InterDigital, Inc.

IDCC

recently inked a slew of patent license renewal agreements with Samsung Electronics and Panasonic Entertainment & Communication Co., Ltd. for an undisclosed amount. In addition, it signed an HEVC (High Efficiency Video Coding) and VVC (Versatile Video Coding) patent license agreement with LG Electronics. The multiple licensing deals underscore the healthy momentum of its licensing portfolio, which includes some of the biggest industry stalwarts.

Samsung had a licensing deal for InterDigital’s portfolio of cellular wireless and video technologies, which expired on Dec 31, 2022. The renewal of the contract will enable this South Korea-based multinational electronics corporation to continue using its technology without any dispute. Panasonic also renewed two patent license agreements relating to HEVC technology. The new license agreements with LG Electronics cover a plethora of LG products, such as TVs and PCs, for a mutually beneficial relationship.

InterDigital’s commitment to licensing its broad portfolio of technologies to wireless terminal equipment makers, which allows it to expand its core market capability, is laudable. It has leading companies, such as Huawei, Samsung, LG and Apple, under its licensing agreements. Consequently, the company expects to generate solid recurring revenues from the patent licensing business in the forthcoming quarters as well.

InterDigital’s global footprint, diversified product portfolio and ability to penetrate different markets are impressive. Apart from the company’s strong portfolio of wireless technology solutions, the addition of technologies related to sensors, user interface and video to its offerings is likely to drive significant value, considering the massive size of the market it licenses. Furthermore, the company remains committed to pursuing acquisitions to drive its product portfolio and boost organic growth.

The company is focused on pursuing agreements with unlicensed customers in the handset and consumer electronics markets. InterDigital aims to become a leading designer and developer of technology solutions and innovation for the mobile industry, IoT and allied technology areas by leveraging its research and development capabilities, technological know-how and rich industry experience. At the same time, it intends to enhance its licensing revenue base by adding licensees and expanding into adjacent technology areas that align with its intellectual property position.

Additionally, more and more companies are increasingly offering the work-from-home option to employees to ensure their safety and well-being. Several firms are also providing a secure and connected workplace setup through quick onboarding and enablement services to support the seamless continuity of businesses and enable employees to fulfill their professional obligations. This, in turn, is likely to create new revenue-generating opportunities for InterDigital, as humans become solely dependent on the digital platform to stay connected not only for their professional lives but also for online education, shopping, dining and entertainment.

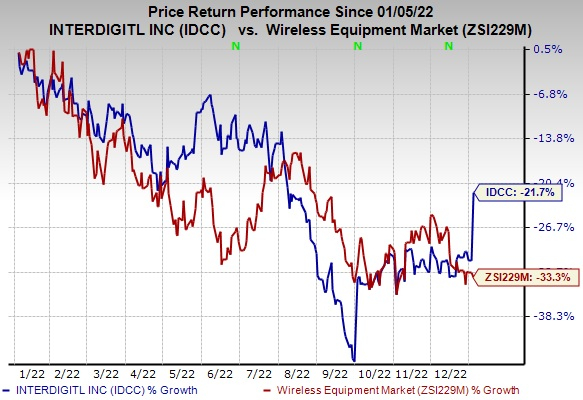

The stock has lost 21.7% over the past year compared with the

industry

’s decline of 33.3%.

Image Source: Zacks Investment Research

InterDigital currently carries a Zacks Rank #4 (Sell).

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Ooma Inc.

OOMA

, sporting a Zacks Rank #1, delivered an earnings surprise of 21.7%, on average, in the trailing four quarters. Earnings estimates for Ooma for the current year have moved up 37.8% since March 2022. It has a

VGM Score

of B.

Ooma offers communications services and related technologies for businesses and consumers in the United States and Canada. It helps to create powerful connected experiences for businesses and consumers through its smart cloud-based SaaS platform.

Arista Networks, Inc.

ANET

, sporting a Zacks Rank #1, is likely to benefit from the strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 17.5% and delivered an earnings surprise of 12.7%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Clearfield, Inc.

CLFD

, sporting a Zacks Rank #1, is a leading provider of communication networks, telecom services and support solutions. The company is witnessing a strong demand environment, largely driven by an effort by rural broadband operators to establish themselves as dominant broadband access providers. In addition, Clearfield is gaining traction with Tier 2 carriers that aim to extend their fiber connectivity across the country.

Headquartered in Minneapolis, MN, Clearfield has gained 17.8% over the past year. It delivered an earnings surprise of 39.7%, on average, in the trailing four quarters.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report