Horizon Therapeutics plc

HZNP

announced that it has held highly preliminary discussions with big pharma companies like

Sanofi

SNY

, Janssen, a subsidiary of

J&J

JNJ

and

Amgen

AMGN

, which may or may not lead to its potential acquisition by any of these giant drugmakers.

Horizon said that in accordance with Irish Takeover Rules, the possible bidders must say whether they intend to make an offer or not latest by Jan 10, 2023.

However, there is no certainty that any acquisition offer will be made.

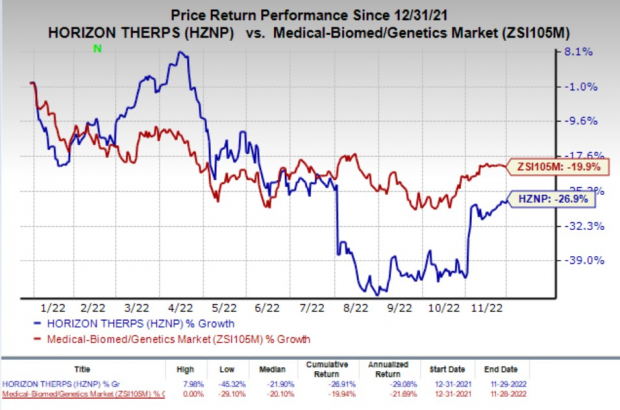

Shares of Horizon were up 30.5% in after-hours trading on Tuesday following the announcement of the news. However, the stock has declined 26.9% so far this year compared with the

industry

’s decline of 19.9%.

Image Source: Zacks Investment Research

Horizon is engaged in developing medicines for treating rare autoimmune and severe inflammatory diseases. The company reports financial results under two segments, Orphan and Inflammation.

Horizon’s biggest drug, Tepezza, was approved by the FDA in early 2020 as a treatment for patients with thyroid eye disease (TED). With this nod, Tepezza became the first FDA-approved medicine for the treatment of active TED, a serious and vision-threatening rare autoimmune disease.

Horizon’s other marketed drugs include Krystexxa, Actimmune, Procysbi and Ravicti, which are approved for a range of rare diseases. HZNP is currently working on the label expansion of these drugs.

In the first nine months of 2022, Horizon’s total sales amounted to $2.68 billion while Tepezza generated sales worth $1.47 billion, reflecting an increase of 21% and 37%, respectively, on a year-over-year basis.

Horizon’s recent growth trajectory probably attracted the interest of big healthcare companies like Sanofi, J&J and Amgen, who often seek buyouts to expand their foothold in the market. All these companies have had a portfolio of rare-disease therapies, which is likely to diversify from such acquisitions.

It remains to be seen whether a deal materializes or not from any of the possible offerors for the potential buyout of Horizon.

If a deal does materialize, it would probably be the biggest acquisition of late. Horizon’s market cap is around $18 billion and it could very well be offered more than $20 billion.

Zacks Rank

Horizon currently carries a Zacks Rank #3 (Hold).You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report