International Paper Company

IP

declared that it intends to evaluate strategic alternatives for the possible sale of 50% shareholding interest in the Ilim Group Joint venture (JV) in Russia amid the invasion of Ukraine.

The company stated that it has no intention to suspend operations or any initiation of liquidation or bankruptcy proceedings related to Ilim Group.

Several companies have been winding up business operations in Russia. Recently, the U.S. President called for an elimination of normal trade relations with Russia, enabling new tariffs to be imposed on Russian imports in response to the Ukraine invasion. The company is donating $0.8 million to support Red Cross and Global Foodbanking Network Ukraine Relief efforts to aid refugees.

In 2007, International Paper entered into an agreement with Ilim Holding S.A and formed a 50/50 JV, Ilim Group, which is Russia’s largest integrated pulp and paper manufacturer. Ilim has the three largest pulp and paper mills and two modern corrugated box plants in the European and Siberian regions of Russia. It is also the largest foreign-domestic alliance in the country’s forestry products sector. The company’s total annual volume of pulp and paper production exceeds 3 million tons. International Paper mostly exports pulp products to China through the Ilim JV. In 2021, the company generated equity earnings of $311 million from Ilim.

International Paper will gain from the solid demand environment for corrugated packaging and pulp. The company is also witnessing strong demand driven by processed food, beverage, proteins, chemicals, paper tissue and towel. It projects EBITDA to be $3.1-$3.4 billion in 2022 compared with $2.6 billion in 2021. The company expects gross benefits to be $200-$225 million stemming from Building a Better IP initiatives.

International Paper continually evaluates its operations for improvement opportunities by focusing on its core businesses, realigning capacity to operate fewer facilities with the same revenue capability, closing high-cost facilities and trimming costs. The company has strategically offloaded businesses in China to focus more on its U.S. operations. It continues to assess disciplined and selective M&A opportunities, particularly in packaging businesses in North America and Europe.

Last October, International Paper completed its spin-off of the Printing Papers segment into a standalone, publicly-traded company,

Sylvamo

SLVM

. The company retained up to 19.9% of the shares of the new company, with the intent to monetize its investment and provide additional proceeds to the company within one year.

Recently, Sylvamo declared that it has started an orderly suspension of operations in Russia amid the ongoing war. SLVM will continue to measure several options for its operations in Russia, which might include a sale or exit.

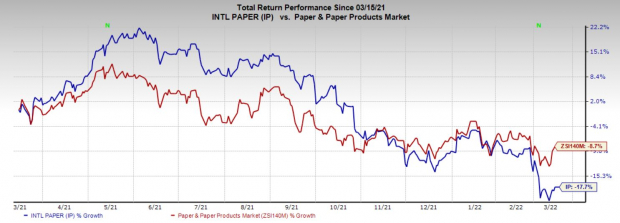

Price Performance

International Paper’s shares have fallen 17.7% in the past year compared with the

industry

’s loss of 8.7%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

International Paper currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space include

Teck Resources

TECK

and

Cabot Corporation

CBT

, both carrying a Zacks Rank #2 (Buy), at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Teck Resources has a projected earnings growth rate of 26.1% for the current year. The Zacks Consensus Estimate for TECK’s current-year earnings has been revised upward by 33% in the past 60 days.

Teck Resources beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters and missed once, the average surprise being 13%. TECK’s shares have surged around 95% in a year.

Cabot has a projected earnings growth rate of 15.5% for fiscal 2022. The Zacks Consensus Estimate for CBT’s fiscal 2022 earnings has been revised upward by 8% in the past 60 days.

Cabot beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 21.6%. CBT has rallied around 49% in a year.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report