Earnings season is just around the corner. For some, the party starts as early as this week. Investors are more than aware of how brutal Q1 of 2022 was, with valuation slashes widespread following many quarterly releases.

This time around, investors are eager to get another glance behind the curtain and get a clearer idea of how companies have navigated the rough macroeconomic backdrop we’ve found ourselves in.

One company slated to kick off earnings season next week is International Business Machines

IBM

. IBM provides advanced information technology solutions, computer systems, quantum and supercomputing solutions, enterprise software, storage systems, and microelectronics.

IBM is currently a Zacks Rank #4 (Sell) with an overall VGM Score of a B. In addition, the company resides within the Zacks Computer and Technology Sector, which has a year-to-date return of -29%.

In order to see how the company shapes up heading into the report, let’s take a closer view of a few metrics.

IBM reports after market close on July 18

th

.

Share Performance & Valuation

IBM shares have undoubtedly been a bright spot in an otherwise dim market, increasing nearly 7% in value year-to-date and easily crushing the S&P 500’s performance.

Image Source: Zacks Investment Research

Upon widening the timeframe to encompass the last year’s price action of IBM shares, we can see that the company’s shares have been substantial for some time now, increasing almost 10% in value and outperforming the general market in this timeframe as well.

Image Source: Zacks Investment Research

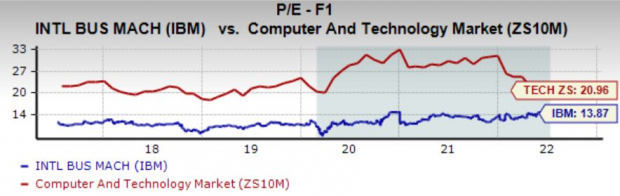

IBM’s forward P/E ratio resides at an enticing 13.9X, above its five-year median of 10.9X. In addition, shares trade at a deep 34% discount relative to its Zacks Sector. IBM has a Value Style Score of a B.

Image Source: Zacks Investment Research

Quarterly Performance & Share Reactions

IBM has primarily reported EPS above expectations, exceeding the Zacks Consensus Estimate in nine of its last ten quarters. Additionally, the company posted a solid 4.5% bottom-line beat in its latest quarter.

However, top-line results have been mixed; the company has exceeded revenue estimates five times over its last ten quarters.

As of late, the market has generally reacted well to bottom-line beats – shares have moved upwards three times over its last four EPS beats, undoubtedly a positive.

Growth Estimates

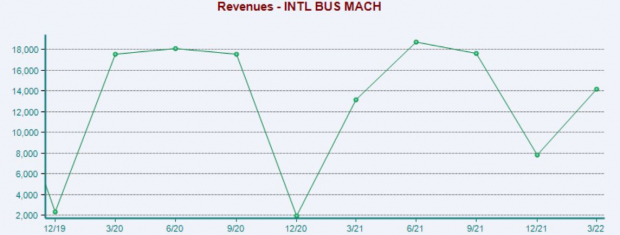

Top and bottom-line estimates display some softening. For the quarter, IBM is forecasted to generate $15 billion in revenue, a double-digit 20% decline compared to the year-ago quarter.

Image Source: Zacks Investment Research

Additionally, the Zacks Consensus EPS Estimate resides at $2.30, notching a slight 1.3% decline in quarterly earnings year-over-year. However, two analysts have positively revised their quarterly estimate over the last 60 days, pushing the Consensus Estimate Trend up a slight 0.9%.

Image Source: Zacks Investment Research

Bottom Line

The top and bottom-line are both forecasted to decrease – something investors should be aware of. In addition, the company carries a Zacks Rank #4 (Sell) heading into the quarterly report.

As with a fair amount of companies this earnings season, it seems beneficial for investors to head into the quarterly release with a higher level of defense, however, the strong share performance year-to-date is undoubtedly a positive.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report