Intel Corp (NASDAQ:INTC) has been generating robust revenue growth over the last few years, driven by its innovative technologies and significant data center sales growth. Its revenue grew from $55 billion in 2015 to a record level of $62 billion in 2017; the company believes fiscal 2018 will be another record year with expectations for double-digit revenue growth compared to last year.

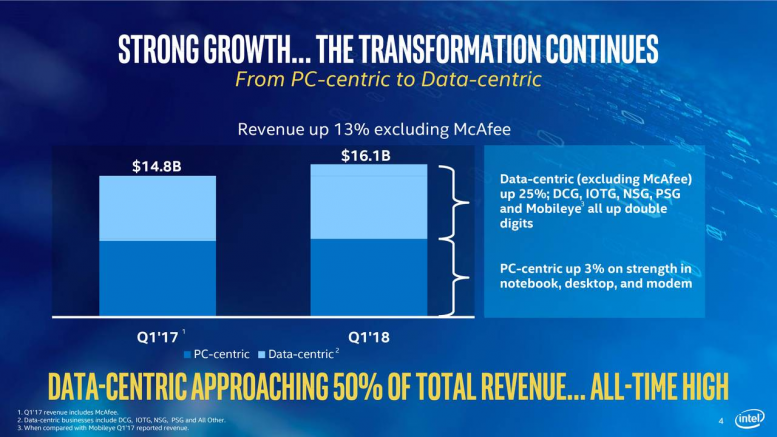

Its fiscal 2018 first-quarter revenue grew 13% to $16.1 billion thanks to 25% revenue growth from data-centric businesses—which accounted for 49% of first-quarter revenue.

Intel Corp Q2 Preliminary Results are Attractive

The company expects Q2 revenue to be around $16.9 billion, higher than its guidance for $16.3 billion and the consensus estimate for $16.2 billion. Its second-quarter revenue also increased substantially from last year’s second quarter revenue of $14 billion.

The significant and sustainable revenue growth shows that Intel’s business strategies are working. Its interim CEO Swan stated, “Intel’s transformation to a data-centric company is well under way, and our team is producing great products, excellent growth, and outstanding financial results. I look forward to Intel continuing to win in the marketplace.”

Intel Corp’s bottom line performance also remains robust. The company expects GAAP EPS to stand around $0.99 for the second quarter; full-year earnings are likely to hit $4.

Intel Corp Share Price Performance

Investors are showing confidence in Intel’s strategy of moving their revenue base towards data center revenues. Its shares rose 56% in the last twelve months.

>> GitHub Developers Tell Microsoft to Cut Ties With ICE or They Will Walk

INTC shares have recently hit an eighteen-year high of $57 a share before falling back to $53 at present. The threat of increasing competition from NVIDIA (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD) hindered its momentum. The price target downgrade from Northland Capital also weighed on traders sentiments. The bulls, however, believe the sustainable revenue growth would continue to offer support to its share price performance.

Featured Image: Depositphotos/© drserg