Ionis Pharmaceuticals

IONS

reported first-quarter 2022 loss of 46 cents per share, which was narrower than the Zacks Consensus Estimate of a loss of 68 cents. In the year-ago period, the company had incurred a loss of 64 cents per share.

The bottom line includes expenses related to the Akcea acquisition and restructured European and North American operations and other items. Excluding these non-recurring expenses, loss per share were 27 cents versus 32 cents in the year-ago quarter.

Ionis reported total revenues of $142 million, up 26.8% year over year due to higher R&D revenues, which made up for lower commercial revenues. Sales beat the Zacks Consensus Estimate of $129.0 million.

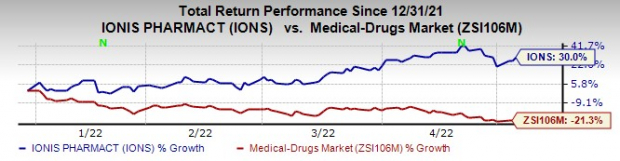

Ionis’ shares were up 2.8% on Wednesday in response to the better-than-expected earnings announcement. This year so far, Ionis’ shares have risen 30% in contrast to the

industry

’s decrease of 21.3%.

Image Source: Zacks Investment Research

Quarter in Detail

Ionis has licensed Spinraza to

Biogen

BIIB

. Biogen is responsible for commercializing Spinraza, approved for treating spinal muscular atrophy, or SMA, worldwide. Ionis receives royalties from Biogen on Spinraza’s sales.

Ionis earns commercial revenues, primarily royalty payments on net sales of Spinraza and R&D revenues, from partnered medicines.

Commercial revenues were $87 million in the first quarter, down 15.3% year over year.

Commercial revenues from Spinraza royalties were $54 million, down 10% year over. Revenues from Tegsedi and Waylivra from distribution fees were $6 million compared with $20 million in the year-ago quarter. License and royalty revenues were $12 million in the quarter compared with $5 million in the year-ago quarter.

R&D revenues of $70 million were significantly higher than the year-ago revenues of $27 million and included $20 million received from partner

AstraZeneca

AZN

for its share of program costs for eplontersen, for which the companies had collaborated in December last year. R&D revenues also included $40 million received from Biogen for advancing some neurology disease programs

Adjusted operating costs rose 8.8% year over year to $173 million in the first quarter, mainly driven by higher R&D costs as the company rapidly advanced its wholly-owned late-stage pipeline. Ionis’ phase III studies doubled over the course of 2021 from three to six studies. The SG&A expenses decreased in the quarter due to cost efficiencies realized from integrating Akcea and restructuring commercial operations.

2022 Guidance

Ionis expects total revenues to be more than $575 million in 2022. Its adjusted net loss is expected to be less than $275 million.

Ionis expects revenues in the second quarter to be similar to the first while in the second half, revenues are expected to be more weighted toward the back end of the year.

Adjusted operating expense is expected to be in the range of $825 million to $850 million. R&D costs are expected to increase in the range of 25-30% in 2022 compared with 2021. SG&A costs are expected to be in line with 2021.

Operating costs are expected to increase in the second quarter and through the rest of the year.

Pipeline Update

Ionis has phase III studies ongoing for six medicines (internal as well as partnered) across eight indications, which include tofersen for SOD1-ALS (amyotrophic lateral sclerosis); pelacarsen for cardiovascular disease due to elevated Lp(a) levels; olezarsen for familial chylomicronemia syndrome, or FCS and severe hypertriglyceridemia, eplontersen for TTR amyloidosis, ION363 for amyotrophic lateral sclerosis, or ALS, with mutations in the fused in sarcoma gene, or FUS (FUS-ALS) and donidalorsen for hereditary angioedema or HAE.

Biogen, AstraZeneca and

Novartis

NVS

are its partners for tofersen, eplontersen and pelacarsen. Ionis expects seven mid- and late-stage data readouts in 2022. Data from the phase III NEURO-TTRansform study of eplontersen in TTR polyneuropathy is expected in mid-2022. Ionis and AstraZeneca are also developing eplontersen for the treatment of cardiomyopathy in the phase III CARDIO-TTRansform study. In the first quarter, Ionis/AstraZeneca increased the size and duration of the study with the aim to generate more robust data. The companies will file for regulatory approval for eplontersen for hATTR with polyneuropathy indication in the second half of 2022 if the data from the NEURO-TTRansform study is positive.

As regards Ionis and Novartis’ pelacarsen, a phase III cardiovascular outcome study, HORIZON, is ongoing in patients with established cardiovascular disease and elevated lipoprotein(a), or Lp(a)

Ionis is advancing and expanding its wholly-owned pipeline to drive future revenue growth.

Ionis is developing olezarsen for FCS, ION363 for FUS-ALS and donidalorsen for HAE on its own in pivotal late-stage studies. Ionis began a second phase III study of olezarsen for severe hypertriglyceridemia and a phase III study on donidalorsen for HAE in November 2021.

Ionis also has several other candidates in phase II development, which it is developing in partnership with Biogen, Roche or on its own. A key wholly-owned candidate is IONIS-AGT-LRx for treatment-resistant hypertension and chronic heart failure with reduced ejection fraction while a key partnered candidate (with AstraZeneca) is ION449, a PCSK9 LICA medicine to treat dyslipidemia, in phase IIb studies.

In April, Ionis/AstraZeneca announced data from the phase IIb ETESIAN study on ION449, which demonstrated robust reductions in LDL-C (bad cholesterol) and PCSK9 levels on treatment with ION449 in statin-treated patients with hypercholesterolemia.

Ionis currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report