International Business Machine (NYSE:IBM) has been struggling to translate modest revenue growth into decent profits. Although it has topped second-quarter revenue and earnings estimates, its earnings per share growth remain unimpressive.

Traders and analysts believe IBM needs to return to steady organic growth combined with improvement in its margins for sustainable multiple expansions from existing levels.

Strategic Imperatives Aids Revenue Growth

Strategic imperatives and cloud revenues are helping to generate a modest growth in revenues despite the downtrend in IBM’s traditional computing and software businesses.

IBM’s strategic imperatives revenue, which accounts for 49% of total revenue, grew 15 % in the latest quarter. Besides revenue growth strategic imperatives, IBM’s software and computing revenues declined sharply year-over-year—resulting in a consolidated revenue growth of only 4%.

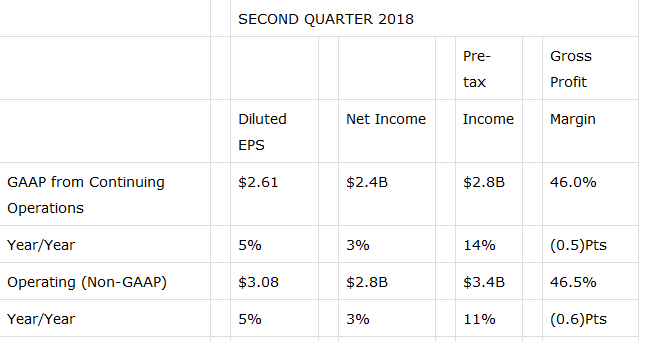

Margins and Earnings Remain Under Pressure

IBM’s margins have been under pressure over the last couple of quarters due to higher operating costs.

The company’s second-quarter gross margin has declined 0.5 points since this time last year, and its operating margin dipped 0.6 points. Consequently, IBM’s net income increased only 3% year-over-year in the second quarter of fiscal 2018. Earnings per share growth in the first half this year also stood at a low mid-single digit rate.

Traders are Unconvinced

International Business Machine shares are down 10% in the last six months, weighed down by traders’ concerns over its financial performance.

The stock is currently trading slightly higher from the 52-week low of $137, but it is sharply lower from the one year high of $177 a share. Lack of earnings growth has also been impacting its valuations.

The IBM stock is trading around 23 times to earnings compared to the industry average of 20 times. Traders say IBM should begin cost-cutting initiatives across all business segments along with focusing on high margin businesses to enhance its earnings potential.

>> Comcast Withdraws Its 21st Century Asset Bid

Featured Image: Twitter