Shares of

Icosavax

ICVX

were up 112.4% on Dec 14 after management announced positive six-month immunogenicity data from a phase I/Ib study. The study evaluated IVX-121, its respiratory syncytial virus (RSV) vaccine candidate, in adults aged 18 years and older.

Data from the study showed that a single dose administration of IVX-121 (without adjuvant) generated a sustained neutralizing antibody (nAb) response against RSV, which lasted for at least six months. The geometric mean titers (GMTs) against RSV-A at day 180 were maintained at 64-98% of the GMTs reported at day 28 in older adults. The pattern of durability for the RSV vaccine was also comparable in both young and older adult groups.

Though the GMTs for RSV-B showed greater variability, they were maintained above baseline through day 180.

The rise in share price was attributable to better-than-expected results from the phase I/Ib study. Investors cheered the news as the GMTs maintained at 64-98% appeared to be better than its competitors like

Pfizer

PFE

and

GSK

GSK

, whose RSV vaccine candidates are currently under FDA review.

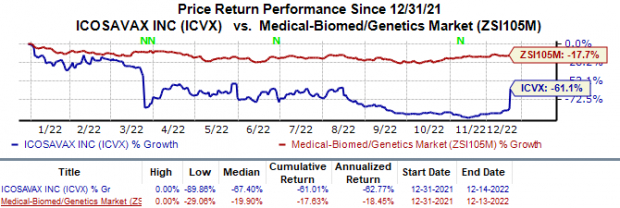

In the year so far, Icosavax’s stock has lost 61.0% compared with the

industry

’s 17.6% decline.

Image Source: Zacks Investment Research

The phase I portion of the study evaluated the RSV vaccine in younger adults aged 18 through 45 years, while the phase Ib portion of the study evaluated the RSV vaccine in older adults aged 60 through 75 years. The study evaluated the RSV vaccine at three different dose levels — 25-µg, 75-µg and 250-µg.

The vaccine was reported safe and durable across both age groups and participants who received IVX-121 did not report any serious adverse events.

Icosavax plans to present additional data from the above study at a future medical meeting. Management also intends to report the 12-month immunogenicity data from the phase Ib portion of the study in mid-2023.

Earlier this month, Pfizer announced that its regulatory filing with the FDA seeking approval for its RSV vaccine candidate, RSVpreF, was granted priority review by the FDA. Pfizer’s filing seeks a review for the use of RSVpreF in older adults aged at least 60 years for the prevention of lower respiratory tract disease (LRTI). A final FDA decision on Pfizer’s RSV vaccine is expected by May 2023.

RSVPreF3, GSK’s RSV vaccine for older adults, is also under FDA priority review, with a decision expected in May 2023. Regulatory applications seeking approval of GSK’s RSV vaccine are under review in Japan and Europe as well.

Currently, there are no FDA-approved vaccines against RSV infections. If approved, either Pfizer or GSK’s vaccines may be the first approved RSV vaccine in the United States. Older adults are at maximum risk of getting RSV disease.

Apart from IVX-121, Icosavax is also evaluating IVX-A12, a bivalent vaccine that combines IVX-121 for RSV and IVX-241 for human metapneumovirus (hMPV), in an ongoing phase I study. With IVX-A12, Icosavax aims to target two causes of pneumonia in one combination. Topline data from this study is expected in mid-2023.

Zacks Rank & Stocks to Consider

Icosavax currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is

BioNTech

BNTX

which carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

In the past 30 days, estimates for BioNTech’s 2022 earnings per share have risen from $34.47 to $35.38. During the same period, the loss estimates per share for 2023 have narrowed from $16.97 to $17.53. Shares of BioNTech have lost 27.8% in the year-to-date period.

Earnings of BioNTech beat estimates in three of the last four quarters and missed the mark once, witnessing a surprise of 58.99% on average. In the last reported quarter, BNTX delivered an earnings surprise of 92.35%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report