Abbott Laboratories

ABT

is well-poised for growth in the coming quarters, courtesy of its solid Diabetes business. The optimism led by solid third-quarter 2022 performance and a few product launches are expected to contribute further. However, forex woes and Nutrition Product recall impeding growth are concerning.

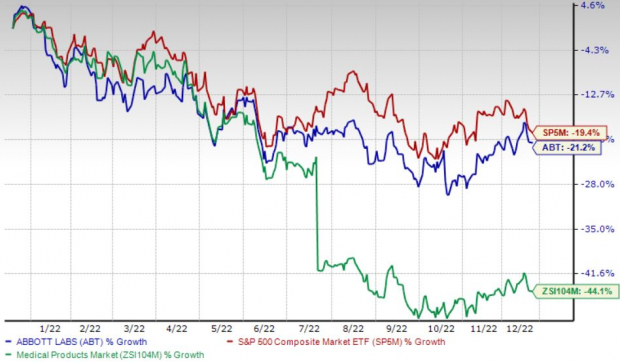

Over the past year, this Zacks Rank #3 (Hold) stock has lost 21.2% compared with 44.2% decline of the

industry

and 19.5% fall of the S&P 500 composite.

This renowned provider of a diversified line of healthcare products has a market capitalization of $185.85 billion. The company projects 5.1% growth for the next five years and expects to maintain its strong performance. Abbott’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 21.8%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Progress With Diabetes Business:

We are optimistic about Abbott’s diabetes business. This business achieved robust organic sales growth in the third quarter of 2022, led by strong growth in FreeStyle Libre. In the quarter, sales of FreeStyle Libre exceeded $1 billion. Abbott’s user base expanded to approximately 4.5 million users globally, while in the United States, sales grew more than 40%.

Product Launches:

We are upbeat about the products launched by Abbott in recent months. At the time of third-quarter 2022 results announcement in October, the company confirmed the launch of its latest-generation FreeStyle Libre 3 system in the United States.

In September, Abbott announced the European launch of its Amplatzer Talisman patent foramen ovale (PFO) Occlusion System to treat people with a PFO who have experienced a stroke and are at risk of having another.

Strong Q3 Results:

Abbott’s better-than-expected third-quarter 2022 results buoy optimism. Within the company’s Diagnostics business, excluding COVID testing revenues, sales growth of routine diagnostic tests in the third quarter went up globally. This was fueled by the continued global rollout of the Alinity instrument for immunoassay, clinical chemistry and molecular testing. In Medical Device, global sales growth was also strong. In the United States, sales growth was led by strong double-digit growth in Electrophysiology, Structural Heart and Diabetes Care.

Downsides

Forex Translation Impacts Sales:

Foreign exchange is a major headwind for Abbott due to a considerable percentage of its revenues coming from outside the United States. The strengthening of the euro and some other developed market currencies has been constantly hampering the company’s performance in the international markets.

Nutrition Product Recall Impedes Growth:

Within Abbott’s Nutrition business, in the third quarter, worldwide Nutrition sales were down on an organic basis, with a significant slump in Pediatric Nutrition sales. The downside in total worldwide Nutrition and Pediatric Nutrition sales can be attributed to a voluntary recall and manufacturing shutdown of certain infant formula products manufactured at one of Abbott’s U.S. plants since last February.

Estimate Trend

Abbott has been witnessing a positive estimate revision trend for 2022. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 4.4% north to $5.21.

The Zacks Consensus Estimate for the company’s fourth-quarter 2022 revenues is pegged at $9.47 billion, suggesting a 17.4% decline from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are

Exact Sciences Corporation

EXAS

,

ShockWave Medical, Inc.

SWAV

and

Merit Medical Systems, Inc.

MMSI

.

Exact Sciences, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 27.5%. EXAS’ earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed the same in one, the average beat being 0.6%.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Exact Sciences has lost 39.3% compared with the

industry

’s 24.4% decline in the past year.

ShockWave Medical, carrying a Zacks Rank #2 at present, has an estimated growth rate of 21.2% for 2023. SWAV’s earnings surpassed estimates in all the trailing four quarters, the average beat being 146.1%.

ShockWave Medical has gained 21.5% against the

industry

’s 28.4% decline over the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 25.4%.

Merit Medical has gained 15.7% against the

industry

’s 11.1% decline over the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report