Investment Research

Let’s delve deeper.

Factors at Play

Q4 Upsides:

IDEXX exited the fourth quarter of 2021 with better-than-expected earnings and revenues. Solid organic-revenue growth is encouraging. Strong sales drove the top line at the CAG and Water businesses. The company witnessed strong growth supported by record instrument placements, resulting in the year-over-year expansion of IDEXX’s global premium instrument installed base. Expanding operating margin and bullish full-year earnings guidance are other upsides.

Strong Global Performance:

IDEXX continues to demonstrate solid growth globally. International revenues in the fourth quarter of 2021 were up 8.4% organically, primarily aided by a double-digit gain in CAG and Water businesses. CAG Diagnostic’s recurring revenues in the reported quarter reflected 14% growth in international regions. Further, Global Reference Lab gains were strong, driven by solid same-store volume growth, including benefits from the expansion of IDEXX 360 program agreements.

CAG Continues to Perform Well:

IDEXX derives the lion’s share of its revenues from the CAG segment. We are upbeat about the stellar fourth-quarter revenue growth within this arm. During the quarter, CAG revenues rose 13% year over year organically. The year-over-year improvement was driven by 13% organic growth in veterinary software services and diagnostic imaging revenues coupled with benefits from the ezyVet acquisition and 18% year-over-year growth in CAG Diagnostic instrument revenues. Continued strong U.S. CAG diagnostic recurring revenue growth was supported by year-on-year gains in U.S. clinical business. In terms of CAG instrument placements, the company witnessed strong gains across the U.S. and international markets.

Downsides

LPD Growth Hampered:

In the fourth quarter, IDEXX’s Livestock, Poultry and Dairy (LPD) revenues declined 18.9% organically. This downside can be attributable to changes in local African Swine Fever disease management approaches, lower pork prices and changes in government requirements related to livestock infectious disease testing programs, among other factors.

Escalating Expenses:

IDEXX’s sales and marketing expenses rose 10.8%, while research and development expenses increased 16.8% during the fourth quarter. These escalating operating expenses led to an 81-basis point contraction in adjusted operating margin, building pressure on the bottom line.

Foreign Exchange Headwind:

IDEXX derives the majority of its consolidated revenues from the sale of products in international markets. This makes the company susceptible to unfavorable foreign currency movements.

Estimate Trends

In the past 90 days, the Zacks Consensus Estimate for IDEXX’s 2022 earnings has moved 1.8% north to $9.45.

The Zacks Consensus Estimate for 2022 revenues is pegged at $3.55 billion, suggesting 10.3% growth from the year-ago quarter’s reported number.

Key Picks

A few better-ranked stocks in the broader medical space are

Owens & Minor, Inc.

OMI

,

Charles River Laboratories International, Inc.

CRL

and

HealthEquity, Inc.

HQY

, each currently carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Owens & Minor has a long-term earnings growth rate of 23.6%. Owens & Minor’s earnings surpassed estimates in the trailing four quarters, delivering a surprise of 32.4%, on average.

Owens & Minor has outperformed the industry over the past year. OMI has gained 55.7% against an 18.5% industry decline in the said period.

Charles River has a long-term earnings growth rate of 14%. Charles River surpassed earnings estimates in the trailing four quarters, delivering a surprise of 10.6%, on average.

Charles River has gained 1.9% against the industry’s 59.3% drop over the past year.

HealthEquity has a long-term earnings growth rate of 16.5%. HealthEquity’s earnings surpassed estimates in the trailing four quarters, delivering an average surprise of 9.8%.

HealthEquity has declined 30.1% against the industry’s 59.3% slump over the past year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report