IDEXX Laboratories, Inc.

IDXX

recently acquired New Zealand-based ezyVet to expand its cloud-based practice information management system (PIMS) offerings. IDEXX’s three core PIMS offerings, including Cornerstone Software, Neo Software and ezyVet, as the newest addition, are well suited to support veterinary practices of varying sizes.

The acquisition is believed to integrate ezyVet’s industry-leading technology with IDEXX’s scale and cloud-based innovation to advance technology solutions to customers raising the standard of care for patients, improving veterinary practices and facilitating effective communication with pet owners.

With the acquisition, IDEXX’s wide range of customers, including veterinary hospitals, corporate groups and universities that cover the needs of both general practice and specialty clinics, are free to choose from a full range of cloud-based PIMS options.

This acquisition is also known to include Vet Radar. However, financial details concerning the agreement have been kept under wraps.

Few Words on ezyVet and Vet Radar

ezyVet is a New Zealand-based next-generation cloud-native practice management software. The PIMS has a feature rich, customizable and easy-to-use platform, largely focused on enhancing experience for veterinary practitioners. It offers a broad array of integrations that support popular veterinary applications.

Vet Radar, in the meanwhile, is a veterinary workflow management solution. Based in New Zealand, it is said to be the only fully mobile-responsive veterinary electronic treatment sheet, whiteboarding and workflow tool growing rapidly across Asia Pacific, the United States and the U.K.

With the acquisition, Vet Radar is stated to become part of ezyVet.

Industry Prospect

Per a report

published in Verfied Market Research, the veterinary software market is expected to see a CAGR of 5.48% from 2020 to 2027. Factors like explosive growth in the pet industry, increasing demand for veterinary services, animal health diagnostics and monitoring services are attributable to increasing adoption of integrated software systems for veterinary diagnostic and treatment. Further, the mounting demand for pet insurance and growing animal health expenditure is expected to contribute to market growth.

Given the market potential, IDEXX’s latest acquisition seems to be strategic and well timed.

Recent Developments

In its last-reported first quarter of 2021, IDEXX registered 21% organic revenue growth driven by 23% growth in recurring revenue in the Companion Animal Group (CAG) Diagnostic segment. The recurring revenue gains were supported by continued high-growth in clinical visits.

IDEXX’s software portfolio also reported an excellent first-quarter performance as PIMS placements in the quarter grew 43% year over year. IDEXX Web PACS saw growth in subscribers and more than 96% improvement in customer retention levels. Armed with Artificial Intelligence (AI) capability, Web PACS facilitates faster procedures while utilizing data to deliver insights and reduce clinic staff efforts.

In March 2021, the company commenced shipments of the next-generation hematology analyzer ProCyte One. This represents IDEXX’s innovation strategy to integrate leading technology with information management to support clinical decisions and help veterinarian partners provide the highest care.

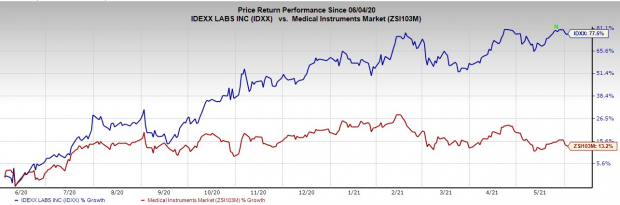

Share Price Performance

The stock has outperformed its

industry

over the past year. It has grown 77.5% compared to the industry’s growth of 13.2%.

Zacks Rank and Other Key Picks

Currently, IDEXX carries a Zacks Rank #2 (Buy).

A few better-ranked stocks from the broader medical space include

PetIQ, Inc.

PETQ

,

Computer Programs and Systems, Inc.

CPSI

and

National Vision Holdings, Inc.

EYE

, each sporting a Zacks Rank # 1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

PetIQ has a long-term earnings growth rate of 25%.

Computer Programs and Systems has a long-term earnings growth rate of 14%.

National Vision has a long-term earnings growth rate of 23%.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report