Installed Building Products, Inc.

’s

IBP

shares inched up 0.06% in the after-hours trading session on Dec 19, post its announcement of the acquisition of ABS Insulating Company, Inc., ABS Sprayfoam Insulation, Inc. and ABS Coastal Insulating Company, LLC (collectively “ABS”).

Jeff Edwards, chairman and chief executive officer of IBP, stated, “With approximately $21 million of annual revenue, ABS is a well-established installer throughout the greater Charlotte and Myrtle Beach markets and helps solidify our presence in these compelling geographies. To date in 2022, we have acquired approximately $109 million of annual revenues, exceeding the $100 million expectation announced earlier in the year.”

IBP’s Frequent Acquisition to Drive Growth

Acquisitions have been a preferred mode of expansion for IBP for years. The company’s persistent focus on prioritizing profitable growth through the acquisition of well-run installers of insulation and complementary building products bodes well. It has a robust pipeline of opportunities across multiple geographies, products and end markets.

In November, the company announced the acquisition of Surface Purveyors, LLC. Working as Lynch Insulation, Surface Purveyors primarily installs fiberglass and spray foam insulation into multifamily, residential and commercial projects in Montana.

In September, IBP acquired a Longwood, FL-based installer of spray foam and fiberglass insulation — All Florida Insulation, LLC — with annual revenue of approximately $2.4 million.

In May, it acquired Statewide Insulation, Inc. (formerly Tri-County Insulation and Acoustical Contractors), an installer of fiberglass insulation, spray foam insulation and acoustical ceiling insulation for new residential, multifamily and commercial projects in California.

In 2021, the company wrapped up 12 acquisitions, representing approximately $211 million in annual revenues, more than doubling IBP’s $100 million acquired revenue target for 2021. In 2022, IBP expects to generate at least $100 million in revenues via acquisitions.

Share Price Performance

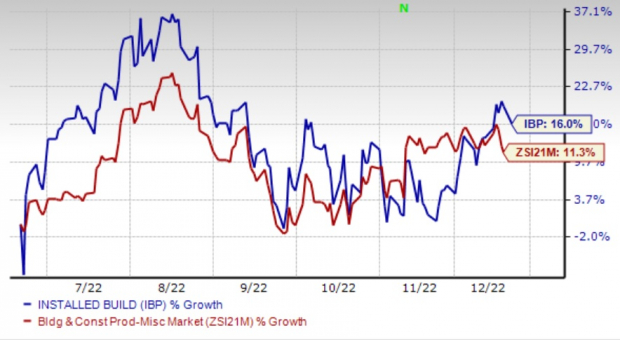

Shares of this Zacks Rank #3 (Hold) firm have gained 16% in the past six months compared with the Zacks

Building Products – Miscellaneous

industry’s 11.3% decline. Although IBP has been facing the heat of inflationary pressure and supply chain issues like other industry players, the solid acquisition strategy is certainly poised to add benefits.

Image Source: Zacks Investment Research

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Some Better-Ranked Stocks

A few better-ranked stocks in the Zacks

Construction

sector are

EMCOR Group Inc.

EME

,

Dycom Industries, Inc.

DY

,

Altair Engineering Inc.

ALTR

and

ChampionX Corp.

CHX

, each carrying a Zacks Rank #2 (Buy).

EMCOR

: Headquartered in Norwalk, CT, this heavy construction company provides electrical and mechanical construction and facilities services in the United States. EMCOR has been benefiting from solid execution in the U.S. Construction segment — comprising the U.S. Mechanical and Electrical Construction units — as well as disciplined cost control. Also, accretive buyouts have been strengthening its overall results by adding new markets, opportunities and capabilities.

EMCOR’s 2023 earnings estimates have increased to $9.10 per share from $8.79 over the past 60 days. Earnings for 2023 are expected to grow nearly 17%.

Dycom

: Based in Palm Beach Gardens, FL, this specialty contracting service provider in the United States has been benefiting from higher demand for network bandwidth and mobile broadband, an extended geographic reach and proficient program management and network planning services. Despite persistent automotive and equipment supply chain challenges, the prospects for the telecommunication business look good given the increased customer need to expand capacity, improve the performance of the existing networks and, in certain instances, deploy new networks. Dycom expects considerable opportunities across a broad array of customers in the future.

Dycom’s earnings per share for fiscal 2024 (ending Jan 2024) are expected to grow 28.1%.

Altair

: This Troy, Michigan-based company provides software and cloud solutions in simulation, high-performance computing, data analytics and artificial intelligence worldwide. Despite significant macroeconomic uncertainty, ALTR has been registering solid growth in billings on a constant-currency basis and witnessing strong demand across all geographies. The company’s focus on delivering services with outstanding technology developments and applications is expected to drive growth.

Altair’s earnings for 2023 are expected to witness 21.5% growth from the year-ago report.

ChampionX

: This engineering services company provides chemistry solutions, engineered equipment and technologies to companies that drill for and produce oil and gas. CHX’s Chemical Technologies offering consists of chemistry solutions for flowing oil and gas wells as well as chemistry solutions used in drilling and completion activities. The company has successfully implemented price increases and surcharges to offset cost inflation. Moreover, CHK remains optimistic about the constructive demand tailwinds in its businesses that support a favorable multi-year outlook for the sector.

ChampionX has an expected earnings growth rate of 46.3% for the next year. The Zacks Consensus Estimate for next-year earnings has improved 4.7% over the last 30 days.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report