One of the most famous songs about conflict is Edwin Starr’s “War”. The memorable anti-war lyrics make a powerful point about the cost of war: “War, I despise, cause it means destruction of innocent lives, war means tears to thousands of mother’s eyes…War, huh, yeah, What is it good for? Absolutely nothing.”

While it is tough to argue with the song’s sentiment from a human perspective, war can benefit the economy and defense stocks. Think back to the late 1930s when the unemployment rate in the U.S. reached nosebleed levels of 25%. How did the nation claw its way out of the Great Depression? World War II. After Japan attacked Pearl Harbor, America was dragged into the war and began a massive mobilization effort. Companies such as

Ford Motor

F

retooled their factories to support the effort leading to an enormous recovery in unemployment and leaps in manufacturing innovation.

Following the 9/11 terrorist attacks, defense stocks took off as the U.S. began its Middle East war efforts. Names such as

Lockheed Martin

LMT

trended for months even as the U.S. market suffered from the post-internet bubble blues and the fallout from the Twin Tower attacks. While the U.S is not in a “hot war” currently, America’s involvement in the war in Ukraine is bolstering the performance of domestic defense contractors.

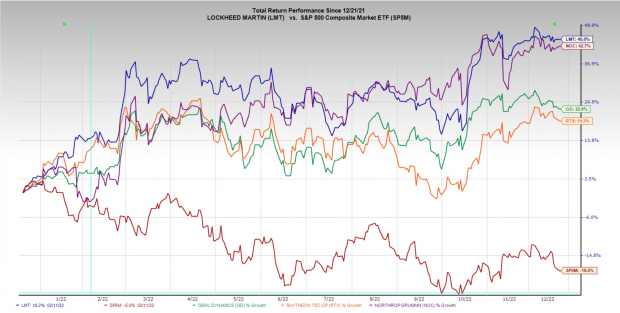

Image Source: Zacks Investment Research

Pictured: Defense names have drastically outperformed the S&P (red), as Ukraine war drags on.

As the war drags on in Europe, Ukrainian President Zelenskiy is expected to travel to Washington to address congress. At the same time, President Joe Biden is expected to announce $2 billion more in military funding to Ukraine. Meanwhile, Russian President Putin warned this week that Russia has “no limitations” on spending for the war. In other words, pending any drastic changes, such as peace talks, the conflict looks destined to drag on.

Though the Aerospace – Defense industry is a low ranked industry group, and most defense stocks have mid-tier Zack’s Rankings, new spending could bolster consensus EPS estimates in the coming months. The primary defense contractors such as Lockheed Martin,

General Dynamics Corp

GD

, Raytheon Technologies

RTX

, and Northrup Grumman

NOC

should all benefit. From a valuation perspective, GD, RTX, LMT, and NOC have similar forward P/E ratios between 17 – 23. However, Lockheed separated itself from the pack with its technical setup and relative price performance.

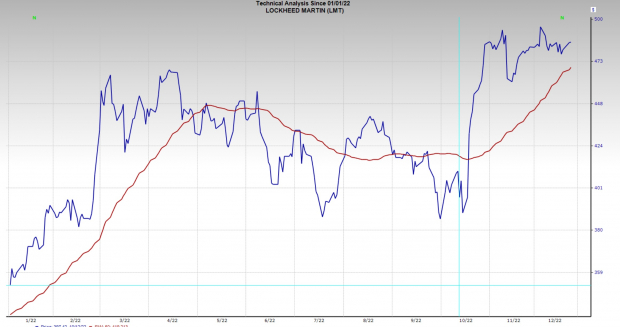

Image Source: Zacks Investment Research

Pictured: LMT chart looks strong from a technical perspective as it consolidates in a bull flag above its 50-day moving average.

Lockheed Martin has been outperforming the general market and its peers by a wide margin over the past few months. The stock is consolidating near highs in a bull flag and looking to get support at its rising 50-day moving average. Investors should look to shares of LMT if they believe that the Russia-Ukraine war will persist and the U.S will keep funding it.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report