Ionis Pharmaceuticals

IONS

announced positive top-line data from the phase III NEURO-TTRansform study on its investigational anti-sense drug eplontersen in patients with hereditary transthyretin-mediated amyloid polyneuropathy (ATTRv-PN). The candidate is being developed in partnership with

AstraZeneca

AZN

.

Data from the 35-week interim analysis of the NEURO-TTRansform study showed that eplontersen had a positive impact on disease progression in study participants who were treated with it. A large number of study participants treated with the drug also showed improvements in neuropathy impairment and quality of life.

The study met its co-primary and secondary endpoints.It achieved its first co-primary endpoint of eplontersen achieving a statistically significant and clinically meaningful improvement in percent change in serum transthyretin (“TTR”) concentration.

The study met another co-primary endpoint of change in the modified Neuropathy Impairment Score +7 (mNIS+7) with statistical significance in participants who were administered the drug compared to those who received placebo. The mNIS+7 is a measure of neuropathic disease progression.

The study also achieved its secondary endpoint by demonstrating that eplontersen led to a statistically significant and clinically meaningful improvement inchange from the baseline in the Norfolk Quality of Life Questionnaire-Diabetic Neuropathy (Norfolk QoL-DN). Attaining this endpoint shows that the treatment with the drug improved patient-reported quality of life,as compared to the patients who were treated in the placebo group.

Based on these results, Ionis and AstraZeneca plan to file a new drug application, seeking marketing approval for eplontersen in ATTRv-PN.

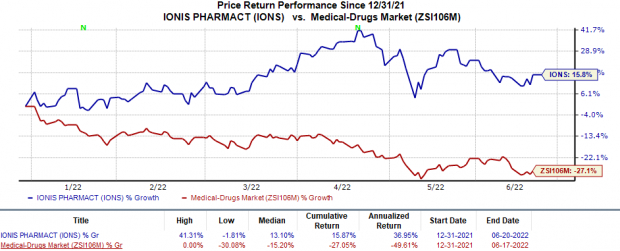

In the year so far, shares of Ionis have risen 15.9% against the

industry

’s 27.1% decline.

Image Source: Zacks Investment Research

The final primary endpoint analysis of the NEURO-TTRansform study will be completed at week 66. Ionis and AstraZeneca are also developing eplontersen as a potential treatment for amyloid transthyretin cardiomyopathy (ATTR-CM) in the phase III CARDIO-TTRansform study.

AstraZeneca and Ionis entered into a strategic collaboration last December to develop and commercialise eplontersen for the treatment of transthyretin amyloidosis. AstraZeneca and Ionis are jointly responsible for developing and marketing the drug in the United States. However, AstraZeneca will have exclusive global rights to develop and commercialize the drug outside the country (excluding Latin America).

Other than AstraZeneca, Ionis has partnerships with many pharma giants like

Biogen

BIIB

and

Novartis

NVS

. These partnerships enable IONS to enjoy diverse revenue streams, which include commercial products and royalties as well as numerous sources of collaborative and R&D revenues.

Biogen and Ionis are collaborating on developing advanced treatments for neurological disorders. Ionis has licensed Spinraza to Biogen, which is approved for treating spinal muscular atrophy in pediatric and adult patients. While BIIB is responsible for commercializing Spinraza worldwide, Ionis receives royalties from Biogen on Spinraza’s sales.

The company is developing another pipeline candidate, pelacarsen, in collaboration with Novartis. Ionis and Novartis are evaluating pelacarsen in the ongoing phase III cardiovascular outcome study, HORIZON, in patients with established cardiovascular disease and elevated lipoprotein(a), or Lp(a). Novartis is responsible for leading the global development and commercialization activities for the candidate.

Zacks Rank

Ionis currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report