Catalent, Inc.

CTLT

is well poised for growth in the coming quarters, backed by its slew of strategic deals over the past few months. A robust third-quarter fiscal 2021 performance, along with integrated development and product supply chain solutions, is expected to contribute further. However, stiff competition and regulatory requirements persist.

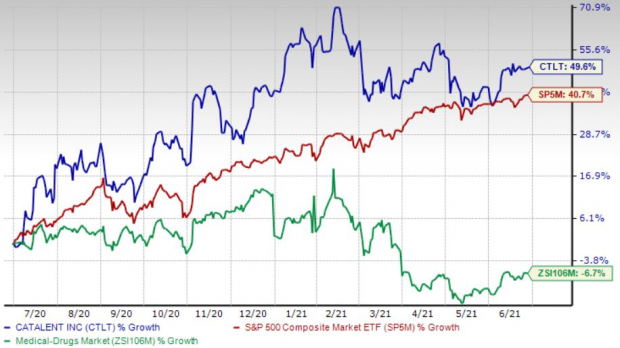

Over the past year, this Zacks Rank #3 (Hold) stock has gained 49.7% compared with 40.7% rise of the S&P 500 composite. The

industry

fell 6.7% in the said time frame.

The renowned global provider of advanced delivery technologies has a market capitalization of $18.76 billion. The company projects 20.9% growth for the next five years and expects to maintain its strong performance. Further, it has delivered an earnings surprise of 10.17% for the past four quarters, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strategic Deals:

We are optimistic about Catalent’s robust growth opportunities via its recent tie-ups and buyouts. The company, this month, reached an agreement to acquire RheinCell Therapeutics GmbH. Catalent, in May, acquired Promethera Biosciences’ cell therapy manufacturing subsidiary, Hepatic Cell Therapy Support SA, including its 32,400 square-foot (3,010 square-meter) facility in Gosselies, Belgium.

The company, in May, announced that it has begun a global innovation partnership with Norwegian biotech company Hofseth BioCare ASA. In April, Catalent tied up with the developer and manufacturer of ultra-low temperature freezers for life science and biopharma research — Stirling Ultracold.

Integrated Development and Product Supply Chain Solutions:

We are upbeat about Catalent’s ability to bring together its development solutions and advanced delivery technologies to offer innovative development and product supply solutions to aid its customers. Management believes that Catalent’s development and product supply solutions, such as the OptiForm Solutions Suite and OneBioSuite, will continue to contribute to its future growth.

The company, in April, announced that it has made an investment to expand capabilities at its clinical supply services facility in Philadelphia to support sponsors developing cell and gene therapies.

Strong Q3 Results:

Catalent’s solid third-quarter fiscal 2021 results, along with year-over-year uptick in both the top and bottom lines, buoy optimism. Continued strength in global demand for COVID-19 vaccines and treatments drove the Biologics arm in the quarter under review, which is encouraging as well. Robust performance by the Clinical Supply Services segment also raises our optimism. Expansion of both margins bodes well. A solid revenue guidance is also encouraging.

Downsides

Regulatory Requirements:

The healthcare industry is highly regulated, where Catalent and its customers are subject to various local, state, federal, national and transnational laws and regulations. Any change to such laws and regulations could adversely affect the company. Failure by Catalent or its customers to comply with the requirements of these regulatory authorities could result in warning letters, product recalls or seizures, and other adverse business impacts.

Stiff Competition:

Catalent operates in a highly competitive market where it competes with multiple companies, including those offering advanced delivery technologies and outsourced dose form or biologics manufacturing. The company also competes in some cases with the internal operations of those pharmaceutical, biotechnology and consumer health customers that also have manufacturing capabilities and choose to source these services internally.

Estimate Trend

Catalent is witnessing a positive estimate revision trend for 2021. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 3.5% north to $2.93.

The Zacks Consensus Estimate for the company’s fourth-quarter fiscal 2021 revenues is pegged at $1.13 billion, suggesting a 19.4% improvement from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks from the broader medical space are

Veeva Systems Inc.

VEEV

,

AMN Healthcare Services Inc

AMN

and

National Vision Holdings, Inc.

EYE

.

Veeva Systems’ long-term earnings growth rate is estimated at 15.8%. The company presently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare’s long-term earnings growth rate is estimated at 6.5%. It currently flaunts a Zacks Rank #1.

National Vision’s long-term earnings growth rate is estimated at 23%. It currently sports a Zacks Rank #1.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report