Shares of

Intuitive Surgical, Inc.

ISRG

reached a new 52-week high of $949.29 on Jul 6, before closing the session marginally lower at $948.04.

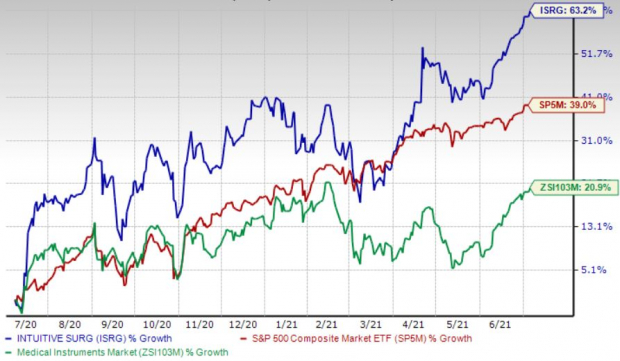

Shares of the company have gained 63.2% in the past year compared with the

industry

’s 20.9% growth and the S&P 500’s 39% rise.

The company is witnessing an upward trend in its stock price, prompted by its strength in robotics. Intuitive Surgical’s solid performance in the first quarter of 2021 and its innovative technologies also buoy optimism. However, rising production costs and risk of procedure adoption are major downsides.

Image Source: Zacks Investment Research

Let’s delve deeper.

Key Growth Drivers

Strength in Robotics:

Intuitive Surgical’s robot-based da Vinci surgical system enables minimally invasive surgery that reduces the trauma associated with open surgery, thus raising market sentiment. The da Vinci System is powered by robotic technology, which has provided the company with solid exposure to medical mechatronics, robotics and AI for healthcare.

The company launched an upgrade to its flagship Vinci Xi technology – da Vinci X. Notably, the Xi suite is designed to seamlessly integrate future innovations, such as advanced instrumentation, surgical skills simulation, software upgrades and other advancements into one dynamic platform.

Innovative Technologies:

Intuitive Surgical continuously introduces technologies for surgical systems, buoying market optimism. Besides launching da Vinci X, an upgrade to its flagship Vinci Xi technology, the company has also been a constant outperformer in Mature and Growth procedures, especially in general and thoracic surgery. In the United States, the company has two cleared indications for da Vinci SP, and is in the process of designing trials for additional indications, including thoracic surgery and other surgical disciplines.

Intuitive Surgical launched its Extended Use Instruments in the United States and Europe in the fourth quarter of 2020. The company plans to unveil these instruments in other markets in 2021 and 2022, subject to regulatory requirements.

Strong Q1 Results:

Intuitive Surgical’s better-than-expected results in first-quarter 2021 buoy optimism. Increase in revenues in the first quarter reflects Intuitive Surgical’s procedure growth and higher-than-expected system placements. Strong segmental performance was seen during the quarter, along with an uptick in da Vinci’s procedure volume. Expansion of both margins bodes well. Overall international sales improved in the quarter. The company’s core businesses exhibited stability despite the pandemic-led challenging business climate, reflecting solid operational health.

Downsides

Escalating Production Costs:

The pandemic adversely affected global supply of semiconductors and other materials used in Intuitive Surgical’s products. Although the company is making efforts to secure supply required to ensure fulfilment of consumer demand, global shortages might lead to higher production costs or delays in production.

Risk of Procedure Adoption:

Intuitive Surgical faces the risk of adoption of its procedures. Adoption growth takes time, as each procedure needs to gain credibility. Furthermore, broad use of the company’s products requires training of surgical teams. Market acceptance could be delayed by the time required to complete the same.

Zacks Rank & Key Picks

Currently, Intuitive Surgical carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are

Veeva Systems Inc.

VEEV

,

AMN Healthcare Services Inc

AMN

and

National Vision Holdings, Inc.

EYE

.

Veeva Systems’ long-term earnings growth rate is estimated at 15.8%. The company presently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare’s long-term earnings growth rate is estimated at 6.5%. It currently flaunts a Zacks Rank #1.

National Vision’s long-term earnings growth rate is estimated at 23%. It currently sports a Zacks Rank #1.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report