How long can Intel (NASDAQ:INTC) stock sustain the bull-run? Intel’s share price rally of 52% over the last twelve months has caused investors to wonder whether the stock is offering an attractive opportunity to capitalize on recent gains. This is because smart growth investors don’t fall in love with any stock; they like buying on the dip and selling on high when the stock reaches its fair value.

Source Image: finviz.com

Financial Numbers Backs INTC Share Price Gains

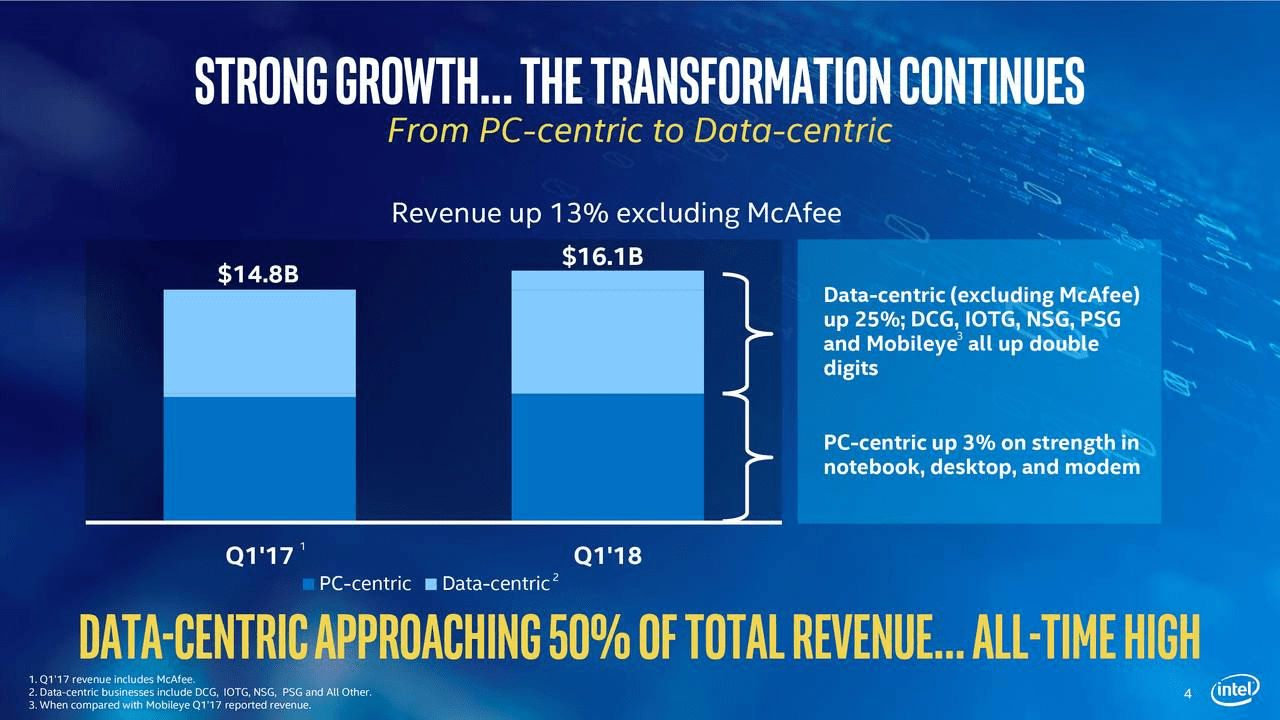

In the case of Intel, the tech company continues backing its share price gains through robust growth in financial numbers. The company’s first-quarter revenue surged 13% from same period a year previous has highlighted the significant improvement in its bottom line and cash generation potential. The company’s strategy of expanding its high margin data-centric businesses is working.

Its data-centric business grew 25% year over year in the first quarter, accounting for almost 50% of the total revenue. Higher margins from the data-centric business along with lower taxes led the company to report 55% earnings growth from the year-ago period.

Hold Intel Stock for More Gains

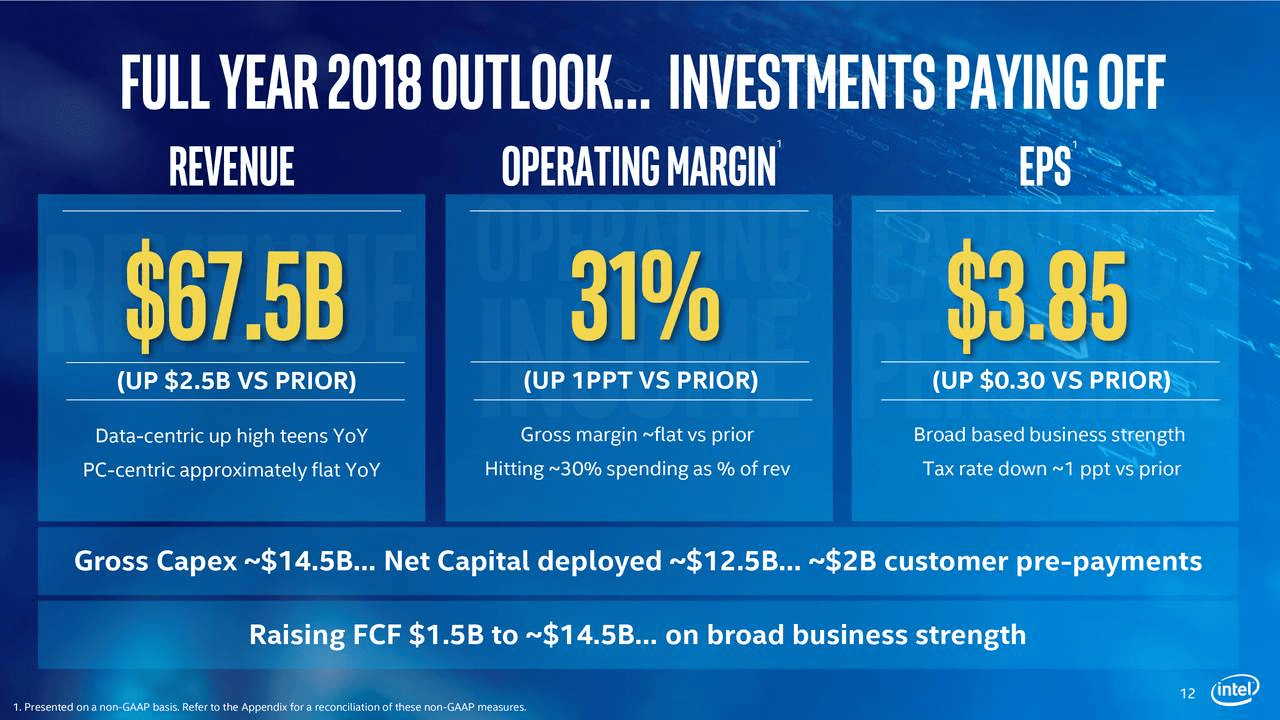

The majority of Wall Street analysts are of the opinion that Intel is in a strong position to maintain its leading position in the semiconductor industry. Intel, on the other hand, has also enhanced trader’s optimism after increasing their sales and earnings expectations for the second quarter and full year.

Bob Swan, Intel CFO said. “Our data-centric strategy is accelerating Intel’s transformation, and we’re raising our earnings and cash flow expectations for the year.”

The company now expects its Q2 revenue in the range of $16.8B, higher from previous guidance of $15.8B and analyst’s consensus estimate for $15.59B. Intel raised its FY18 revenue guidance to $67.5B compared to the previous estimate of $65.07B. Overall, its share price gains are well supported by financial numbers and share price valuations.

Featured Image: Depositphotos/© dragan56