Bruker Corporation

BRKR

is well poised for growth backed by strength across the BSI and BEST businesses. The strong bookings and backlog growth during the fourth quarter buoy optimism. The ongoing rebound in businesses within the Nano Group also seems encouraging. The company’s growing investments in Project Accelerate 2.0 initiatives is an added advantage. However, mounting operating expenses and foreign exchange woes do not bode well.

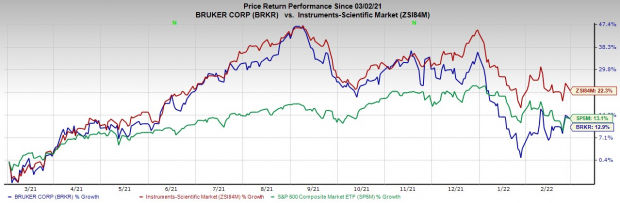

Over the past year, this Zacks Rank #2 (Buy) stock has gained 12.9% compared with 22.3% growth of the

industry

and 13.1% rise of the S&P 500 composite.

The renowned medical device company has a market capitalization of $10.67 billion. The company surpassed earnings estimates in the trailing three months and met estimates on one occasion, the average surprise being 21.9%.

Over the past five years, the company has gained 13.7%, ahead of the industry’s 13.2% rise and the S&P 500’s 2.8% increase. The long-term expected growth rate is estimated at 18.6%, compared with the industry’s growth expectation of 23.1% and the S&P 500’s estimated 11.2% growth.

Image Source: Zacks Investment Research

Let’s delve deeper.

Factors at Play

Q4 Upsides:

Bruker ended the fourth quarter of 2021 with better-than-expected revenues. The top line was driven by robust revenue growth across all geographies as well as revenue growth across the BSI and BEST businesses. The company delivered robust bookings and backlog growth in the fourth quarter, buoying optimism. The company has also increased its investments in Project Accelerate 2.0 initiatives and operational excellence drive, focusing on key opportunities in proteomics and spatial biology. Bruker’s financial outlook for 2022, with solid growth projections over 2021, instills investors’ confidence. A strong solvency position is an added advantage.

BSI Nano Group Grows:

Bruker’s Nano Group’s microelectronics and semiconductor metrology tools continue to perform well on ongoing strength in bookings and backlog. For full-year 2021, the company witnessed a solid rebound in businesses within the Nano Group. Revenues from advanced X-ray, Nano Surfaces and Nano Analysis tools saw considerable growth in 2021 compared to 2020. Nano Group’s 2021 revenues also included revenue contributions from the prior acquisition of Canopy Biosciences, Spatial biology, targeted Proteomics tools and CRO services.

CALID Group Holds Potential:

Bruker’s CALID Group has been making decent progress of late. In the fourth quarter, the business recorded an improvement of 14.5% year over year, primarily resulting from strong performance in life science mass spectrometry and the MALDI Biotyper franchise. For full-year 2021, CALID Group revenues increased in the low-20s percentage with continued growth in mass spectrometry and microbiology businesses along with strength in the FT-IR/NIR/Raman molecular spectroscopy product line. The robust revenue growth in the timsTOF unbiased 40 proteomics and multiomics platform during 2021 also raises optimism.

Potential of PCI Market:

Bruker offers advanced preclinical imaging (PCI) solutions for a broad spectrum of application fields, such as cancer research, functional and anatomical neuroimaging, orthopedics, cardiac imaging and stroke models. During the fourth quarter, BioSpin’s PCI division acquired MOLECUBES– a dynamic innovator in benchtop preclinical nuclear molecular imaging (NMI) systems. This buyout strengthens the company’s position as a leading NMI solutions provider in preclinical and translational imaging research. Further, solid prospects in the global PCI market, offers a significant opportunity for Bruker to strengthen its market position and earn higher profits from this division, going ahead.

Downsides

Escalating Expenses:

In the fourth quarter 2021, Bruker’s selling, general & administrative expenses rose 17.6%, whereas research and development expenses increased 1.8% year over year, respectively. The rise in operating expenses resulted in a 95 basis points contraction in operating margin, building pressure on the bottom line.

Exposure to Currency Movement:

Since Bruker conducts 80% of its business in international markets, unfavorable currency movements continue to lead to foreign currency transaction losses at the company. In addition, currency fluctuations could cause the price of Bruker’s products to be less competitive than its principal competitors’ offerings.

Estimate Trend

Bruker has been witnessing a positive estimate revision trend for 2022. Over the past 90 days, the Zacks Consensus Estimate for Bruker’s 2022 earnings has moved 1.3% north to $2.31.

The Zacks Consensus Estimate for its 2022 revenues is pegged at $2.56 billion, suggesting a 6% rise from the year-ago reported number.

Key Picks

A few better-ranked stocks in the broader medical space are

Henry Schein, Inc.

HSIC

,

Owens & Minor, Inc.

OMI

and

McKesson Corporation

MCK

.

Henry Schein, currently carrying a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 11.8%. Henry Schein’s earnings surpassed estimates in the trailing four quarters, the average surprise being 25.5%. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Henry Schein has gained 37.3% compared with the industry’s 10% rise over the past year.

Owens & Minor, carrying a Zacks Rank #2 (Buy), has a long-term earnings growth rate of 23.6%. Owens & Minor’s earnings surpassed estimates in the trailing four quarters, delivering a surprise of 32.4%, on average.

Owens & Minor has outperformed the industry over the past year. OMI has gained 33.8% against a 15.6% industry decline in the said period.

McKesson, sporting a Zacks Rank #2, has a long-term earnings growth rate of 11.8%. McKesson’s earnings surpassed estimates in the trailing four quarters, delivering an average surprise of 20.6%.

McKesson has gained 58.3% against the industry’s 10% rise over the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report